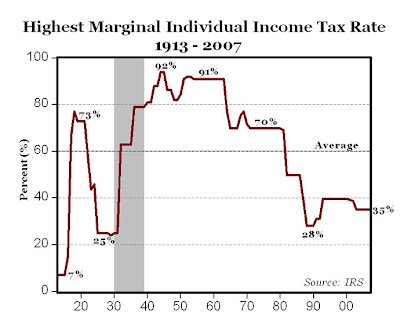

What I like about this chart is that they slip the 16th Amendment past the voters with a 7-percent marginal rate. Keep it that way for a couple of years, then BOOM. Har. Suckers!

And look at the income tax rate during the Great Depression from 1929-1940.Watch how that idea is repeated with similar effect.

“What I like about this chart is that they slip the 16th Amendment past the voters with a 7-percent marginal rate. Keep it that way for a couple of years, then BOOM. Har. Suckers!”

That’s a good reminder for anyone ready to fall for the 999 or “fair” tax scams. That “simple” 9-9-9 will quickly turn into 30-30-30.

And anyone who thinks that the IRS will get smaller or go away with those scams needs to stop huffing ether.

Politicians can raise the current tax program today if they want to.

Doesn’t matter what the tax program is.

What it takes is a group of voters with a backbone to fight tax increases. The problem is not a revenue problem, it is a spending problem.

The last 20 years boils down to a voter problem. The politicians don’t hire themselves.

That’s what is called a courageous move. Its rather akin to saying: “Screw the next election. I’m going fishing…

Its no more a spending problem than it is a revenue problem.

Its that revenue≠spending and hasn’t since Clinton was in office.

You had Shrub fighting two wars without raising revenue. (In fact he was decimating revenue with tax cuts for his backers [and don’t try the BS with trickle down economics. There are structural reasond why trickle down can’t ever work.{The people getting the benefits are never the ones doing the spending. (The accountants doing the spending are prevented by law and by their code of ethics from letting a nickel of that money escape on anything which does not benefit the bottom line. [Fuck your health care. They don’t care.])}])

The piper didn’t even wait for the last term to end but instead came due on Bush’s Own Watch, and in far less than eight years we went from a balanced budget with a deficit heading in the right direction to being trillions in debt with the congress spending like a bunch of drunken sailors on shore leave.

That’s what happens whenever you leave amoral children in charge of the piggy bank.

Then we get the suits on Wall Street piling on their own incredibly stupid gambling debts (anybody with a fundamental knowledge of math could see the coming debacle,) and we bailed them out too.

Everything you said in your post is absolutely correct, and is the cause of our current problems. The Republicans will never admit it, either. According to them, the way out is to reduce taxes to zero, which would magically cause everyone in the country to have a job. But where would the revenue come from to pay off the current national debt if there are no taxes and no revenue coming into the federal government to pay it off? Hmmm? That’s the question they have never been asked and that they don’t have an answer for.

It’s a spending problem AND a wealth re-distribution problem, with a very significant bias in favor of the top 1%.

Isn’t the chart almost meaningless without knowing a whole bunch more things? Like what was the actual tax paid–I saw a chart here I think a few months back that showed “on average” regardless of the maginal tax rate, the average collected by the IRS was around 30%?–or whatever.

What do you think? As a society becomes more crowded and congested, in a vacuum, should taxes go up, down, or around?

Isn’t a better chart to go along with this one the wealth disparity charts showing the USA is like fifth from the bottom in equitable distribution?

Isn’t a better chart to show how much CEO are making while not contributing a thing to society?

What does the chart show but that taxes go up and down?

Silly.

-“Average collected by IRS” – I know the number of the total collected vs. GDP. It is almost constant at 18% over last 100 years.

-No matter how crowded/congested society is the percentage each member pays must not change. More congested – more people pay more in total. Society “rarefies” – less total collected at the same rate. Automatic.

