The Real Truth About Social Security by W. A. “George” Hale — The Social Security debate is heating up as the White House recently began to attack the AARP. It’s time we started to do some reading. Let’s start here.

One example is the currently proposed folly of “privatizing” Social Security. As conservative as I am, and as much of a believer in personal investments as I am, it gives me nightmares to contemplate new ways of talking of “investment” in relation to Social Security.

Taxes must be raised, or the federal debt must be raised, or the benefits must be reduced to solve the problem. THERE ARE NO OTHER CHOICES!!! How to do that fairly will become clear as soon as responsible journalism surfaces to inform the public about the nature of the problem itself. This is a huge news story. In the absence of that, we are now talking about going in the opposite direction — by lowering taxes.

Contrast with

Another conservativce with another and opposite opinion

For instance: An incredulous secretary of the treasury, William Simon, said in an article appearing in the November 3, 1976 issue of the Wall Street Journal that “as chief financial officer of the U.S. government … I am shocked by what I have learned about Social Security.” He explained:

… today’s contributors have not been building a fund at all. The taxes they are paying into Social Security are being handed over as benefits to other people. In turn, when the current workers retire, they will be completely dependent on future workers for their benefits. Their position is even more vulnerable should anything go wrong with this delicate balance. Each generation has the power through the elective process to refuse to pay.

Read all this and more and the real conclusion you have to draw is not that we have to raise or lower taxes. Or that we have to borrow money or decrease benefits. The one variable never mentioned is to increase the labor force and pay people a decent wage instead of sending jobs overseas. Nobody even mentions this.

So we send jobs overseas where nobody pays into social secutiry and we open the borders for illegal aliens to not only steal jobs, but so they can send the money they make back to Mexico. Forget about SSI with these folks. The money is not even recylced into the system. So who is really killing Social Security?

related links:

Boilermakers

Intense anti-Bush rant

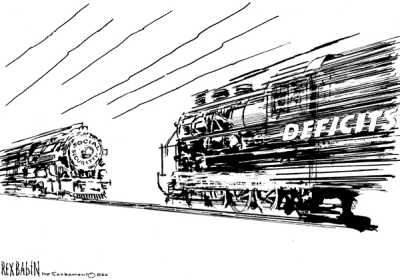

A Tresure Chest of Social Security Political Cartoons

Cato Institute pro-privatization site

Sending jobs overseas isn’t the issue. The social security system is a giant pyramid scheme. If there wasn’t another job sent overseas, social security would still be bankrupt, but at a later date. It would help if the ~85,000 cap on social security contributions were removed, but that still isn’t the point. Social security was yet another fraud foisted upon the public by Rosevelt. It astounds me that anyone ever voted for such a ponzi scheme.

I think that originally social security numbers were indeed account numbers for contributors. The funds would go into their own account for retirement purposes. The problem is when President LB Johnson decided to use the fund for other than its original purpose and instead use it to fund his “Great Society” social programs. At the time there were huge funds in the social security fund. Not any more.

What you have with this is a bunch of people trying to make a system work that is bound to fail sooner or later. In a way it is political and in a way it is financial. The federal deficits can’t be honestly managed, they are out of control. Social Security was honest and well administered for years, then everybody got sloppy about it. The government is now focused on Iraqi Security and winning this war business against some nobody terrorists. Social Security was a program for the benefit of the older World War Two generation who knew what service to the country was and knew what the Depression was all about. People will end up with what they deserve. The baby boomers are bound to wreck the entire system to pay for their luxury lifestyles and pass the buck mentality. More finance people are into fraud these days and make big political contributions and you have much more government corruption, so you can’t have a system that depends on honest administration. Today it’s run based on fear and intimidation.

When the World War Two generation is gone, you will see Social Security raped for every last dime the the Bush boomers can sqeeze out of it. Social Security worked well for years, but we have new faux thinkers who want to fund some sort of world police force and save the day for Iraq or some other mission into hell. I don’t see why people are so shocked that the current gang in Washington would do what they are planning. These are same people who turned the savings and loan industry into a smouldering ruin of fraud and stuck Uncle Sam with the tab. Now they’re investing in Iraqi real estate looking for some big payoff. If you think Social Security was a fraud, wait until you see what they replace it with. This will make Enron and WorldCom look like a bunch of saints. Everybody and their broker wants to manage your money, without being a source of money for you. Maybe they’ll privatize the United States Mint next to save a few bucks on making the money. They can have some corporate donors run the presses and have Bush $3 bills and put Reagan on plastic dimes. You might as well burn your Social Security cards before these losers burn you for a quick buck. Stick with cash. I don’t think they can ruin that. They’re working on it.

