Search

Support the Blog — Buy This Book!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

Twitter action

Support the Blog

Put this ad on your blog!

Syndicate

Junk Email Filter

Categories

- Animals

- Art

- Aviation

- Beer

- Business

- cars

- Children

- Column fodder

- computers

- Conspiracy Theory

- Cool Stuff

- Cranky Geeks

- crime

- Dirty Politics

- Disaster Porn

- DIY

- Douchebag

- Dvorak-Horowitz Podcast

- Ecology

- economy

- Endless War

- Extraterrestrial

- Fashion

- FeaturedVideo

- food

- FUD

- Games

- General

- General Douchery

- Global Warming

- government

- Guns

- Health Care

- Hobbies

- Human Rights

- humor

- Immigration

- international

- internet

- Internet Privacy

- Kids

- legal

- Lost Columns Archive

- media

- medical

- military

- Movies

- music

- Nanny State

- NEW WORLD ORDER

- no agenda

- OTR

- Phones

- Photography

- Police State

- Politics

- Racism

- Recipe Nook

- religion

- Research

- Reviews

- Scams

- school

- science

- Security

- Show Biz

- Society

- software

- space

- sports

- strange

- Stupid

- Swamp Gas Sightings

- Taxes

- tech

- Technology

- television

- Terrorism

- The Internet

- travel

- Video

- video games

- War on Drugs

- Whatever happened to..

- Whistling through the Graveyard

- WTF!

Pages

- (Press Release): Comes Versus Microsoft

- A Post of the Infamous “Dvorak” Video

- All Dvorak Uncensored special posting Logos

- An Audit by Another Name: An Insiders Look at Microsoft’s SAM Engagement Program

- Another Slide Show Test — Internal use

- Apple Press Photos Collection circa 1976-1985

- April Fool’s 2008

- April Fool’s 2008 redux

- Archives of Special Reports, Essays and Older Material

- Avis Coupon Codes

- Best of the Videos on Dvorak Uncensored — August 2005

- Best Videos of Dvorak Uncensored Dec. 2006

- Best Videos of Dvorak Uncensored July 2007

- Best Videos of Dvorak Uncensored Nov. 2006

- Best Videos of Dvorak Uncensored Oct. 2006

- Best Videos of Dvorak Uncensored Sept. 2006

- Budget Rental Coupons

- Commercial of the day

- Consolidated List of Video Posting services

- Contact

- Develping a Grading System for Digital Cameras

- Dvorak Uncensored LOGO Redesign Contest

- eHarmony promotional code

- Forbes Knuckles Under to Political Correctness? The Real Story Here.

- Gadget Sites

- GoDaddy promo code

- Gregg on YouTube

- Hi Tech Christmas Gift Ideas from Dvorak Uncensored

- IBM and the Seven Dwarfs — Dwarf Five: GE

- IBM and the Seven Dwarfs — Dwarf Four: Honeywell

- IBM and the Seven Dwarfs — Dwarf One: Burroughs

- IBM and the Seven Dwarfs — Dwarf Seven: NCR

- IBM and the Seven Dwarfs — Dwarf Six: RCA

- IBM and the Seven Dwarfs — Dwarf Three: Control-Data

- IBM and the Seven Dwarfs — Dwarf Two: Sperry-Rand

- Important Wash State Cams

- LifeLock Promo Code

- Mexican Take Over Vids (archive)

- NASDAQ Podium

- No Agenda Mailing List Signup Here

- Oracle CEO Ellison’s Yacht at Tradeshow

- Quiz of the Week Answer…Goebbels, Kind of.

- Real Chicken Fricassee Recipe

- Restaurant Figueira Rubaiyat — Sao Paulo, Brasil

- silverlight test 1

- Slingbox 1

- Squarespace Coupon

- TEST 2 photos

- test of audio player

- test of Brightcove player 2

- Test of photo slide show

- test of stock quote script

- test page reuters

- test photo

- The Fairness Doctrine Page

- The GNU GPL and the American Way

- The RFID Page of Links

- translation test

- Whatever Happened to APL?

- Whatever Happened to Bubble Memory?

- Whatever Happened to CBASIC?

