From a post at the Big Picture

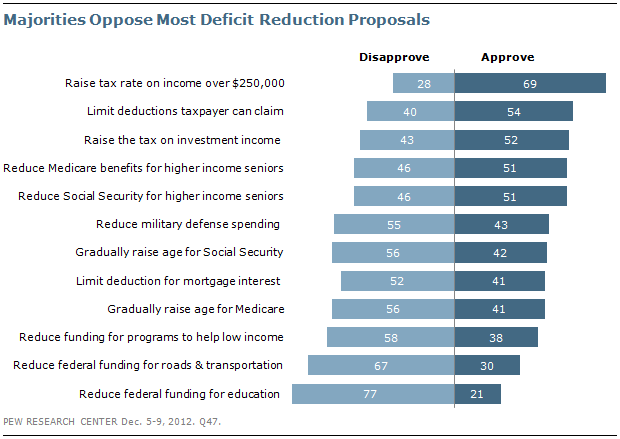

Despite all of the back and forth over the fiscal cliff and the deficits, when you get specific about deficit reduction, the majority of Americans are not supportive.

Of course, some of us understand how much of the so-called reduction is still ideological crappola. The best example being suggestions on modifying social security. You could remove social Security, SSA, entirely from the budget and nothing would change in the deficit.

SSA pays for itself, has years of equity remaining. All that needs to be done is to remove the cap on contributions – don’t stop collecting the tax when people pass $105K/year income – and we’re good till the next century.

What do you expect? It’s a nation of welfare dependant perma-children living in the glory of its distant past. Doped up entitled kids with a hollowed out culture of political correctness.

There may be a minority of capables left but that means nothing when the majority rule.

The big brother welfare state rapidly turns into a self centred mentality of how much can you loot from it and how little can i contribute to it.

“self centered mentality of how much can you loot from it and how little can i contribute to it.”

Sounds like a typical conservative strategy to me.

What is the difference between what you say the 99%ers are saying versus what the corporations and the 1%ers are doing.

Everybody is against a rationalized system of health care, right up they get a diagnosis that will wipe them out.

Deal with reality, instead of your hopeful fairy tales.

Difference:

-Remove all Government services to top 1 or 2% and remove all income Government gets from them: Deficit SKYROCKETS.

-Remove all Government services from bottom 50% and remove all income Government gets from them: Deficit DIVES.

Simple test to see who is really robbed and who really pays more than their fair share vs. who is really robbing and who is not contributing their fair share.

I would buy this argument if the government actually attempted either approach. I think you’d find something else would happen, not necessarily an opposite effect but overall a less than efficacious one.

Neither approach has a chance of being implemented, there is no ‘upside’ for the politicos to be likely to vote for the changes. The politicos do what put the ‘hidden paycheck’ in their pockets, forget about serving the public.

Just not true. The rich and big corporations take more than they give while the rest of the people give more than they get. That is why there is such a huge difference between rich and poor at the moment. If what you said was true then there would be much more equality of income.

I’d like for our creditors to cut us off, demand we pay back everything in 30 days with gold, oil or other items of value not fake printed money. If we don’t, they come in and seize property, maybe a state or two.

FOR all the things that they COULD ASK THE PEOPLE…

They do this AFTER they have messed things up..

And its a LIMITED question and answer..

HOW about a better QUESTION??

HOW to CUT the cost we are paying for the GOVERNMENT??

The money we are paying to BANKS

The money for the Drug war..

The money we are GIVING to other nations for favors..

RE-ORGANIZE business practices..

SAME TAX for all people..

ALL people in government making more then $100K, should have their JOB EVALUATED..

Simple really, more going out than coming in. We all know that.

If allowed to continue unchecked and given enough time our currency will collapse.