It’s not a Ponzi scheme if the size of the current workforce paying into the system stays flat or continues to rise. But the Boomers represent an overwhelming bulge in the demographic history of our country. They couldn’t forsee that before WWII when SS was started.

[John, even if everyone over 18 had a job in this country, it still wouldn’t be enough to plug the gap. The Boomer numbers are too overwhelming.]

But around the time of Treasury Sec. Simon in 1976, the baby boom had been over for at least a decade and it was clear they were going to have a problem in the future. Yet nothing was done. Even the tax rise 10 years later in the mid 80s to create a net surplus into the SS trust fund has proved not to be enough.

Which means ipso facto that the Baby Boomers have not paid their fair share into Social Security!

For 20 years of their working lives, from the mid-60s to the mid-80s, they only paid enough to pay the benefits of their (much fewer) parents and grandparents. The assumption is that you pay for the previous generation, and then the next generation pays for you. You get out of it what you put into it. But they didn’t put in enough to pay for themselves. At current benefit levels, the Boomers as a whole are going to receive a lot more than they paid in. They got off cheap, and the ones who come later will have to bear the burden, NO MATTER HOW WE FIX IT.

The only fair thing to do is reduce their benefits because they didn’t pay enough into the system. The governments they voted into office all those years screwed up. But that’s not their children’s and grandchildren’s fault.

I read that if the cap on Social Security tax was removed, Social Security would be ‘solvent’ until at least 2079. Also, aren’t there many trillions of dollars in US Treasury bonds that are the basis of the Social Security trust fund?

It’s unbelievable to me that folks don’t see through this not even thinly disguised scheme to funnel tax-payers’ money to Wall Street via standard commissions for all the ‘private accounts’.

The administration admits that, a) the privatization scheme will not change the ‘solvency’ issue, and b) that the scheme will cost between 1 and 2 TRILLION dollars to support.

As far as off-shoring jobs, the new reality is that VC money expects companies to have an off-shore component to them at the outset. This means that those jobs NEVER APPEAR in the jobs moving off-shore. They’re not moving; they were never here.

The fallacy of the Bush tax cuts is that the money, given back to the wealthiest, chases the best rate of return. It goes into VCs, it goes off-shore, it buys Euros. Money isn’t patriotic.

seems that the concept of making corporations pay taxes for every worker that’s oversees….would be a start…to make it less attractive AND to get that money back into services for Americans (i.e. social security). Also seems that if we would export at least as much as we import….would be beneficial. Support American products at home… by clear labeling, would help too. Meanwhile, the illegal aliens that are here…wouldn’t find it so attractive if we imposed a fee for each dollar shipped out via wire to Mexico, and if we started going after the Mexican government to strengthen THEIR border…(as they do with the country to the south of them). The whole idea of social security was to benefit older American worker….a cushion, a forced savings account, and a reward for paying long and faithfully for the country. The boomers have worked and supported the WW2 retirees…. so NOW….what? They get stiffed. Hmmm, seems amiss.

Everything that has ever been privatized has turned to baby excrement….so, how/why would this be any different. It’s a snow job…just like breaking up MA Bell, and just like the pressure in California to deregulate the power companies….and let Enron have us “pick up the soap in the prison shower”. I’ve HEARD all this “oh it’s good for you” but, it’s not. It’s only good for business…so why would Bush push for anything that is good for Americans. He would be breaking his perfect record.

It’s lies. Bush is out for corporations…not individual Americans. I think the god he speaks of is the one that says “in god we trust” with the pyramid and the eye on it.

….But, certainly, his PR machine is in full swing…the Walmart shoppers of the country won’t think a thing about it. I’m going to save up and buy a nice shopping card and start saving my cardboard up…I’ll NEED it for when I retire. Maybe Alice Waters will cook at the government run old folks soup kitchen?

The KISS principle says that if there is a simple solution, it is stupid to chose the complex one.

Here is my simple solution

1) End the contribution cap

2) Push back the eligibility age by a couple of years.

3) Make IRAs totally tax free in and out.

This would fix Social Security for decades and would create an even better “private” retirement program.

