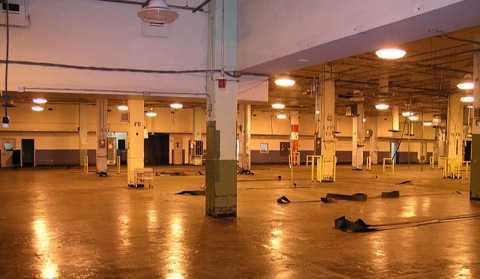

So many empty stores, office buildings and other commercial real estate dot the country that you wonder if many of them will ever be filled again. Makes you also wonder if you’re renting an apartment it wouldn’t be cheaper to rent office space from desperate owner and live there.

A group led by Tishman Speyer Properties has decided to give up the sprawling Peter Cooper Village and Stuyvesant Town apartment complex in Manhattan to its creditors in the collapse of one of the most high-profile deals of the real-estate boom.

The decision comes after the venture between Tishman and BlackRock Inc. defaulted on the $4.4 billion debt used to help finance the deal. The venture acquired the 56-building, 11,000-unit property for $5.4 billion in 2006—the most ever paid for a single residential property in the U.S. The venture had been struggling for months to restructure the debt but capitulated facing a massive debt load and a weak New York City economy that has undercut rents and demand for high-priced apartments.

The property’s owners signaled they would be unable to reach a deal with lenders and instead decided to allow creditors to proceed with what amounts to an orderly deed-in-lieu of foreclosure, which means a borrower voluntarily gives the property back to lenders to avoid a foreclosure proceeding.

And then there’s this:

Problems in the U.S. commercial real estate market are expected to continue in the first quarter and are likely to be the cause of more bank failures in the coming year, a top banking regulator said Wednesday.

Federal Deposit Insurance Corp. Chairman Sheila Bair said in a speech that regulators expect banks to report higher delinquencies and charge-off rates for commercial real estate properties in the first three months of 2010. Speaking to the Commercial Mortgage Securities Association, Bair said even income-producing properties have seen a decline in credit performance.

“Commercial real estate credit problems are affecting large and small banks alike,” Bair said.

The Us’s loss is Canada’s gain. Toronto’s skyline is littered with cranes. Up up and away.

What a great spin to the topic: your loss is my gain. Now that you put it in that perspective I see things in a whole new light. Thanks!

The phony demand from the _continuing_ Ponzi scheme (“financial innovation”) that caused the huge credit/housing bubble resulted in a level of consumer demand that probably won’t return for a decade or more, if then. CRE is now paying the price.

What’s that I hear? It’s the sound of the other shoe dropping.

Many times I’ve wanted to just rent office space rather than an apartment, since in some places there is a surplus of unused office space, but I have always been told that if a structure isn’t zoned as residential, the owner will get in trouble if he rents it for living in, and usually they have a strong aversion to doing so for other reasons anyway. And when they deign to help renters by converting a commercial space into residential, it’s always as expensive lofts that almost no one can afford.

This like watching a train wreck in slow motion from inside the train. Make some popcorn.

We need to declare vacant CRE sovereign Haitian land, move Haitians here, chain them to their workstations, pay them their regular wage ($1 per day), and solve two problems at once!

More Ponzi Failure: Stuyvesant

Excerpt:

“Frenzy overtook common sense, and it wasn’t limited to New York. State pension funds “invested” in the Ponzi that was Stuyvesant and lost their shirts – Florida has written off in its entirety the coin they threw into this mess – a big chunk. In the days and weeks ahead I’m sure we’ll hear that the loss to California was 100% as well.

It would be nice to see people wake up, but so far I see precious little evidence of it. Everyone wants to talk about “politicizing The Fed” and other BS, when the real issue is far simpler – we have built a Ponzi finance system that relies on ever-increasing levels of debt in the system, and we hit the wall in terms of being able to pay. Instead of doing the right thing we decided to paper it over because it was “easier”, but all that has done is make the problem worse, and the “leakage” in areas such as this will continue to show up until finally, at long last, the bright light of recognition shines through.

When that day comes, and it eventually must, it will not be market friendly, but that day, irrespective of whether it comes with a market “correction” or a “crash”, will mark the time when our economy will begin to move back toward balance and a sustainable road forward.”