The only answer I see it increased taxes for ALL and decreased spending. How you do that is the problem. No one likes any of their benefits reduced. And no one likes increased taxes (except bobbo and Warren Buffett).

bobbo must be rich like buffet and most of his wealth is found in unrealized (non-taxable) capital gain. of course they like increased taxes, when they never pay any. disegenenous doucheweasels should go buy their secretaries a house or three.

disingenuous… ugh it’s early in the am.

You’re making progress by including raising taxes in your argument. I’m delighted that the new message to include tax increases is being propagated to the Sheeple.

George Will made a funny last week: “It is very clear that the American Public wants a lot of benefits and programs and doesn’t want to pay for them.” /// Fact is: every society should provide many benefits for a variety of reasons summed up as “the General Welfare” AND the American Public HAS PAID for them. Sadly, those payments have been fraudulently transfered to the SUPER RICH.

Just look at base statistics comparing USA to other advanced economies. We get less and pay more—over and over again.

Much like our military we claim to be so proud about being No1?===Sure, spend as much as the rest of the world combined and then be insecure if any reduction is made.

Silly Hoomans. Lied to and taking it hook, line, and stinker.

Of the $16T of debt China owns $1.1T. The BUSH WARS cost $1.4T, and don’t claim the terrorists caused those, BUSH’s stupidty and arrogance did. BUSH started with a surplus and gave that surplus to his rich ahole buddies and left us lefties and middle class working stiffs to foot the bill. SSI is INSURANCE as is MEDICARE INSURANCE, we and our employers PAID FOR IT. And dammit we want what we paid for. And you arrogant aholes it’s PRESIDENT BOBBO and whatever racist crap you want to call him. He, WE won the election fair and square. If you don’t like it, leave. Move to whatever pure capitalistic country you can find and leave this country to us commie slackers.

Eliminate all deductions, and reduce everyone’s marginal tax rate by 5 points (if your rate is currently 0%, you don’t get a rate of -5%). Whatever isn’t funded is then cut.

Here’s an awesome plan that will fix everything! Everyone that earns anything in any amount will pay a flat 30% federal income tax, each state will then charge a flat 20% income tax, all loopholes and deductions will be ceased, a VAT of 25% shall apply to all purchases including food, and everyone shall pay an additional 25% tax on income for universal government provided health insurance.

Problem solved, and everyone will live happily ever after.

Careful TooManyPuppies you’re making sense.

Your plan would retore us to fiscal health in about 3 to 5 years.

I forgot to add that anyone with any remaining money and or profit at the end of each day must surrender said money or face a 5 year mandatory forced labor term on any public project that FEMA deems needed.

The “cliff” and the Alternative Minimum Tax, that has not been adjusted for this year, will give us a good start on your plan.

And you hauled out your I’m Cwazy! card…

But I’d still back your tax plan.

Sounds very much like a european model.. and it’s working out so well there.

Well, appart from Greece.. erm and Spain.. Italy, Portugal, France and maybe Ireland and the UK… but appart from all those exceptions it’s positively Utopian!

Uh huh, the rich are still rich and the poor will not have enough to live on. No, it’s not supposed to be about income redistribution, but the fact is that the middle classes are not so much against getting taxes more, rather that their buying power is insufficient to support modern infrastructure. 30% here, 2o% there, 25%VAT, and 75% of the population is looking at giving things up, and no not just extras like cable TV and data plans, but things like medicine, food, insurance on the car, yadda yadda. They are tapped out, underemployed and underpaid. Fix THAT first, then you can consider this idea.

Besides we employed a plan in the past that took care of something very similar to this; shortly after WW2. Look at what THEY did; that worked.

The numbers have been run and a single mother of 2 making less than 28,000 has more disposable income than if she were making 55,000 due to government programs designed to help the poor.

Translation: A huge hunk of the poor are better off staying poor than working hard to get ahead…

So you’re saying that without your VAT, everyone pays 75% of their income in taxes and we’ll all be happy? Do the math before spouting off nonsense.

