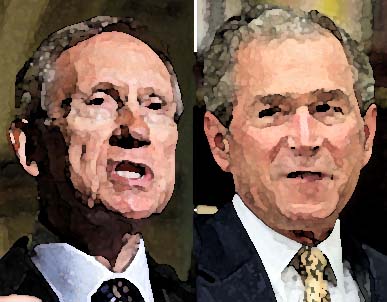

Today seems like a good day for a good, ol’ fashioned conspiracy theory, especially one that seems like it’s true.

In a largely symbolic vote designed to score political points, the House voted Thursday to extend the Bush tax cuts for 98 percent of Americans, and Harry Reid plans to follow suit with a similar Senate vote, plus one on extending the tax breaks for everyone.

The Democratic move, which will vanish into Senate quicksand, infuriated Republicans.

[…]

In Washington, where anything beyond last week’s news cycle is considered ancient history, the jury-rigged nature of the Bush plan—and the fiscal sleight-of-hand involved—have been all but forgotten.“We knew that, politically, once you get it into law, it becomes almost impossible to remove it,” says Dan Bartlett, Bush’s former communications director. “That’s not a bad legacy. The fact that we were able to lay the trap does feel pretty good, to tell you the truth.”

[…] Had the tax breaks been made permanent—or even extended beyond Sept. 30, 2011—the fledgling Bush administration would have had to muster a 60-vote Senate majority under the so-called Byrd Rule, named for master parliamentarian Robert Byrd. (The final version, cutting taxes by $1.35 trillion, garnered 58 votes.) And by moving up the expiration date by nine months, the Bush team saved $100 billion and made the bill’s deficit-busting impact appear smaller.

As an added bonus, the “sunset” provision, in Beltway-speak, was a political time bomb: At some point in the way distant future, Democrats could be accused of raising taxes if they tried to undo the Bush breaks and return to Clinton-era levels of taxation.

Found by Gary the Dangerous Infidel

In the world of the libtard, he’s either the stupid ChimpyMcBushHitler or he’s a cunning devil who planned a political hit 10 years in advance and orchestrated the biggest conspiracy in US history.

Hey Dave, why don’t you post something relevant, like the fact that Barack Hussein Obama is a complete and utter failure and is leading us into an economic depression. Unemployment took a big leap yesterday. Heck of a job, Barry. Hope and change! Hope and change!

Hey Dave, here’s something else that you won’t touch. On Nobel Peace Prize winner Barack Hussein Obama’s war:

2010 death toll of US troops nears that of 2001-2008 combined

That’s Change We Can Believe In.

Laying the ground work was incompetence and cronyism. The trap was running presidential candidates that were unlikely to win.

A trap that the Democrats knew was coming?

Obama had no problem calling for higher taxes.

Kerry had no problem calling for higher taxes.

It is the Democrats who are insisting on higher taxes, and for some reason, now they are upset about it.

Now Democrats are whining about the tax trap in which the President has placed them, and ten instead of voting for a permanent tax plan, they are considering extending tax rates for 2 years.

Tax Breaks are a political football there to distract you from the one thing that fundamentally CONTROLS the economy. The Banks.

Cutting or raising Taxes doesn’t matter. Banks not lending because Glass/Stegeall was removed is all that does. We gotta take off the partisan blinders and pay attention to the real issues.

How can you give a tax break to 98 percent of people, when 50% don’t even pay taxes? But I digress.

Still, the very people that Obama wants to raise taxes on, are the same people who report their business income with their personal income, i.e. the small business. Between this, the healthcare provisions, and an increasing government present in every day life for those same businesses, is it any wonder the engine of our economy (small businesses) have stalled in the last two years.

I know allot of my liberal friends will start screaming “trickle down economics”, but at some point even they have to admit their policies are going to cause small businesses to start shedding people in order to for the expenses they have saddled them with.

Breetai, you are the man you are spot on. Deregulating the banking industry was the worst thing they could do. It totally gave banks a license to steal, and with our revolving door congress many are working for these same banks or as lobbyist for the banking industry.

I believe they conspired with some of the top CEO’s not to hire people in order to make the Democrats look bad. Corporations have higher profits and more cash on hand then any time in history. The problem is that they no longer need Americans to buy or make their goods. Between off shoring and technology we are screwed.

Bob,

Your logic is faulty.

A business that can afford to shed employees, must shed employees. Large or small.