John, you’re one of the few legitimate journalists that has the courage to use the word “privatize”. Even with the quotes.

The Talking Heads of American media are so accustomed to spitting back out the PR releases they get from politicians and corporations, they automatically parrot, “reform” — as if it was a meaningful description of what is proposed.

GSA numbers verify what T.C. says [above]. There isn’t any question about that — except [1] in the lies we get daily from the thugs in power; and [2] from the flacks who roll over, stick all four feet in the air and say, “feed me, feed me!”.

Your comment about illegal immigrants is misinformed. The vast majority of illegals pay into Social Security – and never draw that money out. They’re not sending home Social Security money – but their take home wages. The only people not paying in are people working in the black/grey economy – usually below market wages in cash, and while a lot of them are illegals, there are plenty ‘o citizens who participate w/o paying taxes.

Immigrant labor makes agriculture, construction, meat packing, and any number of service industries run. These folks work hard for low wages – just to try to give their families a better life. They live on our economy, buy food, pay rent – and contribute to our economic life every day. You can’t say that for programmers in India.

I’d like to see how many Americans would line up to walk four hundred miles for a job that pays $5.25/hour. At least these immigrants aren’t whining, they’re doing something to make a better life.

Here’s the reality – the retired generation is the wealthiest generation living – they have more disposable income than people raising families. So why the hell do we send Social Secuirty checks to people who use the money to pay their gardener (who is probably illegal)? Social Security is welfare, it should be needs tested and given to people who need it. It should be taxed on all income (not capped at 85k). If we did those two things there would be no issue with it.

We shouldn’t blame people who work for the problems of people who don’t.

John has a point that outsourced jobs circumvent income taxes. I agree with meetsy, why not make the corporation accountable for those unpaid taxes? (because, you can be sure that those outsource employees pay taxes in India which builds infrastructure in India, not America, which further decreases America competitiveness.)

“Taxes must be raised, or the federal debt must be raised, or the benefits must be reduced to solve the problem. THERE ARE NO OTHER CHOICES!!!”

Wrong. As RonD mentioned above, what helped create this problem in the first place is presidents since LBJ raiding the Social Security trust fund for their own pet programs. And LBJ isn’t the worst offender, either. That distinction belongs, as far as I know, to Regan and Bush I.

I don’t recall reading any uproar about Bush II burglarizing funds out of SS, but then again the media has become so neutered under this administration that it may have gone unreported in the mainstream press.

Increasing the work force delays the problem buyt doesn’t solve it. The reason is that benefits are increased not with inflation but with wages, so higher wage growth and a growing economy would solve the problem for the current generation, but not for the generation that follows. Private accounts basically bring the cost forward in time, and ensure that future generations’ needs are met.

kevin,

How, pray tell, can an illegal alien pay INTO a system, if they do not have social security numbers? The big benefit of illegals in this neck o’ the woods…is that they ARE undocumented.

I see a lot of illegals, undocumentos..whatever, and they are mostly paid “under the table”. Employer doesn’t take out taxes/ss/sdi/health insurance/yada yada….the employee doesn’t have any benefits…takes the cash and runs, or more likely, sends it south. Now…..how, does this cover the costs of medical services (because the state does pay for illegals who need service), jails (because there is a growing crime rate), the judicial system, etc…etc. You gotta understand — it’s not like we’re getting all upstanding citizens crossing that border illegally.

Meanwhile, the low payed workers are driving down the wage for everyone….and, causing a lot of anger for the workers here legally…who are now less desirable because they ARE documented.

I’m sorry Kevin…but the illegals are taking work from people who would love to work, they are taking work from people who came legally. You must have fallen victim to the brainwashing. Take the RED PILL.

You must have fallen victim to the brainwashing.

meetsy, we had this conversation already. Your presumption that homeless, poor, and unemployed people would want the jobs taken by illegals is unfounded. Talk to some social workers about the kinds of jobs their clients will take.

Also on another thread/post on this blog, someone mentioned the millions of contributions that flow into Social Security each year marked with invalid Social Security numbers. Assuming 1/2 are data entry errors, thats still a lot of fake SS numbers being used and money contributed to the system that won’t be withdrawn. Use Dvorak’s search function.

It would be nice to have some hard numbers on how many illegals contribute to the system without any hope of getting their money out. Of course they should still comply with the law.