-“Disparity” chart matters only if you want Communism. Disparity is irrelevant for tax collection. No “from everyone as much as they can contribute”. Absolutely NO. Yes to “identical fraction from every dollar earned”. Egality. Rich and poor, white and black, male and female… humans tread as humans, as equal individuals.

-CEO income charts matter for jealous and envious. It is their income which they negotiated and achieved. Not yours. Something children should learn before age of two.

-Chart shows cheating lying Congress and taxes rising correlated to economic downturn.

Real answer: strong fundamental Constitutional amendment making it impossible to change tax rates or introduce new ones without again amending Constitution (hard). Flat tax treating every person and business equal. Including mandatory balanced budget hence freezing both sides of the budget and controlling out-of-control Government.

All that you have said is rather Utopian… as if society and government were perfect. Corruption permeates all levels, starting at the top. You presume that the 1% at the top earned their position, and those at the bottom deserve theirs. That is total BS. The bulk of wealth is controlled by greedy, sneaky, liars and manipulators. When those sleazebags slip up and show what they are made of, we can’t do a damn thing about it… well not until the whole shebang blows up in their face.

If someone of low income could inflict the kind of damage that bankers did leading up to 2008, they would be stripped or their measly assets, and thrown in jail until they rotted. That’s reality.

For corporations, no tax on money used for expansion and jobs, but the individual rich who have obscene amounts of money for doing relatively nothing should be reigned in. There’s healthy and fair capitalism, and there’s out of control obscene, greedy, destructive capitalism. We (western society) have become the latter.

Dismal – let’s parse:

-”Average collected by IRS” – I know the number of the total collected vs. GDP. It is almost constant at 18% over last 100 years. /// Yes, I think thats the number I was recalling. Grossing up numbers can hide a lot, or reveal something basic. Or a mix of the two? I think reading this whole thread what I am reinforced about is that “lots” of info has to be taken in and very limited views of any subject cannot be but misleading. Like minimum info voters===who appeals to them?

-No matter how crowded/congested society is the percentage each member pays must not change. More congested – more people pay more in total. Society “rarefies” – less total collected at the same rate. Automatic. /// I don’t think so. I think the more congested things are the more expensive PER PERSON things will naturally be. More traffic lights, more mass transit, more public health, more enforcement for the more rules and so on. An issue that would need more than one simple chart, or one simple idea to come to grips with?

-”Disparity” chart matters only if you want Communism. Disparity is irrelevant for tax collection. No “from everyone as much as they can contribute”. Absolutely NO. Yes to “identical fraction from every dollar earned”. Egality. Rich and poor, white and black, male and female… humans tread as humans, as equal individuals. /// By equal individuals you must also mean pay them the same? Its my favorite example of a kind of common sense that is turned on its head. I have always been paid well. Top 3rd percentile but I also like what I do. Now, take some bottom job==coal miner for instance. Selling one’s health and vigor for a minimum wage. Now==in fairness and us all being equal and what not, lets reverse these jobs. Pay me the coal miner’s wage, and the coal miner’s mine. NOW–which job would I rather do? Well, I’d probably take the coal miners job and see how long I could last. Don’t know if I would ever “like” it though. Bill O”Reilly: tax me that extra 5% on my next one million dollars and I’ll pack it in. It just won’t be worth it to me. HAW-HAW. What a bloviating sack of BS. By and large, rich people enjoy what they are doing and they by far prefer it over the less paid jobs. Communism has nothing to do with it.

-CEO income charts matter for jealous and envious. It is their income which they negotiated and achieved. Not yours. Something children should learn before age of two. /// I’m with Skeptic on this one. Books have been written on the cabal of interlocking boards of self dealing CEO’s. YOU Dismal take this disproportionate payment as a measurement of worth, I see it as a measurement of fraud.

-Chart shows cheating lying Congress and taxes rising correlated to economic downturn. /// Or loss of alcohol revenue as stated “below.”===only idiots attribute any one social event to any one social cause. Pukes enjoy doing it.

