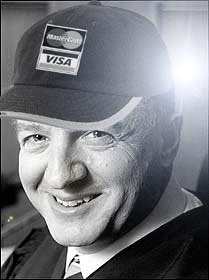

Judge Kramer — Apparent fan of Identity theft

Here’s a judge who has no concept of the real, technology filled world. I wonder if he can be sued by anyone who has a credit “emergency” who wasn’t notified?

A California judge ruled Friday that Visa and MasterCard don’t have to send individual warnings to thousands of consumers whose personal account information was stolen during a high-tech heist uncovered earlier this year.

“I don’t see the emergency,” San Francisco Superior Court Judge Richard Kramer said in rejecting a request for an order against the nation’s two largest credit card associations. “I don’t think there is an immediate threat of irreparable injury” to consumers.

Both Visa and MasterCard argued they shouldn’t be obligated to send the notices because they don’t have direct relationships with the account holders, whose cards were issued by thousands of banks that belong to the associations.

Hmm… Their cards sit firmly in my wallet on my ass. That’s a pretty direct relationship I have with them.

The chances of identity theft are minimal, Visa and MasterCard said, because Social Security numbers and home addresses weren’t taken in the CardSystems breach. The theft involved customer names, account numbers and security codes, providing the tools for criminals to make bogus credit and debit cards.

This is bull. I have an ex-girlfriend who is a private investigator. She could find everything about anyone with whatever info was stolen.

The key words are I don’t see.

I don’t see no evil.

I don’t hear no evil.

I don’t speak no evil.

You have people walking around blind without a cane.

Justice is blind. In some cases it is deaf and dumb as well.

We had a couple of local judges that needed to be corrected.

One couldn’t see that he was a drunk and the other couldn’t hear

the freight train about to hit him. Both were left speechless and I

might add robeless. It was like the blind leading the blind and nobody had to blindside anybody. They blindsided each other.

We just sat back and watched the collision with reality. It was rather ugly, but had a certain entertainment value like watching the detectives does. Courts generally don’t deal with emergencies very well, but neither does FEMA and they have an agency budget for this sort of thing. Some people believe that more government and more political power will solve social or economic problems. I have one word for them. Russia.

You are better off with more cash, than more credit. As for credit cards and other forms of payment go, who can argue with cash when it’s right in front of you? I like the cartoon where the broker is telling the client that his dotcom stock isn’t worth the paper they didn’t print it on. Funny stuff in a sad world. You can’t beat cash in an emergency.

You can try.

“If individual notices were sent, more customers might request a replacement card — something that could be expensive for the industry. Each replacement account costs about US$35.” Ah HA… there’s the real reason they don’t want to notify individual users.

“Visa and MasterCard have maintained there is little financial risk to even the most vulnerable account holders because of their “zero liability” policies that reverse all fraudulent charges.” Yes, but they won’t compensate you for the time you spend trying to get them to correct the fraudulent charges that appear.

They will start to care when the fraud charges start to come in.

A credit card is supposed to be less costly than cash.

This is sort of like Windows being less costly than an open

source program. I guess it depends on your idea of less

costly.

Well hell, if it’s not a direct relationship than I guess I don’t have to pay them monthly, why can’t I just pay them next time I see them or when I get around to it?

I would never do this, but I’ll bet that judge would change his mind pretty quickly if someone were to steal his identity. As John says, this guy has no clue. Maybe if enough people get their identity stolen, he can be impeached. He certainly deserves it. WAY more than Clinton ever did, and I don’t like Clinton.

The judge lives in Judge Land, which is a whole different planet and universe as the world we live in. In HIS world it doesn’t matter if the credit card assigned to YOU is compromised and given to someone else. All that matters is the huge corporate monsters are happy and don’t have to send out extra mailings. After all, he knows who lines HIS pockets.

You make this seem like the judge is doing something wrong. Where’s the law that requires this? I didn’n know judges were responsible for preventing crime too.

And may Visa / MasterCard be prosecuted for fraud and sued by every person whose identity was stolen.

Hey wait a minute. Any fines would just be added to the card charges and bank fees I already pay. Maybe some Bank and credit card executives need to see the inside of a jail cell for any change to happen.

Another benefit to doing business with a l’il ol’ locally-owned bank.

Century Bank, here in Santa Fe, has been around since 1887. They notified everyone whose card number was on the list. Immediately canceled their cards. Overnighted new cards in. Set-up the bank’s public auditorium for a week as a center for folks to pick up their new cards.

Just in case.

Just a little local bank; but, they ended up with over nine hundred really

impressed and very happy customers.

#9 AB CD –

The law, California Civil Code 1798.82, requires that if a company discovers or is notified that certain kinds of computerized information have been disclosed, and the company reasonably believes that the personal information was acquired by an unauthorized party, the company must notify California residents of the security breach “in the most expedient time possible and without unreasonable delay.”

The law took effect July 1, 2003.

Here’s a link to more details:

http://www.loeb.com/CM/Alerts/Alerts60.asp

This is like the car recall math that we are all familiar with.

How much does it cost to mail the notifications and replace the cards, vs. how much will the fraudulent charges, stolen identities, and law suits add up to. I don’t see how someone can steal your whole identity with just a credit card account number and “password”.

Since I’m not lazy, and actually pay attention to my bills every month, I don’t see anything wrong with waiting for a fraudulent charge to appear before requesting a new card.

In fact, that may be what I’m doing, since my details may have be stolen, and I don’t know about it. What, me worry?

It is too bad that Judges cannot be named in class action suits when they commit civil offenses against people in the same way that individuals can, because this loser has made identity theft easier by thinking without knowing that it is not that big of a deal.

Here’s to 50% interest rates and increased finance charges towards footing the end users’ bills… having credit card information stolen results in access to planty. If they’re a good social engineer they could have it all through compiled information. At the very least they would likely have full name, site password, limits, ccv#, mother’s maiden name, at least last 4 of social, residence address, phone number, names of other card members (and their information), links to other billpayed sites… don’t tell me a lot can’t be done with all information, at the very least it will ruin your day or go as far as screw you up royally!

Most amusing and disturbing to me is the extraordinary care with which the judge carves the following sentence:

—————————————————————————————

“I don’t think there is an immediate threat of irreparable injury” to consumers.

—————————————————————————————

Ah… with standards like that, who needs laws anyway? The judge is arguing that until there *is* an immediate threat of irreparable injury, no action should be required. That in itself is a helluva perspective.

I’ll say it again.. we are LONG OVERDUE for some class action suits against corporations who neglegently allow out credit card numbers to get stolen.

It seems like there are class action suits for all kinds of tech stuff (I got a coupon for my failed Zip Drive!) than why not on somethings that really matters?