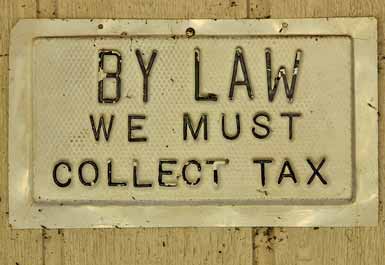

While the Illinois state legislature waits to see if Gov. Pat Quinn signs a bill into law requiring out-of-state Internet retailers to collect a 6.25 percent sales tax on purchases made by Illinois residents, the Illinois Department of Revenue is moving ahead with its own plan to put the taxpayers on the hook for the tax, requiring it be paid alongside the state’s income tax.

Critics say that the move puts ordinary residents at risk of being tax evaders if they don’t keep track of all the items they purchase online, or pay an estimated tax suggested by tax officials.

Other states are likely to adopt the Illinois plan, if legislators in other financially-troubled states see it as an easy way to collect more revenues from taxpayers.

Found by Cinàedh.

This destroys incentive to buy from online retailers. Although, a good thing never lasts…

Never underestimate the governments apatite for money. If allowed, it will consume more and more until their is not more left. Or the system which supports the tax code collapses.

Is that legal? Can one state force the inhabitants of another state to collect taxes for them?

I’m probably not affected by this one way or another (I don’t live near Illinois, and I am not a lawyer), but I suspect this kind of rule is likely to affect interstate commerce in some negative way that was never thought of by those Illinois state legislators.

It’s not bad enough they increased my incomtax by 60%, but they expect me to track my purchases so I can pay more taxes. Fat chance of that. I’ll pay tax for on-line purchases when the state cuts spending and comes close to balancing the budget.

I have not had a pay raise in years, in fact had a pay cut, and the governors office gave it’s staff a raise, and now they want more of my money. F-U Quin, Amazon gets my money not you and your corrupt ‘friends’ in Chicago.

Illinois has had this for a long time. What’s new?

Colorado’s Amazon tax just got thrown out by a federal court.

Shouldn’t this be the rule? Why do you support tax evasion?

scandihoovian in #1 said “destroys incentive to buy from online retailers.

NFW does it destroy my incentive to buy from online retailers.

If the convenience of having anything selected from everything available for the price of some shipping, if it isn’t free, and a few days of waiting doesn’t do it for you, go to the mall and pick from what they felt like stocking up on.

The amount of tax collected by the seller depends on the ship to address, as does which states department of revenue the quarterly check is made out to.

This is a standard business practice.

Move along. Nothing to see here.

Come and get your “tax” money. Hell, come and get me! You have my address. If found guilty what are they gonna do, put me in debtors’ prison and house me, feed me and provide access to medical care? Are they really going to give me back so many of the things that I have lost in these last 25 months?

Your governments are impotent.

They act in YOUR name.

Can I suggest that the BASIC fundamentals of capitalism are… COMPETITION.

IF the companies in Ill, cant compete, it tends to be because of SOME FACTOR IN THE STATE..

Land TAXES/LEASES/RENTALS.

TAXES,

Employment costs and such.

Then on the top is CORP WAGES.

Some person on the net, selling goods, also pays MOST OF THESE COSTS and taxes. but out of a warehouse NOT located in a town or city.(less taxes)

AND if Ill forces these taxes..it takes NOTHING to start a business for 1 year and DROP it name and START UP again NEW.

@msbpodcast – so you as a shipper are happy to do the paperwork for every state/county/city/municipality bylaw in the country?

If my town has an extra tax on wood that is going to be used for making model ships rather than model cars, but only if the maker is registered as an artist (unless they are also a native artist) – Oh and the orders have to be signed off by a CA registered in my municipality – then your company is happy to rebuild it’s ordering systems to handle this?

Here in Fascist Kalifornia, the state income tax return clearly states you must pay the “use fee” on all purchases from out of state retailers.

There’s more. States can require UPS to divulge the number of packages an address receives in a year, and from whom, because UPS rolled over. The USPS refuses to do this.

I, fortunately, receive NO purchases from anybody, and don’t have to worry. I also don’t buy anything in this state, since the sales tax went to 9.5%.

Looking ahead to retirement and the increased sales taxes, I have already purchased everything I will ever need, except food.

1873 Colt,

My condolences. Rather than trying to operate within the constraints of being fiscally responsible, California just chose to raise taxes on everyone. If only everyone could increase their own revenue by burdening everyone whenever they don’t feel like living within their means.

At least one state has a governor being realistic in today’s times: http://tinyurl.com/6zyd7y2

Tax it too high and people will find a way to avoid the taxes. That is why lower taxes earn more revenue.

Gotta love those dumbass Illinois Democrats! Way to stifle an economy!

I think the fed gov would need to pass that law because it is interstate commerce.

However I’ve always thought the tax should be paid at the location the purchase is made. That is where the sale is made rather than where the buyer is.

# 4 Floyd said, “I suspect this kind of rule is likely to affect interstate commerce in some negative way”

Like a federal tax on interstate sales?

Makes no nevermind to me. I live in on of the 5 states that don’t have a sales tax. My guess is we have higher income or property tax to make up for it but that’s ok with me. It’s great to whip out a $5 bill to pay for something that costs 4.98 or to just know how much something is going to cost when you reach the register.

Missouri has looked on and off at an internet sales tax. My understanding is that the since the purchase is in the state even if its online, the state sales tax kicks in. I don’t recall last time if when I purchased something from a Missouri retailer on line if sales tax was charged.