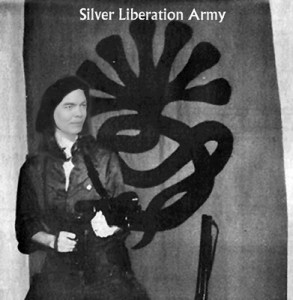

The Silver Liberation Army Has Launched Our Official Website!

http://silverliberationarmy.com/Where the people that function within the “system” will no longer tolerate the corruption that surrounds our every day lives as it is! We the people are starting to take peaceful action against the corporate banking occupation that stands to hold us down and suppress our well being. This is no longer acceptable when banksters can take millions of dollars in bonuses while taking away our homes, the food from our families mouths, our assets, our savings and our dignity…because of a system they designed to destruct!

These banking elite took these bonuses immediately after they took bailouts from our government’s tax dollars that we worked hard to earn and contribute into! They took these bonuses without concern or regret. And Yet They Boast They Are Too Big To Fail…

WRONG AGAIN!

No longer can we stand to allow a banking system that is trying to create a, Criminal New World Order and One World Currency, under their control without any say from us… the People. No More!!!

“FIAT MONEY SUCKS!”

We the people will no longer tolerate rapid inflation due to printing of your worthless fiat currencies without protecting ourselves from your global tyranny! The Silver Liberation is Strong and We Stand United on a Global front…We Will Beat You at Your Own Game by Purchasing the One Weakness You Have Left Exposed!!! We will not be stopped! We will not coward to your suppressed prices and we will continue buying this precious, hedge against your inflation until we have…WON!

The PLAN explained December post.

FIAT ROCKS ARE SHINY! (and pretty)

Personally I can’t stand listening to the guy, it’s his voice. It keeps conjuring up images of Gilbert Gottfried.

I hope his silver thing picks up though. I’ve been using nothing but silver, gold and other barter items in all personal transactions for the past 5 years. Last Saturday I just bought myself a new motorcycle with some gold and took of of the extra honey I have and traded it for some fresh fruits at the local farmers market.

Don’t know how long this will last though as the DOJ classifies this as domestic terrorism.

I went through a libertarian phase, it took me about a year to grow out of it.

Reading this guy make me glad I didn’t fall off that cliff of irrationality.

It is not that they are Too Big To Fail that bothers me. It is that they are Too Big To Jail.

And how are they paying for the silver?

Oooh let me guess, shells and copper bells right?

Oh no! Fiat Currency… oh how sad.

Cursor_

#6 Normally I’d say you were right but people are buying gold as a hedge against inflation. That’s because as interests rates go up the value of the money used to pay it goes down.

In a situation like that the value of commodities including gold and silver skyrocket along with the inflation so trading gold for dollars which are rapidly losing value would not be a great move.

Let me put it to you this a way, a $20 gold piece from 1900 would buy a new colt revolver and it still will. It’s going to take a heck of a lot more than that in paper.

Max Keiser rocks. I listen to his youtube show every week.

A single world currency would have never given a woman I knew back in the early nineteen-eighties the opportunity to play currency trades and make the Bank of Nova Scotia about seventy-five million dollars (CDN) per year, year after year, moving money from German marks to French franks to British pounds to US dollars to Israeli shekels to …

She always had lots of expensive irons in the fire and a knack (which consisted of a lot of knowledge of unternational deals planned and in the early stages of execution,) for picking a currency which was pretty much done with making its way back up (so she’d sell it,) from a period when it was down (when she had actually bought it.)

Working for and with a Canadian bank, (which are usually larger than US banks because, by law, there are only seven of them for 25 (now 35) million people.

It always fascinated me how she’d leverage using dollars from Hong Kong to buy guilders from Holland by way of other currencies (which she’d buy and sell as intermediaries/neutral deals.)

If there had been any marketplace for them, I am sure she’d have traded Yap stones.

Each trade she’d realize a profit on I figured she’d cause the remaining currency to devalue by that much.

In the ten years I knew her, this woman leached almost a billion dollars from the economy while fattening her employer’s pockets.

in #6 ReadyKilowattsaid: the day the FED decides to raise interest rates (and it will happen)…

is the day I take out a loan.

Right now I’m earning doodly-squat on my cash holdings, fuck-all on my real-estate, and having to squander the cash on crap like food and shelter. <sigh>

#3 did it make you feel dirty to get on your knees and plug back into the Donkey-Elephant matrix?

Odd, on the silverkeiser.net web-site, where you can buy silver coins, they sell a 1oz silver coin for $45.50, but silver is currently $41 per oz.

And the 5 oz coin they sell actually sells for $49 per oz. Shouldn’t a 5 oz coin sell for exactly 5X the price of the 1 oz coin?

It couldn’t be that they’re trying to rip off the poor fiat currency holders?

The first case of inflation in history occurred when Spain started bringing back huge quantities of silver from South America.

The resulting price inflation and destruction of wealth is supposed to be the reason that Spain went from european superpower for the first half of the last millennium to runner-up in best 3rd-world country in europe for the last couple of centuries.

#3. “I went through a libertarian phase, it took me about a year to grow out of it.”

Yeah, because the Dems and Pukes are doing such a great job…we should just stick with that.

Do you ever change your dirty underwear?

#16, HERE, HERE!!

#16

Do you ever change your dirty underwear?

No. I give it away to the tea party so they can have a snack with their tea.

Considering JP morgan only has 30,844 troy oz on hand at the moment.. maybe he is winning.

#13 -yeah, they a bit more over spot..must be a keepsake thing.

in any case, he is a capitalist.. cant fault him, really.. caveat emptor always applies…

personally, I use apmex.com for silver..

-s

You gold fanatics _are_ aware that the price of gold fluctuates just like other valuable metals do, aren’t you?

The price of your gold will drop if a new and easier to mine and refine source of gold, silver or platinum (for instance) is found. It happened in Nevada not that long ago.

I thought not…

It’s not all that bad actually for the speculators, but the prices do change because of shortages or surpluses.

#20, Gold is more than just an investment. It is the single most accurate method of determining the confidence in a country’s currency.

Currently, with the price of gold and silver going up, confidence is low.