Click pic to embiggen and see additional comparisons

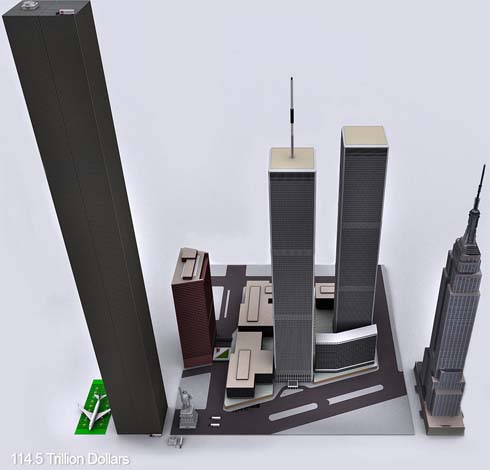

$114,500,000,000,000. – US unfunded liabilities

To the left you can see the pillar of cold hard $100 bills that dwarfs the WTC & Empire State Building – both at one point world’s tallest buildings. If you look carefully you can see the Statue of Liberty.The 114.5 Trillion dollar super skyscraper is the amount of money the U.S. Government knows it does not have to fully fund the medicare program, medicare prescription drug program, social security, military and civil servant pensions. It is the money USA knows it will not have to pay all its bills.

The unfunded liability is calculated on current tax and funding inputs, and future demographic shifts in US Population.

Should we become more like Brazil?

yes, I do believe in Keynesian economic theory. “All” the experts do. They receive Novel Prizes for it.

Obama won the Nobel peace prize, what’s your point?

Credentials and awards only matter in support of their point Bobbo.

Scientists are egotistcal, manipulative propaganda machines when they say their studies indicate CO2 production is contributing to climate change.

vs

Hundreds of scientists believe in Intelligent Design, so it must be true.

If you’re not drinking the cool aid, your opinion doesn’t count.

The biggest drains on the federal budget are Medicare and Social Security.

When our dog got old, we did the “humane” thing and put her to sleep.

The only way to balance the budget is to put the elderly to sleep.

Remember the elderly Indian chief in the movie Little Big Man who kept saying, “It is a good day to die”? He was right.

Consider that the Archmage of Keynesianism, Ben Bernanke, couldn’t see the housing bubble collapse when it was a few weeks out.

Consider too that people like Peter Schiff and Ron Paul called it.

There is and was a small minority of economists who never abandoned reason for sycophancy.

If I wanted to flatter myself with the conceit that I know something about economics, I’d familiarize myself with what the knowledgeable few were saying rather than following the crowd that didn’t seem to notice that the stagflation of the Carter years had totally gutted the credibility of their theories.

But that’s me.

You might be more comfortable in the herd.

http://youtube.com/watch?v=d0nERTFo-Sk&feature=relmfu

#35

Yes, its difficult to save during good times, but its good to know we would be better off if we did

That’s just it. We never did. Government spending, outside of total war, never got us out of the depression. The paying down of the debt was due to the war debt which was on top of Roosevelt’s debt. We never did pay off Roosevelt’s debt directly. It was only mitigated in importance due to inflation.

But its good to know the other half as well–that in bad times, the government should spend/borrow/deficit spend to lessen the damage.

Again, that has yet to ever work. IMO, deficit spending should be restricted to a time of total war. Other than that, IMO, the government should never be allowed to spend more than it makes. What we do know is that government’s running up huge debts is a doomed long term solution.

#51

Congress is responsible for the way so much of this spending was wasted, /// Congress. YES CONGRESS–not Obama. The spending was 1/3 job stimulus, 1/3 Pork, and 1/3 Tax Cuts.

Ooooh. So now, it’s Congress’ fault. So, it wasn’t Bush’s fault that we ran up huge deficit’s? You do realize, that many of the more conservative posters here have been saying that Congress is to blame for our fiscal situation for many years now. For the past 10 years, that has been countered by the liberals like yourself saying it was Bush’s fault. You can’t have it both ways. If the President is responsible for budgets (since he sends them to Congress), then Obama is at fault now. If it is Congress’ fault, then Bush isn’t to blame for the deficit of the past decade. Which is it?