- Whatever Happened to Compact Disc Interactive (aka CDi)?

- Whatever Happened to Context MBA?

- Whatever Happened to Eliza?

- Whatever Happened to IBM’s TopView?

- Whatever Happened to Lotus Jazz?

- Whatever Happened to MSX Computers?

- Whatever Happened to NewWord?

- Whatever Happened to Prolog?

- Whatever Happened to the Apple III?

- Whatever Happened to the Apple Lisa?

- Whatever Happened to the First Personal Computer?

- Whatever Happened to the Gavilan Mobile Computer?

- Whatever Happened to the IBM “Stretch” Computer?

- Whatever Happened to the Intel iAPX432?

- Whatever Happened to the Texas Instruments Home Computer?

- Whatever Happened to Topview?

- Whatever Happened to Wordstar?

- Wolfram Alpha Can Create Nifty Reports

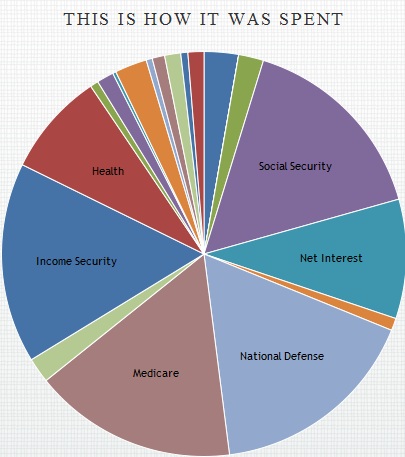

Sorry for these stupid questions:

What is Income Security and why does it cost so much?

I suspect the slice for national defense is quite a bit bigger in reality.

This varies quite abit from the one the at the whitehouse.gov site at whitehouse.gov/taxreceipt. I wonder which one is right or are they both fudging the numbers to promote a certain agenda.

It matters little. The right wing nuts will soon be on here to tell us how the government is mismanaging the tax money and how Liberty Loser needs a new kitchen to spur the economy. Alphie will demonstrate why a universal mental healthcare program is needed. Benji and Doozie will make up some more garbage that has no base in reality. And Lyin’ Mike will pull something else out his butt that only makes sense to him. And each one will ignore the fact THEY are the cause of the deficit.

#1: Click on the image and then click on the slice in the interactive pie to see.

I paid nearly 16 grand for defense and 9 grand on interest borrowed for Bush’s war on Muslims. Just what i wanted to see.

In the mean time, the Teabagger Congress is debating how to reallocate my 3.3 cents paid to feeding kids in public schools.

@#4 “It matters little. The right wing nuts will soon be on here to tell us how the government is mismanaging the tax money and how Liberty Loser needs a new kitchen to spur the economy.”

You forgot to mention Dear Leader who will try to tax the rich, forgetting that even if we rob the rich (100% taxation on all 250K$ or more) … we only get 1T$/yr. < HisHollyTaxator's budget deficit of 1.7T$/yr.

Only way out is cutting down Govt. to size, nothing else matters much.

Don’t forget that if you are employed your employer is matching (and more than matching for 2011) your “contributions” to FICA (Social Security) and Medicare. Double whammy on you if you are self-employed

It is your duty to pay as little income tax as you possibly can. I love the way that 43% pay nothing in income tax. That’s what makes this country great. Thank god for excise, social security, medicare, and sales taxes. At least they pay something, unless they are getting SSI, Soc Security, or a small pension.

Do not believe government statisticians. Basing a critical decision on baked numbers (which is why they call them “pie charts”) is exactly what they want you to do.

I call bullshit. There is no slice for the black budget, or the money given to foreign banks.

Lets go to a flat tax, across the board for everyone, including illegals, since there is no interest in deportation.

I’m Canadian (yay!) I made $80,100 (CDN) last year (yay!).

I paid $13,349 in total federal+provincial taxes. I also paid $747 for Unemployment insurance, and $2163.15 for the Canada Pension Plan (Social Security). And another $648 for Health care premiums. That’s $16,907 all in.

The Canadian dollar is currently $1.04 US. So $1US is worth 95.74 cents.

According to the wheredidmytaxdollarsgo web-site, I would have paid $20,915 in taxes, including Medicare and Social Security, plus an unknown amount in State income tax.