Real answer: strong fundamental Constitutional amendment making it impossible to change tax rates or introduce new ones without again amending Constitution (hard). /// Thats just retarded stupid. The one simple solution that flies for thinking among the Pukes. I’d give you a balanced budget requirement with some kind of exception process. Thinking is hard.

Flat tax treating every person and business equal. // On their disposable income? Good enough.

Including mandatory balanced budget hence freezing both sides of the budget and controlling out-of-control Government. /// Fantasy BS.

Depends on what entitlement programs you want to kill off or maintain. What assumptions are you making?

Why? Because you have p3nis envy? 🙂 When has the American society EVER been about knowing what other people make or pay on taxes? It’s a liberal issue not an American society issue.

Guyver, I wonder what news-free planet you live on…

Guyver–entitlement programs don’t fit. I’m thinking those can vary as the society chooses. No–the question clearly goes to what kind of costs increase NECESSARILY because of congestion? Clean water, waste disposal becomes more difficult requiring more money be spent on it. Is that more money requirement met by having more people? More people paying zero doesn’t raise any more money-and the analysis builds from there.

Penis envy? Ha, ha. Amusing how you Pukes go to that issue so quickly==confusing your own penis with a pile of otherwise useless moldy cash. Yes, its all about penis envy==but of which kind and by whom will always be the issue. Seriously: it goes to how corrupt a society has become: ripped off by the insiders, always reflected by their accumulated wealth. Clueless to deny it.

All else being equal, they will get more money simply because there will be more tax payers as the population grows. Are you suggesting that tax rates NEED to increase in spite of tax revenues increasing anyways?

Keep it simple. Do away with ALL tax loopholes and go to a Fair Tax instead taxing people on their income. “Rich” people will contribute more to society simply from their consumption of more resources. No need for p3nis envy.

McGuyver==you aren’t up to speed. I’ve said it 2-3 times now and used different explanations: does per capita cost go up with congestion. I assume so, but am not dogmatic on the subject.

I think its been proven that rich people do not contribute by spending more==kinda a vague reference to trickle down?==what they do is invest overseas which the jobs follow. Show me a rich person and I’ll show you someone who doesn’t contribute a thing to society===they are just takers.

PS–McGuyver–neither you or me or our kiddies or grandkiddies or any of their friends will ever be “the rich.” You are only an idiot who over identifies with them and not your own real situation. I’m a cohort who takes a minimum trickle down pleasure in pointing this out to you and your ilk.

Stoopid Hoomans.

Isn’t a better chart to show how much CEO are making while not contributing a thing to society?

Yeah! Does the world need the likes of Steve Jobs? Of course his salary was only $1.

I’ll give you Steve Jobs. Now justify the rest of them. Go with the Bernie Madoffs and Goldman Sachs of the financial industry. What does someone earning billions by skimming .001 per stock transfer every .01 second provide to you and me?

Why do you support the excesses of the 1%/.1% when you and your kiddies are part of the 99%? When the 1% fail, why should your taxes go up to keep them rich? Why do you continue to fail to reregulate them so your taxes won’t get raided again?

Have you no common sense of self preservation?

No thank you regarding SJ.

As there are thousands of CEOs in the US me “justifying the rest” would take awhile.

Interestingly a lot of Bernie’s clients though he was doing something crooked. They thought it was “front running.” Actually he was stealing from his clients the old fashioned way. Bummer!

What does someone earning billions by skimming .001 per stock transfer every .01 second provide to you and me? Probably not much, but then I did not expect it. My broker charges seven bucks per trade. From them I expect speed.

why should your taxes go up to keep them rich? That’s a good question. Who gave them my taxes?

The chart is also mostly meaningless because it doesn’t give the minimum income amount to get to the highest rate (it was $2,000,000 from 1935 to 1941, $200,000 after that until the 1970s), nor does it give the lowest rate and the income amount below which there was no tax.

And, all those income figures would have to be adjusted for inflation to make any sense.

And, often, the highest rate applied only to “unearned income excluding capital gains”.

Of course, Social Security and Medicare taxes aren’t counted.