#64

I do believe in Keynesian economic theory. “All” the experts do. They receive Novel Prizes for it.

There are also armies of economists who received their doctorate or the Nobel Prize showing the flaws in Keynesian theory. Government’s love Keynes because he presented a theory to spend like crazy which is great for getting re-elected. It’s akin to the theory of eugenics to people that are racist. It provides a justification for abuse.

At the end of the day, Keynes assumed governments can control and improve the economy. They can’t. They can only make it worse.

#64

“Government’s love Keynes because he presented a theory to spend like crazy which is great for getting re-elected. It’s akin to the theory of eugenics to people that are racist. It provides a justification for abuse.”

Amazingly well said dude.

#68

Consider that the Archmage of Keynesianism, Ben Bernanke, couldn’t see the housing bubble collapse when it was a few weeks out.

Let’s also not forget that it was Bernanke who for years talked about the evils of an inverted yield curve and its ability to predict recessions and then proceeded to make decisions that he knew would create one.

Ha, ha. So we reject expertise and substitute our own common sense riding on the back of faulty memories, dogma, and mixed metaphors????

Well, economics is complex enough, like global warming, wherein bad ideas are tough to negate. Even harder than global warming that is more science based the effects of which are all around us if we would only look. Just LOOK!!

Sad to live in a world where the opinion of a half informed idiot presents itself on equal footing with a considered opinion.

But thats the way it is.

Yea, verily.

“I do believe in Keynesian economic theory. “All” the experts do.”

LOL, tell that to the Austrians or the Real business cycle adherents… who have their Nobel laureates as well.

The first thing to learn about macroeconomics is that there are a dozens of theories and models that are all perfectly consistent with themselves, and none of them can adequately explain the real world.

SL–well thats interesting and we even mostly agree.

How do those other schools of thought contradict Keynesian thinking?

Be specific. Be short.

Keynesian: spend in bad times, save in good times.

Go!

Because it is interesting if you don’t step in the dogma:

Austrian School: can’t be tested, not mathematical….”instead using mainly verbal arguments based on what proponents claim are self-evident axioms.”

YOU KNOW: what else is self evident? Thats right==BS. Well, they sound more credible right off the bat than the “Real business cycles” which sounds like Rush Limbaugh? I thought the “main” contender against Keynes was “the Chicago School”.

Good to know at least one sentence precis on all the different flavors.

http://en.wikipedia.org/wiki/Austrian_School#Criticism_of_the_Austrian_School

According to RBC theory, business cycles are therefore “real” in that they do not represent a failure of markets to clear but rather reflect the most efficient possible operation of the economy, given the structure of the economy. //// Ha, ha. Yeah, pretty much self evident BS. “The most efficient possible….” a toxic tell for sure.

http://en.wikipedia.org/wiki/Real_business_cycle_theory

Gee, if I was an expert, I’d probably know these are not “schools of thought” but rather kneejerk libertarian responses to any government regulations or taxes.

Nice to equate a robust theory with an axiomatic argument that can’t be proven.

Ha, ha. Yes indeed. A low water mark even for a Sea Lawyer.

Got milk?

Chicago school promotes unfettered free markets. We know how well that works.

Sea Lawyer–I don’t know where any of the bright lines are in the various schools of thought but I am convinced that “an unfettered free market” is not a school of thought beyond what exists only in Ivory Towers. Fraudsters and criminals repeat it loudly because it is that kind of farcical non-think that lines their pockets.

Talk about what kind of market regulation, how much, when and you have my ear. Want to push unrestrained free market and you can talk to the hand.

http://en.wikipedia.org/wiki/Chicago_school_of_economics

#73

Lest we also remember that Keynesian theory is 70 some odd years old. Quite a bit has been written and learned about economics since then.

#74

Keynesian: spend in bad times, save in good times.

Fundamentally, modern economists recognize that individuals nor individual bodies can efficiently direct markets nor economies. The use of government intervention to improve a faltering economy runs directly contrary to that fundamental truth. Spending in bad times provides, at best, a temporary reprieve at the cost of long term stability. Saving in good times, after spending in bad, means you spend your boom years paying for the spending during recessions and never get to the point of paying down debt accumulated before the cycle of spend/contract. Further, it means that money that might have been used to start new enterprises or invest in long term ventures is redirected via ever higher taxes towards wasteful projects and interest on accumulated debt.