If an employee isn’t earning more for the business then he takes home, he must go.

Tax cuts have nothing to do with it.

Credit Bush Co for convincing the American Sheeple to borrow an additional $800 Billion to pay for tax cuts for billionaires that neither need it nor are asking for it.

Now THAT’s magical.

Isn’t it comical how Uncle Dave and the other extreme lefties constantly ridiculed Bush for being a country-bumpkin, and now when their Messiah falls from grace, they think Bush had this plan figured out 10 years ago.

Make up your mind Uncle Dave!

Let’s not let facts or sanity get in the way of the liberal mindset.

Let’s not remember that it was the DEMOCRATS that demanded a sunset to the Bush tax cuts (which Bush wanted to make permanent, but couldn’t because of DEMOCRATIC OPPOSITION)!

That it was the DEMOCRATS that drafted this sunset clause because DEMOCRATS love higher taxes!

Karma’s a bitch.

…and Uncle Dave has just jumped a shark. Kewl!

#13 Ah_Yea, I think you’re mistaken, despite your nearly-convincing use of capital letters for emphasis. The sunset provisions of the tax cuts were the Republican method to circumvent the Byrd Rule in the Senate. Without the sunsets, the Democrats could have invoked the Byrd Rule on consideration of this bill, and then a 60-vote majority would have been required to waive that rule and continue. The Republicans didn’t have that supermajority, so they included the sunset provisions to exempt the bill from the Byrd Rule, allowing it to be passed by the normal simple majority instead.

Even with the sunset provisions, only 2 Democratic senators voted to pass the final bill (Miller & Nelson). The vote tally was 50-50, and our good buddy Dick Cheney broke the tie. That made him feel so good that, even against his cardiac doctor’s advice, he ate a fried puppy-and-kitten sandwich at the celebratory luncheon.

“he ate a fried puppy-and-kitten sandwich”

LOL! Are you sure they weren’t still living??

#16. Ok the puppy and kitten sandwich joke was funny.

#8 “50% don’t even pay taxes”

How do they all avoid the taxes on properties, purchases, gas, phones, soc sec/medicare?

Let me turn that around. Here is a list of inflow-outflow of Federal tax dollars, by state.

8 of the top 10 winners in the Federal money game are red states. What a bunch of welfare queens!

That, right there, is why the GOP never spends less. The populated states support the hinterlands, and the hinterlands respond with a lecture about fiscal responsibility.

Since the GOP is concerned about everyone living within their means I am waiting for state GOP politicians to start rejecting all money from the federal government in excess of their state’s contributions.

“We knew that, politically, once you get it into law, it becomes almost impossible to remove it,…”

I thought this was about taxes. Why is he talking about healthcare?

#10

Faulty logic indeed. Higher taxes mean the business must charge higher rates for their goods and services. Higher prices mean lower demand and thus lower business revenue. Lower business revenue requires the business to lower costs and that typically means laying off people that they would have kept prior to the tax increase.

If an employee isn’t earning more for the business then he takes home, he must go.

Indeed. When business taxes go up, the company’s marginal costs go up raising the barometer of marginal benefit required by each employee in order to be profitable.

#15

We went from a more or less balanced budget with deficits headed in the right direction under Clinton

Not true. We haven’t had a balanced budget (defined as expenses being equal or less than revenue in a given fiscal year) since 1957. Admittedly, Clinton did get close one year when we “only” spent 17 billion more than we made.

#19

How do they all avoid the taxes on properties, purchases, gas, phones, soc sec/medicare?

You are being disingenuous. I know you will find this amazing, but lowering consumption taxes has been anything but an Obama or Democrat priority. He’s raised taxes on numerous consumption items. When Obama speaks of lowering taxes for the “middle” class, he is only speaking about income taxes.

Must agree with the person that noted 50% of Americans don’t pay Fed taxes and those making under about 42,000 a year are supposed be getting their money’s worth.

Next point. Bush didn’t want an expiration date, the Dems did, so why push a fabrication about Bush setting a trap? Scapegoating?

#9 You do know that you just said the US is redundant both as a producer and a consumer?

#10 That isn’t what small business says. They say they have to be assured of higher profit margins per employee because taxes and other mandated expenses per employee are eating up their profit margins.

The Health Insurance foul up is the same. What I’m seeing locally is that manufactures would rather work one person two shifts rather than deal with the overhead required to hire a second person or a part timer.