If you want to solve the problems we’re having look at when the country was doing best historically. It was when we had a strong middle class with strong purchasing power. Ever since “trickle-down” theory was implemented the economy has been degrading.

You sir, off to the camp! Feel proud as Dear Leader Obama has assigned to you an 8’x10′ house and you will receive health services and food. Dear Leader loves you.

BTW you completely fail at sarcasm detection. Do not worry! As it IS a mental illness (seriously, it is. read the DSM) and I’m sure you qualify for some sort of government provided assistance for treatment of your defect.

Hey, significantly more Americans believe that miltary fund should be reduced as opposed to education. Maybe there is hope for our country.

Can’t we just sell Florida and the Mexican border to China. It would prevent deformed babies being born in Arizona due to cross border pollution (by American factories in Mexico) of the water table. Florida can go fuck its pill farm self into oblivion.

Get outta here. Seriously, please go away.

You must be from FL.

http://www.vice.com/read/a-violent-stripper-a-crazy-naked-man-and-4000-pounds-of-cocaine

Class supervisor said, in part:

“…

There may be a minority of capables left but that means nothing when the majority rule.“ [Emphasis added.]

Aye, there’s the rub — if you think a minority should rule, just how is it decided which minority?

“The big brother welfare state rapidly turns into a self centred mentality of how much can you loot from it and how little can i contribute to it.”

Hmmm — minimize cost, maximize profit. Sounds like a good plan, pretty much what everyone tries to do, regardless of the form of government.

Do the “rich” have enough money to make this problem go away?

What is everybody else’s obligations?

If our debt exceeds our entire national worth, how is “taxing the rich” going to help anything at all?

They aren’t going to be any happier when our credit runs out and the dollar collapses at which point in time everything is going to get chopped even if more devalued paper is thrown at it.

I don’t know what to suggest other than create a food cache and hopefully be prepared to grow most of what you eat if at all possible. You might want to keep a good stout stick or a thunder stick handy…

So you are saying Goldman Saks is not going to underwrite debt offerings? Hmmm. Your ignorant.

What will all the ruling elites in Opec, Russia and China do with their money? It is in our stock market.

Where are you putting your retirement? Do you have one? Don’t BS me about your gold.

What country or foreign enterprises do You invest in?

I’m curious I missed your segment on Squawk Box.

SS doesn’t pay for itself. It is running a cash deficit, and the problem started in 2007, when the surplus started shrinking. Since the government spends all of SS’s surplus, once the surplus started shrinking that increased the deficit. You would be right if Social Security were privatized, and these funds couldn’t be touched. Your solution of eliminating the cap means you are raising taxes to pay for Social Security. If you actually paid out at a level equal to these new taxes, your problem is not solved. Other solution would be to switch to price indexing of benefits, so economic growth would solve your problem, as long as population doesn’t decline.

Mike, you are WRONG..

SS, started having problems when the US GOV. decided to use the money to Cover its ASS. It started in late 70’s..

AT this time the US Gov. OWES SS. OVER 120+ billion..WHICH if left there and gathered interest, would have covered EVERYTHING..

No it wouldn’t, since they are still maintaining the accounting as if they hadn’t raided the money, and that tells us SS is running a shortfall now and the ‘trust fund’ runs out by 2030 if not sooner, I’m betting on sooner.

スーパーコピー時計 is Japanese for “Super copy watches”

I call BS on any post where the content reads: “I feel that since this person leaves, the topic of AKB that I was reduced to.“

The soon to happen collapse of this country reads like a Heinlein novel.

Why isn’t repealing Obamacare part of the poll?

“SSA pays for itself, has years of equity remaining.”

There is no “equity”. What comes in, goes out. The so-called “equity” still involves current account government spending. There is no pot from which we can continue to draw.

To suggest otherwise is either criminally deceitful or criminally stupid.

John Boehner proposed raising taxes only on millionaires and billionaires. Harry Reid declared it dead on arrival.