Wow. It sucks to be an American. It’s a good thing you guys had that revolution a while back because you didn’t want to pay a tea tax.

And thanks for handling all those wars for us. And if I ever need some Health care that isn’t covered here, I can just drive down to the nearest US hospital and put it on my AMEX.

Jopie,

I had the same question. Here is the breakdown for “income security”

$424 Unemployment Trust Fund

3.8% of total

$177 Payments to the Unemployment Trust Fund

1.6% of total

$165 Civil Service Retirement and Disability Fund

1.5% of total

$162 Supplemental Nutrition Assistance Program

1.5% of total

$120 Military Retirement Fund

1.1% of total

$117 Payment Where Earned Income Credit Exceeds Liability for Tax

1.1% of total

$111 Supplemental Security Income Program

1.0% of total

$55 Payment Where Child Credit Exceeds Liability for Tax

0.5% of total

$48 Payment Where Making Work Pay Credit Exceeds Liability for Tax

0.4% of total

$43 Tenant Based Rental Assistance

0.4% of total

$40 Temporary Assistance for Needy Families

0.4% of total

$40 Child Nutrition Programs

0.4% of total

$35 Payment Where Tax Credit to Aid First-Time Homebuyers Exceeds Liability for Tax

0.3% of total

McCullough would rather radically restructure the tax code than spend 30 seconds Googling.

>> McCullough said, on April 19th, 2011 at 7:12 am

>> Lets go to a flat tax, across the board for everyone, including illegals, since there is no interest in deportation.

——————–

Deportations Up 70% Since Obama Took Office

The Department of Homeland Security (DHS) announced last week that it had broken its own record for deportations, affirming the Obama administration’s zeal for heavy-handed immigration enforcement. According to the announcement, deportations have increased by 70 percent since the Bush administration, totaling 392,000 in fiscal year 2010.

http://tinyurl.com/338xsq5

# 15 GregAllen >>McCullough would rather radically restructure the tax code than spend 30 seconds Googling.>> 70 % huh? I’d like to see those numbers verified. Meantime, McC is right. Toss out the tax code and start a flat tax and a VAT – with a Vat the illeglas that are still here will get to pay for some of the services they recive.

#17. No, GregAllen would like to stay with failed policy. It’s the mark of a loser.

%9, Here are some interesting numbers to go with your 43% assertion. These statistics were calculated using 9th grade math from data collected from the IRS site for all tax returns from 2008.

The top 5% are paying a 57% tax share on 33% of the income

95% are paying a 43% share on the other 67%.

With 40% pay no taxes, 55% of taxpayers are paying a 43% share of taxes on no more than 67% of the income.

100% – 5% – 40% = 55% of income earners are in the middle and upper range

100% – 57% = 43% of taxes are paid by the middle and upper income earners.

100% – 33% = 67% share of taxable income is paid by middle and upper income earners

43% / 67% = 64%.

Thus, middle and upper income earners are paying 64% of an equal share of taxes. Guess who’s paying the other 36% of their share? The top 5%.

Consolidated:

The top 1 percentile’s share of income is 19% and their share of taxes is 37%.

They are paying 195% of an equal share.

The 2nd – 5th percentile’s share of income is 14% and their share of taxes is 20%.

They are paying 143% of an equal share.

The 6th – 10th percentile’s share of income is 11% and their share of taxes is 11%.

They are paying 100% of an equal share.

The 11th – 25th percentile’s share of income is 22% and their share of taxes is 17%.

They are paying 77% of an equal share.

The 26th – 50th percentile share of income is 21% and their share of taxes is 12%

They are paying 57% of an equal share.

In other words, if you aren’t in the top 5% of income earners, you are probably paying less than an equal share of taxes. You aren’t paying income tax for the bottom 40%; Bill Gates is.

Clearly, the Bush tax rates do put the squeeze on the wealthy. In fact, the middle class is getting a tax discount of 1/3 off.

The Democrats want us to believe we are being screwed by the rich.

The Republicans want us to believe we are being screwed by the poor.

Where’s the section on paying people to issue bonds to pay for another pie?

#20 TeaDud

Cool story, bro.