Any one who wants to claim something else is passing hot gas because I’m seeing it.

I think the decision to cut taxes only for particular groups of people is grossly unfair. Being successful doesn’t mean you can’t enjoy the same benefits as people with lower incomes.

We could lower tax rates for businesses and individuals to zero, and the general economic outlook would still look gloomy and uncertain to the many millions of homeowners who have seen the most expensive purchase of their entire lives go from what they thought was a gold mine to becoming worthless (in terms of equity) or even worse, an outright liability.

It’ll be years before those people feel it’s safe to return to their prior spending levels, if they ever do. The psychological effects of this sudden loss of wealth won’t go away as soon as some people think. Fear doesn’t dissipate as quickly as euphoria sets in. Just from the loss of their home (or equity) alone, a lot of people have formed an unpleasant lifetime memory. Contemplating life without a roof over your head is a very scary thing.

This is by far the greatest source of uncertainty that businesses face — lack of demand for their products and services. On top of everything else, European austerity measures are in the process of shrinking our export markets even further. This isn’t over yet, and it has nothing to do with potentially higher tax rates on the net profits of an S-Corp that flow through to the owners in excess of $250K. Those people are always happy to hire when they see potential sustainable growth in their customer base.

#21 I am not being disingenuous, you are being innumerate.

Only people who make less than $7000 are exempt from federal income tax. At that level you won’t be paying much, maybe zero if you have kids, but you’d still be dirt poor.

Not in the GOPs wildest dreams have 50% of the domestic working population been reduced to under $7k.

I will admit that the overall tax burden, measured by percentage of total revenues collected, is higher now for the wealthy. That is somewhat understandable, because most of the benefits of the last 30 years went to the top 10% of households.

I’ve seen people argue that the bottom 50% of the population are gainers, comprehensively considering tax payments and available benefits.

In answer to that I think the analogy to states is apples to apples. I don’t even mind these no-job, no-edu, no-prospects red states taking more than their fair share.

What boils my britches is that these hicks pump their low brow mob to insanity when they are exactly what they profess to despise.

I’ve always been impressed that Bush was stupid and incompetent while being an evil genius. If the lefties are going to craft stories to make us all hate W they need to get their story straight.

By Tax cut compromise does he mean do whatever the Republicans say? This is such a joke. I voted for obama. Am a huge Liberal. I think the man himself is incredible and his story is inspirational. But GOSH I wish I had another candidate to choose from. It hurts my stomach because I know once he starts campaigning again he’s gonna win me over with his talk and speeches, because the guy is an incredible mind. But he has absolutely no guts, and no loyalty to the people who not only voted for him…but spent 2 years campaigningg for him to get elected.The fact is the tax cuts more the middle class people really isn’t all that much. If you make less than 50K it’s really not all that noticeable. I am FOR the tax cuts for less than 200K or even 1 million, however…is it worth it to give people who make 50K an extra $1000 to give all these millionaires millions of dollars that they don’t need? The answer is no. Let them all expire. Republicans say they won’t do business until a deal is reached? Then go at them every single day about how they are stopping government from working like little children. How is this a hard strategy to understand? The Democrats are on the right side of every argument and usually have the majority of opinion on their side….How are they losing this? It’s amazing.

We’re Americans! We don’t pay taxes!

We pay FEES!

I want call them out , I think i will call them heroes. We need the President Bush tax cuts continued across the board.There are many small businesses that would have suffered a tax increase they can’t handle had obama and the liberals had their way and been able to push through a TAX INCREASE on small businesses making $1M and up. You don’t get it.Small businesses drive this country!!! Listen to the voters!!! Oh, and by the way this is just one of many congressional votes the liberals will lose so get used to it.Let me make a prediction for you, Hillary will challange and defeat obama for the democratic nomination next election.Talk to you soon and don’t forget to watch Sarah palin’s Alaska Sundays at 9PM.

Need to cancel the Tax Cuts and restore them to what they were – a whopping 3% more.

So far these cuts have cost $700 Billion in DEBT. Extending the cuts puts American $800 Billion further in debt.

We can’t afford this Republican SPENDING masqueraded as a tax cut. The top 3% neither need the extended cuts not are asking for them.

The American Sheeple need to take a remedial course economics.

Let me help:

When you cut revenue (extend tax cuts to billionaires) and not cut spending (you still buy the same shit as before), that means you have to borrow more money from China. You see how that works?