“Burglarizing” Social Security

The surplus of cash that flows into the SS trust fund is replaced with IOUs that pay market interest rates. They are not technically Treasury Bills and Bonds because those are only issued to the public, but they are essentially the same. This is not “stealing”, but merely borrowing.

To not spend it would be to let it sit under the government’s mattress, not earning interest. Meanwhile, more government debt would need to be issued to the public, which takes money out of the economy and affects the money supply and value of the dollar. That’s why the government uses a “Unified Budget” to measure the budget deficit or surplus because that reflects our government fiscal policy’s true impact on the economy.

In 2018, the net outflow of money from the SS trust fund begins, at which point the government will need to raise more cash to cover the IOUs. This will be done by issuing more government debt than normal, putting more strain on the money supply and the dollar.

Personal Accounts

AB CD is right. Personal accounts do not affect the funding shortfall, but are a way to address the problem identified by Treasury Secretary Simon 30 years ago: Social Security is a pay-as-you-go system, where benefits paid are loosely and tenuously tied to the money contributed, and are always subject to political risk. Bush acknowledged that personal accounts alone would not solve the problem around the time of the State of the Union.

Also, in the State of the Union, the proposal he finally committed to said that personal accounts would be administered by the government (not “Wall Street”), would have a limited number of investment choices, would go into Treasury bonds by default, and would have many safeguards in place to limit the risk.

The most important point of a personal account is that it’s personal and it actually has a personal “balance” that you can see each year.

Look at the current statement you get from SS. It says ‘your earned the following amounts of money in each of the last Y years. If you were to retire right now you would receive a SS benefit of W, or if you were to become disabled, you would receive Z.

It doesn’t say anything about “you paid this much in Social Security taxes into the system, and you will be paid out of these funds, or based on this contribution, over the following years.” The link between what one puts in and what one gets out is tenuous, and subject to the whims of politicians (like Mr. Bush). Personal accounts represent money you have contributed, can see every year, and will help pay your benefits when you retire.

Boomers vs. the X Men

Also, I suggested earlier that the Boomers should be “punished” because they didn’t pay enough into the system. Of course this won’t happen per se, but many people interpret any change to the benefit payouts as a “benefit cut”. Increasing the retirement age is a benefit cut, because you are paid SS for X number of years less until you die, resulting in a lower payout than if you had retired at the original retirement age. The alternative is raising taxes, whether it’s raising the income cap for payroll taxes or whatever.

This is unfair to the current generations paying into SS. We will pay in much more — in order to pay for he Boomers — than we will get out of it. If our money had been saved as we went along. If we had had personal accounts — a forced savings account, as meetsy erroneously said we have now — back in the 60s, this wouldn’t be a problem. We would be getting back our own money in benefits.

Personally, I think we should think of SS as insurance against old-age poverty, and break that expected link between the amount one puts in and the amount one gets out. But that would make the program extremely unpopular, and would be a huge risk for politicians. The program is viewed and planned for as a retirement benefit.

It would also make SS seem very expensive as “insurance”. Under this thesis, any retiree whose income is over the poverty-line should have their benefits reduced or eliminated. That would not fly. So once again we return to soaking the rich.

Talk to social workers? TC what planet are you on? Social workers don’t have a handle on it….

I talk to the unemployed, the homeless and the bottle recyclers they’re real people ….. forget that nonsense about them not WANTING jobs… they want them. They just can’t get in the door because some south of the border citizen has taken it for half the wage that was offered a year ago. Kitchen jobs have almost dried up in California for anyone who’s legal. Labor jobs are almost 100% undocumentos, except on union sites (and the union workers can’t compete on price).

Meanwhile, it’s like we have slave wages in the US….so bad, in fact, that a number of the undocumentos have taken to sleeping in backyards near where they stand and wait for day labor work (had one in my neighbors yard camping one night. I don’t exaggerate.) The amount of crime is rampant…especially undocumento v.s. undocumento. The cops acknowledge it, but there is little they can do, because the undocumented know they’ll just get deported. It’s getting ugly. Yet, you think that it’s okay because some guy “might” be putting some bucks into the social security system that they can’t get out? HUH? How much do you think it costs to deal with the trash, cleaning up the urnination and human excrement issues (yes, come visit…I’ll show you the wonderful sights), the violence, the sex violence (hey, single guys get horny, and it’s not their country), the damage done to property (come see what a campsite in a backyard looks like!), the medical costs, the judicial costs, and the transportation to Mexico costs….and add it up. Do a spreadsheet…does it equal the amounts paid into Social Security? Not.