It would be better to be fiscally conservative in both good times and bad times and not get in the way of recoveries nor attempt to ride booms. I.e., governments shouldn’t try to out-guess markets.

Here is an article which is a retort written by John Cochrane, a University of Chicago economics professor in response to a NYT article written by the Democratic stooge Paul Krugman. In it, he discusses problems with Keynesian theory as it relates to Krugman’s article. A good read.

http://faculty.chicagobooth.edu/john.cochrane/research/papers/krugman_response.htm

Thomas–did we discuss this a while back. Anybody thinking they “know” anything contrasted to my own “I don’t know” position?

but as time marches on, yes, I do think I know, based on observation only, that an unfettered market is too volatile with waste and fraud overcoming the deficiencies of wrong regulation.

So, at the end, we have only arguments, no proof, which comes down to “values.” My value is for the government to provide jobs when the economy cant. You may continue to argue for further tax cuts to our esteemed “Job Creators” even when you should know they can only Bake Cakes, and then only when forced to by sound social policy.

Yes, values. I reject your values, and substitute my own. I challenge anyone to say that arranging society to suit 1% over the 99% is superior to the other way around.

Yea, verily. Bake that Cake.

Thomas–crap piece of writing at your link there. I read the first few Paras, skimmed the rest. Dismal Science.

I can’t finish in detail a critique that starts with an argument against a subject by analogizing to an unrelated subject. In this instance saying rebuking the last 50 years of economic theory is the same as rebuking the last 50 years of scientific progress. Thats just BS. You know what BS don’t you Thomas. Do I have to spell it out?

But with one chance left, he goes to a reliance on “the rational investor.” Pray tell what is rational about computers set to automatic when .001 profit appears? What is rational about huge institutional investors plugged into WS directly ready to ring in one micro-second before, and one after the opening and close? Whats rational about portfolio managers investing and getting paid on the churn?

Nope. Your article is pure BS—just as most are. Pure FUD. That is our market. I’d have to skim again to confirm if there is a basic conflation between our economy and the market. Two different things, confused for the benefit of the 1%.

All BS.

Ah, Paul Krugman. America’s favorite Liberal columnist.

http://krugman-in-wonderland.blogspot.com/ is always a fun place to visit.

lol, bobbo. Keep skimming through wikipedia articles, maybe you’ll eventually become an expert.

I do give you credit though… you are the only person here to proudly claim that your opinion is completely uninformed, and yet are so willing to call anything contrary to it BS and FUD. Good show.

HEY!–SL==funny how that works. Imagine how poorly formulated a position is if a know nothing like me can see right thru it? And yet you advance it. Yes, quite telling.

I would “hope” but already see its not true, that any notion of “free market regulation” outside of completely irrelevant consumer goods and a few garden variety personal service arrangements has been COMPLETELY DEBUNKED.

Didn’t Greenspan admit before Congress the lack of regulation “allowed” our current troubles and the “I was wrong” when thinking enlightened self interest of sophisticated investors would provide a stable market?

I’ve said it well enough already: the inefficiencies of a poorly regulated market avoid the big swings, the booms and busts, that bring down entire societies.

But, in doing nothing but attack me, clever and humorous as it is, we are off subject. My points were clear. I claim no special expertise when it comes to economics. That doesn’t mean I don’t stand head and shoulder above all others posting here, just that my expertise is sufficient to appreciate how complex the subject matter is.

As a starter, I’d say take your average intelligent libertarian, multiple that knowledge base by 10, and thats me. Still not understanding the complexities, but not fool enough to go with “unfettered mareketplace.”

Bake a Cake.

Ha, ha. And when I say I’m x10 smarter than a libertarian==that goes to how dumb THEY are.

Free market indeed.

Dolts.

A free or perfect market is very much like an ideal gas or kinetics “in a vacuum” or a “frictionless surface.”

Its a mythical condition that can be used to approximate ideas or theories. But no one should be foolish enough to think it accurately reflects conditions on the ground.

as tcc3 just said.

#79

My value is for the government to provide jobs when the economy cant.

