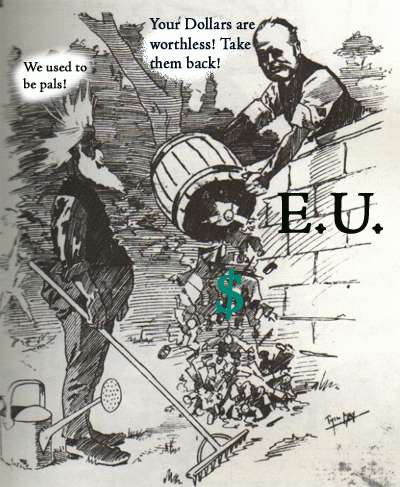

WORLD VIEWS: Global alarm over ‘disappearing dollar’; Blair pressured to count Iraqi deaths since invasion; and Britain debates controversial religious-hatred law — Apparently all hell is breaking loose. Since the newspapers have to fill their pages with entertainment news, all the international stuff goes into the same article. This dollar thing is the worst. George Bush managed to sink our money in less than two years. And this got him re-elected. In two more years we’ll be a third world country. But no matter. We still have the best looking actresses, more or less. And they are soooo fascinating.

Fawaz Turki, a columnist for Saudi Arabia’s Arab News, observed that “because we live in a globalized world of free trade, and because the decline in the currency of a major trading nation can affect the standard of living of people in other trading nations …[, the] fate of the dollar … impacts on us all.” Turki pointed out that the dollar had lost 35 percent of its value against the euro

An Interesting blog debate on a devalued dollar here.

A commentary in the Chicago Tribune that said that the plan was to devalue the dollar to about 1.60 Euros by 2005, so that the trade gap could be reduced. This would mess up lenders and people with maxed out credit cards, but the author was saying you cannot make policy around people who have high credit card bills.

The joke of this is that this will just make stuff more expesnive and we’ll still have a deficit. We don’t make LCD TV’s. We don’t make computers (we assembled them from Chinese parts). We make cars that cannot compete on an even straight-up basis. We make jets, but much of that is now being offshored. We do construction. We do make great washing machines, but they are too big for anyone but Americans with big homes. All we really do nowadays is middleman scams. So with a weak dollar we have to spend more and more to get less and less creating a worsening deficit. Or has nobody noticed that this administration, which has been sinking the dollar has been pushing us deeper into debt. The argument is that with a weak dollar we’ll export more. But I ask: export more what? Everything is already from China. Export more wheat? Export more wine? Export SUV’s?

Americans need to realize we’re not the center of the economic universe. Anyone who has traveled or lived overseas knows this. I’m surprised how few people have actually been overseas, which explains our general ignorance. Mexican and Caribbean resorts aren’t representative of the real world! There is a price to pay for thumbing our nose at world public opinion and our dollar is going to pay it.

> Americans need to realize we’re not the center of the economic universe.

Actually, we are the center of the economic universe. Americans spending more money than we earn, and buying up loads of foreign goods, has kept the world economy, especially the export economies of Asia, afloat for about 3-4 years now. Any economist will tell you that the US economy leads the world out of world recessions and into them, as so many exporting countries depend on our consumption for growth (whether we’re spending more than we earn or not).

This is why our trade deficit is so large, and why the dollar is sinking.

It hasn’t sunk further and faster because Asian central banks are buying up dollars at an alarming rate, in order to keep their currencies relatively low against the dollar and so keep their exports competitive in the American market.

But all those $30 DVD players and microwave ovens are being charged against our Asian-Central-Bank Platinum Credit Card. And the 0% interest rate is expiring soon, because those central banks are running out of money.

> There is a price to pay for thumbing our nose at world public opinion and our dollar is going to pay it.

This is economics, not politics you twits. That includes you, John.

The balance of trade decides the disposition of our currency, not the President and not public opinion, foreign or domestic.

Also, our economy is much more broad and varied than you hint at. Third world country status isn’t decide by our currency, but by our infrastructure, and the resilience and flexibility of our economy.

If the dollar sinks, then imports will become more expensive, and those manufacturing firms (foreign or domestic) that have factories in the US will get a huge competitive advantage over imports. Sony and Samsung may actually open factories in America, just like the Japanese car companies did in the 80s to blunt the threat of protectionism and reduce the trade deficit in cars.

The fall of the dollar will actually slow the flight of manufacturing jobs abroad, and will probably boost our economy even more.

The fall does threaten the dollar’s status as a reserve currency, but we’ll see if the Bush administration responds to economic reality and presents a reasonable plan to balance the government’s budget deficit. Spending (and by extension “printing”) money the government doesn’t have is the real long-term threat to the dollar.