You say that people don’t want the jobs. That is a boldfaced lie.

When some crummy website like Craigslist has a job posting for an 8 dollar an hour job and gets 500 applicants…..for the SF Bay Area (one of the most expensive places to live in the country, and 8 dollars isn’t even a LIVING WAGE) …. something is terribly wrong. And, certainly with thinking that justifies the 8-10 MILLION illegal workers in the US.

Now, social security is all some have to live on after working their whole lives. It benefits the poor more than it benefits the rich. It’s hard to save up a retirement fund when you can barely make ends meet working minimum wage jobs. It’s hard to save up a retirement fund when every penny goes to surviving. That is what social security was to address…. not having millions of Americans destitute and without any income at all. It was to eliminate the POOR HOUSES. It is our obligation to help support the elders, the injured. I think our government spends too much on silly things like overseas involvement, and pushing agendas that favor one interest group over another — mostly ignoring what is best for the citizens of America, and America’s long term health as a nation.

Sure, a lot is wrong with social security, but a lot of other things are wrong with the countrythat are much more dire…like medical coverage, and health care, priorities and corporate greed and lack of consumer protection. The poverty in OUR COUNTRY can rival some “3rd world” countries.

T.C. come “slum” with me, I’ll show you a whole different world. You need to get out more, and widen your views on what America is.

TC: “It would be nice to have some hard numbers on how many illegals contribute to the system without any hope of getting their money out.”

The way that many local restaurants are dealing with lack of documented aliens..is to take old ssn#s of ex employees, and of employees that did “try outs” (restaurant speak for..”come cook a few shifts, let’s see how you do, then you didn’t work out…two days of shift pay, maybe, and oh yeah, sorry, no job “) and shove the SS money and taxes into those accounts. Most people don’t actually figure out their pay stubs …and compare it to what the W2’s (and in the case of the tryouts..w2 would be below what would be necessary for an employee to issue). So, this money goes towards an account. It’s not like it’s there…never to be claimed by anyone. I have three instances of someone adding $$ to my social security for years that I was self employed and KNOW how much I put into the fund. Wish they’d contribute more…. but it sure screws with my returns…as the feds come back and ask ME to pay taxes on it. Again, how many people complain when the IRS asks for more money? Most of us are not about to go into that issue…and, trying to rectify that is a huge, HUGE pain for a citizen. It’s more paperwork than simply paying another 50 or 100, or 200 dollars in taxes, or having it deducted from your return. IRS makes “adjustments” and corrects tax returns all the time…to correct these kinds of “errors”. If the bogus user of the ssn didn’t have the correct deductions…guess who pays? The rightful ssn owner.

TC have you checked your tax returns/ ss contributions to make sure that no one else was using YOUR ssn?

Of the payroll clerks I’ve talked with about this problem…they say that the government goes really EASY on them, just sends a letter, when any complaint about a wrong ssn shows up. It’s a letter, and if they ignore it, nothing comes of it. They say it’s easy enough to simply change the number, to another bogus number, and say that it was clerical error. No problem. No accountability necessary.

So, really, it’s not some poor illegal mexican who cannot reclaim “HIS” social security contributions….it’s some poor soul who must pay taxes on some income that they didn’t report because they didn’t KNOW about it.

The problem with Social Security is FDR’s crew didn’t take into account the number of retirees ratio to workers would increase due mostly due to much longer life expendences. It is tough as the fix requires a mix of higher taxes, raising age for retirement, reducing benefits, adding ones under other plans all of which will be difficult to swallow. Just bashing the other party will do nothing but make the fix more difficult.

Personal accounts of some type may have merit but have nothing to do with solving the cash shortage for the unfunded obligations.

Boyd Stephenson

I just discovered your site and this thread. I’m always gratified to see my article discovered and discussed.

I was interested in the comments on illegal aliens. Why do you think both parties are leaning toward full naturalization of illegals?

When the truth is finally out to the American public, and they understand it all, it will be a profound embarrassment to every politician that has served since the 1930’s! SS is the last surviving vestige of the New Deal.

However, think about how much a sudden increase of 12 to 30 million FICA taxpayers would mitigate the problem, buy some time, and placate an outraged population?

Think about it!