Doug Noland: Just Say The Words!

Excerpt:

“Doug Noland over at The Prudent Bear has written a piece that everyone, in my opinion, should read – particularly the section on “The Volcker Rule”:

While certainly not without faults, the financial system back in the Volcker era was more stable. The ABS market barely existed. The Wall Street firms and their marketable debt instruments were not major factors in system Credit creation. The banking system dominated the extension of private-sector Credit. Derivatives markets were in their infancy – and certainly didn’t dominate the financial world. Outside of some GSE MBS, mortgage Credit was in the form of bank loans. There were only a handful of hedge funds – not thousands. Leveraging marketable debt instruments wasn’t The Game.

….

One of the big problems today is that there are tens of Trillions of marketable securities out there – and their value depends greatly on the ongoing creation of Trillions more. Our system needs major financial reform – no doubt about it. From today’s Wall Street Journal: “The White House’s relationship with Wall Street is close to the breaking point.” A war on Wall Street would put Credit growth, asset markets and economic recovery all at risk.

Just say it Doug: It’s a Ponzi Scheme and thus ultimately must fail, as do all Ponzi Schemes.

I find it amazing how far people will go – describing the essence of the scam, go through it in detail, laying it all out right in front of your eyes – and then they walk right past the obvious (and indeed the only) statement that sums it all up.”

Winston,

Man, you’re out of touch!

This morning I heard a guy on NPR’s Market Watch Morning Report (whatever it’s called) say that we need to continue to borrow and spend to maintain our prosperity!

#10 Yeah, that is the typical Keynesian route, but it simply cannot work in the long run for this kind of economic collapse, one where hitting a debt wall was the cause. Using massive debt creation to “fix” a debt problem has the same effect as using alcohol to “cure” an alcoholic. It isn’t really a fix. That is so obvious, but it is politically unacceptable to take the _very_ bad medicine right now to fix the problem long term. Instead, they push it off into the future as they have always done, risking that the ever larger bubble bursts will, probably next time, _literally_ be unstoppable with _any_ reasonable amount of bailout money printed out of thin air. Like a car out of control on ice, each swerve gets bigger until you hit the ditch.

Not CRE, but a prediction of the 2010 RE future in general:

Existing Home Sales Drop 16.7%, Missing Consensus Of -10%, Biggest Monthly Decline In History

It is the best of times (if you need space for your business) and it is the worst of time (if you have a business).

I almost bought a commercial building that is for sale for only $110,000. It has 1-2 stores on the first floor and 4 apartments above. You can’t buy a house for that. I didn’t because I worried about having to find tenants to occupy the storefronts.

Deed-in-lieu of foreclosure! Nice, I need these people negotiating my mortgage!

Winston,

There was a technology bubble, then a private borrowing bubble, then a public borrowing bubble, then an energy bubble, then a food and water bubble, then there was no one.

Surely higher taxes, increased regulation, law suits, more unionization, and higher energy prices will force businesses to succeed.

The liberal war on business is proceeding well, business is surrendering every where they can’t retreat to China.

#15 Benjamin

In which city/real estate market was this prospective purchase located? Just curious.

I forgot to link to this article earlier.

#19, If I reveal that info here, then I reveal where I live since it is across the street from me. Otherwise I would tell you. Sorry. It is a midwestern small town. I am really tempted because the building has a little shed behind it that is rented to their neighbor. The rent the existing owners collect on the rent would more than pay the monthly mortgage payment.

I am going to look at this building and possibly make an offer. Can’t lose.

When Tishman and BlackRock Inc. default on their $4.4 billion debt it’s just a good business decision.

When Joe Homeowner does exactly the same thing because his job moved to China, he is shamed, hounded to death, and will never live it down.

Welcome to America, the land where corporations rule, and the citizen’s function is to feed them. We are all just prey.

It’s all the internet’s fault.

isn’t less government regulation grand?

“# 23 KMFIX said,

on January 25th, 2010 at 3:05 pm

It’s all the internet’s fault.”

Nice try at deflecting the blame, buddy, but we ALL know that this problem was conceived by toddler George Bush and that he worked his whole life to carry out this nefarious scheme to topple the economy under direct tutelage of Dick Cheney.