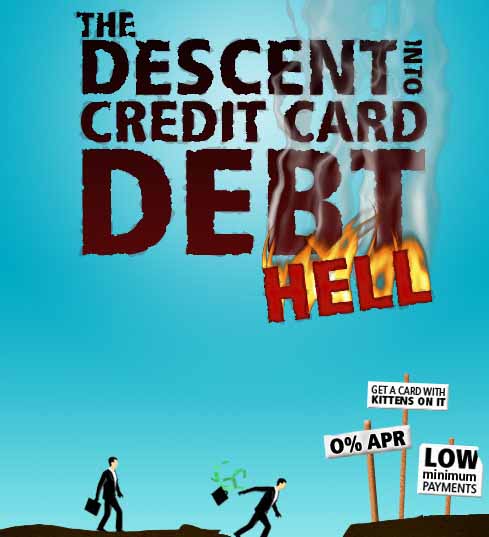

How Credit Card Companies Make Descending Into Their Version Of Hell Easy

By Uncle Dave Friday June 26, 2009

0

Search

Support the Blog — Buy This Book!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

Twitter action

Support the Blog

Put this ad on your blog!

Syndicate

Junk Email Filter

Categories

- Animals

- Art

- Aviation

- Beer

- Business

- cars

- Children

- Column fodder

- computers

- Conspiracy Theory

- Cool Stuff

- Cranky Geeks

- crime

- Dirty Politics

- Disaster Porn

- DIY

- Douchebag

- Dvorak-Horowitz Podcast

- Ecology

- economy

- Endless War

- Extraterrestrial

- Fashion

- FeaturedVideo

- food

- FUD

- Games

- General

- General Douchery

- Global Warming

- government

- Guns

- Health Care

- Hobbies

- Human Rights

- humor

- Immigration

- international

- internet

- Internet Privacy

- Kids

- legal

- Lost Columns Archive

- media

- medical

- military

- Movies

- music

- Nanny State

- NEW WORLD ORDER

- no agenda

- OTR

- Phones

- Photography

- Police State

- Politics

- Racism

- Recipe Nook

- religion

- Research

- Reviews

- Scams

- school

- science

- Security

- Show Biz

- Society

- software

- space

- sports

- strange

- Stupid

- Swamp Gas Sightings

- Taxes

- tech

- Technology

- television

- Terrorism

- The Internet

- travel

- Video

- video games

- War on Drugs

- Whatever happened to..

- Whistling through the Graveyard

- WTF!

Pages

- (Press Release): Comes Versus Microsoft

- A Post of the Infamous “Dvorak” Video

- All Dvorak Uncensored special posting Logos

- An Audit by Another Name: An Insiders Look at Microsoft’s SAM Engagement Program

- Another Slide Show Test — Internal use

- Apple Press Photos Collection circa 1976-1985

- April Fool’s 2008

- April Fool’s 2008 redux

- Archives of Special Reports, Essays and Older Material

- Avis Coupon Codes

- Best of the Videos on Dvorak Uncensored — August 2005

- Best Videos of Dvorak Uncensored Dec. 2006

- Best Videos of Dvorak Uncensored July 2007

- Best Videos of Dvorak Uncensored Nov. 2006

- Best Videos of Dvorak Uncensored Oct. 2006

- Best Videos of Dvorak Uncensored Sept. 2006

- Budget Rental Coupons

- Commercial of the day

- Consolidated List of Video Posting services

- Contact

- Develping a Grading System for Digital Cameras

- Dvorak Uncensored LOGO Redesign Contest

- eHarmony promotional code

- Forbes Knuckles Under to Political Correctness? The Real Story Here.

- Gadget Sites

- GoDaddy promo code

- Gregg on YouTube

- Hi Tech Christmas Gift Ideas from Dvorak Uncensored

- IBM and the Seven Dwarfs — Dwarf Five: GE

- IBM and the Seven Dwarfs — Dwarf Four: Honeywell

- IBM and the Seven Dwarfs — Dwarf One: Burroughs

- IBM and the Seven Dwarfs — Dwarf Seven: NCR

- IBM and the Seven Dwarfs — Dwarf Six: RCA

- IBM and the Seven Dwarfs — Dwarf Three: Control-Data

- IBM and the Seven Dwarfs — Dwarf Two: Sperry-Rand

- Important Wash State Cams

- LifeLock Promo Code

- Mexican Take Over Vids (archive)

- NASDAQ Podium

- No Agenda Mailing List Signup Here

- Oracle CEO Ellison’s Yacht at Tradeshow

- Quiz of the Week Answer…Goebbels, Kind of.

- Real Chicken Fricassee Recipe

- Restaurant Figueira Rubaiyat — Sao Paulo, Brasil

- silverlight test 1

- Slingbox 1

- Squarespace Coupon

- TEST 2 photos

- test of audio player

- test of Brightcove player 2

- Test of photo slide show

- test of stock quote script

- test page reuters

- test photo

- The Fairness Doctrine Page

- The GNU GPL and the American Way

- The RFID Page of Links

- translation test

- Whatever Happened to APL?