Nor, does it account for deductions that were (or were not) available over the years.

Fun to look at, perhaps, but not good for any sort of discussion.

See: http://www.ctj.org/pdf/regcg.pdf

for a still simple, but clearer picture.

You really should change the topic title to “Highest Marginal…” like the chart says. Confusing otherwise.

The problem is that the spending can’t change quickly without having a reaaaally bad effect on the economy.

The problem is that the taxation can’t change quickly without reaaaally harming people.

So, things must happen slowly if they happen at all.

Cain is an idiot.

No one thinks beyond the next election.

Changes to the tax code can and do happen overnight.

It can annoy the ever-lovin’ fuck out of the 12,400 (that way less than 1%) who have as much cash and assets as 150,000,000 of us and we would just write them an IOU.

What’s going to happen?

Are the Warren Buffets, Bill Gates and 398 other really rich fucks out there going to suddenly disappear and take their property with them, and leave this incredible revenue base to head off to Somalia or Uganda, or Ulan Bator or any other stinking hairy armpits of self-styled civilization.

They’d be strung up by their intestines by the inhabitants of wherever they went. Globalization made people toxically miserable the world over.

The rich aren’t going anywhere any different than they were going before.

Shows clearly we have a revenue problem. The sheeple have been trained to believe its a spending problem.

Or perhaps a productivity problem?

Looking at the data, John C Dvorak just proved that the falling tax rate just before the Great Depression was the cause, and the rising tax rate during the Great Depression was the solution.

Oh, right, data is all lies. My bad!

Can you really say that that is the tax rate since taxes are determined by subtracting deductions first. Does anybody actually pay 35%, except the middle class?

The reason for the drop from 73% down to 25%, in the 1920s, might be due to Prohibition. The US gov. wasn’t getting anymore of its revenue from taxing booze. So it had to come from income taxes alone. And the rich probably had something to say about NOT bearing the burden so much. But even so, with alcohol taxes gone. And investment finances getting shaky. All of this probably lead to the Stock Market crash, and the Depression that followed. Prohibition lasted until 1933. And the wealthy that opposed it (after initially supporting it) , because their income had become the only taxable incomes, once everyone else was out of a job. Having alcohol freely sold again, and taxed, got the revenue monkey off their backs. And it put a lot of people back to work, handling legal spirits and beer. About half way thru that gray zone, is when Prohibition ends, and the rate plateaus for a while.

The rate peaked, just at the end of WW2. Probably because all the war profiteering. And after a brief dip, shot back up nearly as high, probably due to the Korean and Vietnam war profiteering. But that’s just a guess. It then plummeted after JFK’s death. So thank LBJ and his Congress for that. And the rate fell sharply again, during Reagan & Bush’s terms. I seem to recall taxing personal saving, went into effect at that time. And the rate went up a little during Clinton’s 8 years. Then down a bit, during Bush Jr’s 8 years. Seems rich Texan-like presidents are responsible from most of the tax rate reductions. What a surprise.

My spin, the biggest spikes coincided with wars and depression. Except the recent wars in Afghanistan and Iraq, which do not appear to be paid for by the top tier income earners.

Keep quibbling while the people on the bottom getter hungrier. Keep swelling the ranks of the Viet Cong. You’ll find out. And considerably sooner than you think.

personally, i find it extremely naive that people point a finger at tax rates and revenues as the primary cause of boom and bust cycles. -a rather absurd notion imo..

the only thing tax rate arguments are good for is distracting the masses from ever realizing or discovering the hidden hands that have been manipulating the monetary, religious and political systems on this planet since the times of babylon and possibly beyond.

the perpetual argument of “the rich” is nothing but a comical farce and slight of hand in its own right. -a mere parlor trick to feed the divide and conquer program installed in your brain.

-s

Aren’t “Har Suckers” sex toys?

and notice how in the 50s, at time of great growth, the top rate was still above 90%. clearly the dogmatic group-think that higher taxes means less economic growth is sorely mistaken.