My value is for the government to abandon attempts at duping the public with short term, temporary jobs or more bureaucratic jobs in a vain attempt to direct the market. I would rather it spent the money it pissed away on delaying low wage firings to pay down debt.

Yes, values. I reject your values, and substitute my own. I challenge anyone to say that arranging society to suit 1% over the 99% is superior to the other way around.

I reject the theory that a government, filled with whatever geniuses you may find, is capable of efficiently directing an economy over the long term (or in some cases, even the short term). By definition, directing the economy to benefit the 99% is fool’s errand because it presumes that the 1% doing the directing (really the 0.000001%) know what’s best for the other 99% all (or even most) of the time.

#80

Your response is proof that the truth hurts. Cochrane is dead on with respect to the last 50 years of economic study. We have far more case studies, far more data about those case studies and an exponentially better capability of crunching numbers on that data than Keynes ever did. We know a lot more about the long term effects of economic theories in practice than Keynes. That’s not BS; that’s science.

#86

You do realize that no economist, from Smith to any economist alive today, believes in a pure free market right? ALL economists recognize the need for regulation.

#87 I’m glad you said so, cause I don’t hear it very often. What I hear is a lot of demonizing of regulation of any kind and promotion of the “wisdom of the market” to the exclusion of everything else.

#88

As with anything, the issue isn’t black or white but one of degrees. The question comes down to the amount and type of regulation and the resources spent on enforcement. There is such a thing as too much red tape/regulation just as there is such a thing as too little.

“Sad to live in a world where the opinion of a half informed idiot presents itself on equal footing with a considered opinion.”

Yes, Bobbo.

But I do take the time to post when your bullshit is especially toxic.

http://whatreallyhappened.com/WRHARTICLES/obamadelusion.php

This pretty well sums it up:

http://original.antiwar.com/justin/2011/07/14/the-banksters-and-american-foreign-policy/

Since this hearty little group is still posting to a relatively “old” post, we must all “care” about our economy. None of us like the current state of affairs.

I’d wage if WE were all put in a room we would actually reach agreement on a long term budget. Because we are all smart and informed? ===No. Because NONE of us would personally benefit from the process.

And therein lies the tale.

Thomas–take out your weasel words and I do wonder how far away your opinion is from tcc3 and mine? You say the words, but deny the reality of the politics we can see going on right now. Libertarianism is a value, but it cannot be applied as it is ALWAYS advocated. Free market can ONLY work in theory–never in practice. Regulation is needed as you say. When you say “over regulated” you show your dogma. There are good and bad regulations–not too many. Are you lazy, incompetent, or a shill?

Onwards to my always too quick read of somebody’s unreviewed/critiqued links. 50/50 their relevancy will be apparent.

#92–First Link==pure crap. The poll Obama is using may indeed be right or wrong. Polls can be pulled in any direction if that is the goal. I refuse to read an article that proceeds by bald assertions to the contrary. Where is the information/data the critic uses? There is none. Pure rhetoric. BS.

somebody==look up what toxic means. Your link would be a good example. On to #2.

Link #2–surprised me. I agree with most of it. Started off really tangentially to this discussion but related. What was it going to be?–a cry for the return to the Gold Standard?? Ha, ha. No. Turned out to be an anti-Obama butt wipe screed:

“……and I would answer that they need to grow a spine: President Obama’s threat that Social Security checks may not go out after the August deadline is, like everything out that comes out of his mouth, a lie.” //// Oh how a pendant clause can ruin a chapter. Lets do some math shall we? There are millions of individual bills to be paid all adding up to 5.3 T but the governments revenue is only 3.8 T. On a failure to refinance the debt of America Obama will have to “choose” which of the bills gets paid. It is true that any category of payment can be made. All foreign debt for instance, plus all active military, plus all MediCare. I don’t know where THAT subset puts us but assuming its approaching our 3.8T revenue==everything else will get nada. No park services, no meat inspection, no OSHA, no road building, no School funding etc.

Did Obama lie? Mathematics actually “prooves” as rigorously as proof is possible that he did not.

Article that say he did are more than suspect. They are BS. They are in fact toxic. Sad, when there is so much good stuff there==but thats what happens when one becomes an ideologue.

Ha, ha.

Yea, verily.