>Deportations Up 70% Since Obama Took Office

This is still 400,000 out of a 12 million population. For that matter is the incoming illegal population more or less than that 400000?

Obama Administration has filed suit in court against Arizona’s attempts at reducing the illegal immigrant population. Workplace raids are up, but actual arrests of illegals during these raids is down, with a preference on just fining the businesses.

They have set a target goal of increasing the number of deportations, with the purpose of giving themselves an image that they can use to push for amnesty. They achieve this by handing out amnesty to the illegal immigrants if they leave the country, allowing them to process people faster. Once they reach their quota, they stop this process, giving them room to break the record again the next year.

The so-called “flat tax” can go **** itself.

Let’s go REALLY regressive — how about an annual fee of, say, $27,445.17 to live in this country? There are some for whom this would be a tremendous bargain, while there are many, many for whom this would be more than 150% – 200% of their un-adjusted gross income.

If this sounds fair to you, you can go soak your head.

After clicking “where did my tax dollars go” it said…

“The change you wanted was rejected.

Maybe you tried to change something you didn’t have access to.”

Maybe too much traffic, maybe because I don’t have cookies enabled.

P.S. Uncle Dave I know you can’t fix it (not your site) but I mention it in case others get the same error message.

[It seems to be working. Don’t know what the message you got is about. –UD]

#25. What the fuck are you babbling about Uncle Fatso? Do you even have a clue? A little edumaction for you.

True flat rate income tax

A true flat rate tax is a system of taxation where one tax rate is applied to all income with no exceptions.

In an article titled The flat-tax revolution, dated April 14, 2005, The Economist argued as follows: If the goals are to reduce corporate welfare and to enable household tax returns to fit on a postcard, then a true flat tax best achieves those goals. The flat rate would be applied to all taxable income and profits without exception or exemption. It could be argued that under such an arrangement, no one is subject to a preferential or “unfair” tax treatment. No industry receives special treatment, large households are not advantaged at the expense of small ones, etc. Moreover, the cost of tax filing for citizens and the cost of tax administration for the government would be further reduced, as under a true flat tax only businesses and the self-employed would need to interact with the tax authorities.

Critics of the flat tax argue that the marginal dollar to the low income is vastly more vital than that of the high income earner, especially around the poverty level. In their view this justifies a progressive taxation system as the added income gained from a flat tax rate to the rich would not be spent on vital goods and services for survival as they might at the poverty level with reduced taxation. However, true Flat tax proponents necessarily contest the concept of the diminishing marginal utility of money and that a marginal dollar should be taxed differently.[3]

Thank heavens Bobbo hasn’t shown up yet.

And we can compare ten years prior, and ten years projected, to see which items are growing the most.

The Teabagger Congress is debating funding for the 2 millicent slice of my $7,800 Health bill for Planned Parent Hood.

Did I mention that? No? Well, the Teabagger Congress is debating funding for the 2 millicent slice of my $7,800 Health bill for Planned Parent Hood.

Well, if my taxes contribute to the killing of random foreigners it makes it all seem worthwhile.

#27, It will never happen.

The tax code is geared so that you get “deductions” if buy a particular friend’s product.

For instance, I could have had a $0 effective tax rate if I had chosen to buy a bunch of company trucks and let my employees drive them as perks.

And seeing as remodeling one’s house is not a certified deduction (but buying a truck IS), I had to send a bunch of money to the federal government.

Congress likes it that way. They get money from lobbyists to put their particular product in the tax code.

Now you know how GE gets away with an effective tax rate of $0. They buy things with their profit. And government still spends like they didn’t . . .

We all pay taxes even us poor people.Sales tax,property tax and most important the tax we pay on every item any company makes so they can pay their taxes.

#34. Yep, I liked my 97 Jeep just fine, but the IRS gave me a $40,000 write off on a brand new 4Runner for my business. I tried to buy a smaller, cheaper, more fuel efficient vehicle, but it HAD to be over a certain weight (6000 lbs, I believe) in order to get the deduction.

The accountant said it would have been stupid not to buy the vehicle and take the deduction. THAT is how insane our tax code is.

Nice vehicle though now that I have it…Thanks Obama!!!!