- Whatever Happened to Bubble Memory?

- Whatever Happened to CBASIC?

- Whatever Happened to Compact Disc Interactive (aka CDi)?

- Whatever Happened to Context MBA?

- Whatever Happened to Eliza?

- Whatever Happened to IBM’s TopView?

- Whatever Happened to Lotus Jazz?

- Whatever Happened to MSX Computers?

- Whatever Happened to NewWord?

- Whatever Happened to Prolog?

- Whatever Happened to the Apple III?

- Whatever Happened to the Apple Lisa?

- Whatever Happened to the First Personal Computer?

- Whatever Happened to the Gavilan Mobile Computer?

- Whatever Happened to the IBM “Stretch” Computer?

- Whatever Happened to the Intel iAPX432?

- Whatever Happened to the Texas Instruments Home Computer?

- Whatever Happened to Topview?

- Whatever Happened to Wordstar?

- Wolfram Alpha Can Create Nifty Reports

The net-net is not paying bills on time is a profitable business.

For me the CC is a wonderful invention that enables me to purchase goods without exchanging dead trees and metal.

Uncle Dave or Dallas. Do you know if reverting the changes to the BK laws in on the table with the current Admin/congress?

Actually, US banknotes are made from paper but with a large amount of mainly cotton or other fabric in them. So you’re sacrificing shrubs as well as trees, you environmental Nazi.

Cut up your charge cards. Use debit cards and cash.

This is one area where we’re fortunate to have several consumer protection laws in place. The new rules enacted last month will help, but they forgot to add a huge one IMO: increase the 2% minimum payment to 5%.

That change alone will prevent people from racking up so much. But. The CC companies will fight it to the death because it’s singularly responsible for huge profits. It’s also singularly responsible for fools ending up with $30k of VISA and MC bills.

Anyone reading this that has more than a few thousand in CC debt, I recommend http://daveramsey.com. I have no affiliation with them. Simple, dirt cheap, and it works.

Lets add some comments..

1. IF the corps would PAY for decent medical, YOU WOULDNT be paying for it..

2. Wages in last 30 years have gone up?? 3-4 times..REALLY.. The BOSS’s wages have?? 10-100 times?? and HE GETS GOOD MEDICAL..

3. corps cut from the ottom up..first thing, MEDICAL..and then CUT HOURS so you dont get benefits..

4. min wage has gone up 3-4 times, TOP wage hasnt changed much in LOWER/MIDDLE income jobs..

5. MIN survival pay..40 hours per week and about $18 per hour. dont matter if you spread it over 1-2-3 people working in 1 house..

After you PAy TAX, 1/3

Pay rent, $600-1000 and HIGHER

BILLS $300-500

FOOD $200-300 per month for 3-4 people.

Car

Car insurance

Entertainment??

how much do you have to pay YOUR OWN MEDICAL, or to pay a CC company??

MOSt of the problem, comes with HOW MANY people you are paying for. How many companies get your medial PAYMENTS before the HOSPITAL gets it.

we end up using our CC cards to assist in paying BILLS and for food, mostly.

If you dont have enough to begin with, it only sets you BACK. Farther and farther…

If something important happens, you are SCREW’D. Medical, will STOMP all over your pay and the CC card comes LAST to pay.

WHO remembers when a small family could survive on 1 income..I do.

and if the other person worked you HAD EXTRA and could afford MORE and BETTER.

It is simple to avoid this. Don’t charge more than you can pay when the next bill comes in the mail. If you pay off your balance every month you have the freedom to cancel on these people if they pull this on you.

Credit Cards are made from (plastics) OIL?

#7…don’t charge at all. If you’re going to pay it off, just use a debit card.

While it sounds like a good strategy to use the credit card to collect points and then pay it off, hardly anybody does that, and the card companies know it.

#9: I do. I charge everything I can to a card I got from Amazon and pay off the balance every month. For every $2500 I charge, I get a $25 voucher from them. So far this year I’ve gotten four. That’s $100 of free money.

Great post! Yeah, these people are not your friends! I have closed 3/4ths of all my cards after paying them off.

I agree heartily with Uncle Dave. I’ve got an amex card I use for everything and pay it off constantly. With the same benefit.

#10 Dang. I use CapitalOne and get miles which are pretty goog. I need to look at Amazon. WOW.

My household (GAY DINK) charges like $30,000 per year!! There must be a limit on that .01% free cass.

The one card I still carry is from Cabela’s, and I get points towards merchandise. It’s about the same 1% as amazon, and when I used it for business travel a few years back Christmas at our house was a Cabela’s delight.

Airline miles are OK if you can use them. I accumulated a ton of miles by actually flying, which were then diluted by the folks earning miles by buying groceries.

Discover gives 2% cash I think, and my debit card gives points towards merchandise, but the amount of points needed seems to go way up as I accumulate points. The bastards.

Still, the vast majority of people end up paying through the nose for those points or credits.