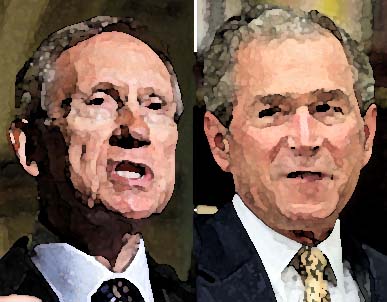

Today seems like a good day for a good, ol’ fashioned conspiracy theory, especially one that seems like it’s true.

In a largely symbolic vote designed to score political points, the House voted Thursday to extend the Bush tax cuts for 98 percent of Americans, and Harry Reid plans to follow suit with a similar Senate vote, plus one on extending the tax breaks for everyone.

The Democratic move, which will vanish into Senate quicksand, infuriated Republicans.

[…]

In Washington, where anything beyond last week’s news cycle is considered ancient history, the jury-rigged nature of the Bush plan—and the fiscal sleight-of-hand involved—have been all but forgotten.“We knew that, politically, once you get it into law, it becomes almost impossible to remove it,” says Dan Bartlett, Bush’s former communications director. “That’s not a bad legacy. The fact that we were able to lay the trap does feel pretty good, to tell you the truth.”

[…] Had the tax breaks been made permanent—or even extended beyond Sept. 30, 2011—the fledgling Bush administration would have had to muster a 60-vote Senate majority under the so-called Byrd Rule, named for master parliamentarian Robert Byrd. (The final version, cutting taxes by $1.35 trillion, garnered 58 votes.) And by moving up the expiration date by nine months, the Bush team saved $100 billion and made the bill’s deficit-busting impact appear smaller.

As an added bonus, the “sunset” provision, in Beltway-speak, was a political time bomb: At some point in the way distant future, Democrats could be accused of raising taxes if they tried to undo the Bush breaks and return to Clinton-era levels of taxation.

Found by Gary the Dangerous Infidel

Over the next 10 years the Bush tax cuts will cost more than:

TARP

Stimulus package

Iran and Afghan Wars

Any amount of BS you can think of

Meaningless tax cuts without any impact. A tax cut is not good or evil. But stupidity is criminal.

#31 Dallas going way off subject again. Let’s pull him back to the subject.

1.) Was Bush a bumbling fool during the his Presidency?

or

2.) Was Bush an intellectual giant, according to Uncle Dave’s article, who years ago masterminded the future downfall of Obama?

If 1.) is yes, (which you have repeatedly said), then how did he accomplish 2.)?

“Masterminding” a future in which tax receipts dropped and spending increased was not a wise thing to do except as a temporary stimulus. Clever tactics were used to achieve a foolish result. Brilliant!

However, the plan won’t be complete until they again hold the reins of power and can begin working toward a privatized social INsecurity system in which private managers can begin making their normal fees on the investment of those retirement funds, which has always been missing with Social Security. Of course, there might be a tiny element of additional risk…

How is it a conspiracy when the republicants are openly joking about how great a trap it was?

Republitards insist in cutting taxes, AND funding the government. If they can’t pay for it, they’ll cut it. The arts will go first, then science (they don’t have any use for science anyway, if it ain’t in the Bible, it don’t matter…). Just wait, next, we’ll be talking about “faith based fire departments and law enforcement”. That ought to go over real well.

@27 Fredie

You have the wrong perceptions.

A tax cut is not giving someone anything, it is taking less away from them.

As many earning 50,000 or less pay little to no income tax there in therory is little to cut. Sometimes the pols will boost the earned income tax credit and call it a “refund”.

#27 Obama’s version of transformative leadership is to wow the public by repeatedly turning into a Republican.

#39 You think Obama has disappointed the right? Talk to left.

Barry really needs to grow himself a pair.

Hey Dave, why don’t you post something relevant, like the fact that Bushco,Inc. was a complete and utter failure and has lead us into an economic depression. Unemployment took a big leap yesterday. Heck of a job, Bush and Dick.

Sheesh, how stupid were people to vote for Bush and Dick?

Obviously when Bush wanted to make these permenant, the Dems fought him tooth and nail. So who exactly set the trap?

NO MORE TAX CUTS for ultra rich bankers who got us into this financial mess! Why shouldn’t they pay more as a penalty for getting us into this mess? They have had the tax cut, and haven’t created jobs. They were too busy playing the Wall Street Casino… AND LOSING! What makes people think that they will change their behavior?

You’ve got the facts wrong above. The Democrats in the Senate could have stopped the tax cut from passing, and were in the process of doing so. Then James Jeffords switched parties, and Pres Bush apparently asked him for a favor, because he announced he was making his party switch effective after the passage of the tax cut. Suddenly, the Democratic stalling disappeared, as they were more interested in gaining power.

Two year extension of current income tax rates.

So this argument can be revisited when Obama is up for reelection. That Bush is such a genius he set a trap or Democrats, and then had the Democrats set another trap ten years later!

In other news, unemployment insurance was extended for 13 months, and the estate tax has been lowered from 55% to 35%, with the first 5 million exempt.

Like we didn’t see this coming? And I am sure that none of us will be surprised when all Bush era tax cuts are extended for years and jobless benefits are not extended. Obama is a fucking Republican and the biggest fucking idiot in the world.

The main problem with capitalism is that a few people become an indecently wealthy. For the past 30 years of conservative rules all productiveness gains have gone to the rich while incomes have stagnated or declined. Productivity has tripled while incomes of the rich have nearly quadrupled. The rich have successfully been waging class conflict against the lower and middle classes.