St. Petersburg, Russia – China and Russia have decided to renounce the US dollar and resort to using their own currencies for bilateral trade, Premier Wen Jiabao and his Russian counterpart Vladimir Putin announced late on Tuesday. Chinese experts said the move reflected closer relations between Beijing and Moscow and is not aimed at challenging the dollar, but to protect their domestic economies.

“About trade settlement, we have decided to use our own currencies,” Putin said at a joint news conference with Wen in St. Petersburg.

The two countries were accustomed to using other currencies, especially the dollar, for bilateral trade. Since the financial crisis, however, high-ranking officials on both sides began to explore other possibilities. The yuan has now started trading against the Russian rouble in the Chinese interbank market, while the renminbi will soon be allowed to trade against the rouble in Russia, Putin said.

“That has forged an important step in bilateral trade and it is a result of the consolidated financial systems of world countries,” he said.

Putin made his remarks after a meeting with Wen. They also officiated at a signing ceremony for 12 documents, including energy cooperation. Wen said at the press conference that the partnership between Beijing and Moscow has “reached an unprecedented level” and pledged the two countries will “never become each other’s enemy”.

Over the past year, “our strategic cooperative partnership endured strenuous tests and reached an unprecedented level,” Wen said, adding the two nations are now more confident and determined to defend their mutual interests.

While I am sure there will be finger pointing by the readers, I just want to take this time to thank both parties of our Government, and extra special kudos to the Federal Reserve. Great job all around guys!!

Yeah Government… just keep printing all that money that will eventually be worthless.

well this seams like a big deal, but I’ll wait and see what the MSM has to say about this before I make a final decision, I’m sure it will be GREAT!!!

Does the term “economic free-fall” mean anything?

The once battered, (Hell! damn near reduced to rubble) Ruble (ру́бль) and the Rock Stable Renmimbi (人民币 or [人民幣] a.k.a. “people’s currency”) are once again taking their place in the international currency stage.

That means the softening of the US Dollar’s previously unshakable status as the world’s hardest of the hard currencies.

Speaking as the holder of a decreasing amount of these USD I’m glad I don’t have all my egg in _that_ currency basket.

Now if only the Euro and the Canadian dollar can avoid going in to the same USD tank, I’ll be happy.

so are we at the middle of the end for the dollar?

Smart move guys. If I didn’t live in America I wouldn’t use the dollar either. Reminder to self, buy some silver.

Printing more money is sort of figurative, since most transactions are done with out actual currency/cash; it’s done via electronic payments or at least with checks. Which always seemed like fake/meaningless money if it is just a number on some computer.

A few well placed EMPs and magic fake money will just go poof. Look ma, no cash.

This is a massive miscalculation by China and Russia. If they wanted to slap the Dollar down, they should have changed to Euro standard or something similar. The Rouble and yuan are far more vulnerable to economic crisis at home than the Dollar. Were a banking “problem” of the scale the US just had were to his either Russia or China, their currencies’ fall would make the dollar look like a pillar of stability.

Both Russia and China have been buying increasing amounts of gold the last few years also.

Good. Nobody’s currency should be used as a “world reserve” currency. One countries currency is null and void outside of it’s own borders.

When I conduct personal transactions, I don’t accept the private “Federal Reserve Note” either.

What a bunch of pantywaists. This move will last about as long as a Larry King marriage. After that, look for a series of problems growing between Russia and China, who by the time my grandchildren are of age will be pointing wma’s at each other again. Meanwhile the US economy will stumble around looking for a new footing, and will come out of it around 2020 looking somewhat grizzled but loaded for bear.

#8 Moose, You are making the fundamental error of seeing those governments as analogues of ours. Those governments are not in thrall to big business; they are in total control, and make no mistake. Single party systems will err on the side of survival. If a banking “problem” on the scale that the US had ever happened in China, for instance, I would expect to hear that the managing directors, managers, and other officers of those banks would ALL be imprisoned, awaiting trial, or convicted and executed, “in the name of the people”. There would be no debate, no outcry, and no delay. And talk about transparency; Everything would be very public, very visible, and extremely final… at least, for those managers.

As for this bilateral trade agreement, better the criminal you understand… Those two very large countries have mutual ideologies that predate their current market liberalizations (most of which were brought into being by suggestions from countries with differing/opposing ideologies). Human nature being what it is, “the enemy of my enemy is my friend” seems to be what’s playing out here. It will be interesting to see if it gains traction…

To those that don’t get why other nations are no longer fond of our ink stained cotton waste, I will gladly trade you $100 in said stained fiber for 100 US sliver dollars. I won’t even ask for boot.

The loonie is almost at par with the USD. Let’s just trade back and forth… what have you got that’s made in the USA? We need mittens.

And snow boots.

Don’t nations always trade back and forth with each other’s currency “if” they have it? so what does each country buy from the other that gives it that country’s currency?

Its rather like announcing both countries will grow their own wheat rather than buy USA? Thats what countries do, if they can.

Otherwise, I’d say China has every incentive to dump its worthless Dollar reserves and probably Russia just doesn’t want it either so they pretend they have an alternative? But yea, the dollar won’t last forever, not under our current assault.

The dismal science.

For international trading the US dollar is not really affected all that much by the Fed policy. It’s still considered a “safe haven”, look at it’s strength since the rise in tensions in Korea.

The main reason for this shift (like the change in oil currency policies) is due to volatility from continued weakness in US banking sector and the massive amount of bad debt the banks still carry (1 in 9 US banks at risk of failure). If the US government had the guts to get the banks back in line then no one would consider moving off the greenback.

Over the last couple of years US banks have lost $4 trillion though unfunded debt, toxic loans, and (the big culprit) OCC trading. The hidden US bank debt is impossible to calculate but it easily dwarfs the US government national debt.

You might hate the Obama administration and the fed for a variety of reasons but they’ve kept the paddles on the chest of the banking system with few tools at their disposal. The Democratic congress did fuck all to straighten out this mess (it’s Congress’ job, duh?). That was criminal. Let’s see if the incoming Republican congress throws a hand grenade like they’re promising and causes a debt crisis followed by more bank failures. That would be suicide.

I’m hoping they are as incompetent as they sound and spend their time running criminal investigations on dog catchers. Nothing would be better than what they’re planning in the name of politics.

Type OTC trading, not OCC.

This matters how? The yuan is tied to the dollar anyway (within 5%). Also, the total amount of trade between Russia and China isn’t that significant. And finally, how is this any different than 20 years ago when neither of these countries would have been trading in dollars anyways… a bunch to do about nothing…

And THAT is why the big corporations are all buying gold, silver, platinum, petroleum, etc, instead of sticking to the USD, if I had any kind of investment, it would definitively be in anything BUT USD’s. Peace.

#19

It’s about showing off and not taking sht from US. Who the fck are they to care what happens and how people might suffer for the decisions. Do people really think this is going to affect anything much? Trade between Russian and China, solely? hahahaah if you can’t see the funny in this then it’s already over.

As for me, I’m just waiting to sign up for war nowadays. Here’s hoping there’s a war between N.Korea and S.Korea and we (US and China) get involved. I’m so going to waste some N.Koreans and Chinese people.

These are command regimes, so are they doing this in the best interests of their people, or for other political reasons that hurts their population?

I don’t really care what currencies other countries use. The whole point of the currency is as a measuring stick to exchange value. It makes more sense for Russia and China to trade in their own currencies than use a third currency. That they were using the dollar at all probably meant other countries didn’t think much of the ruble or yuan.

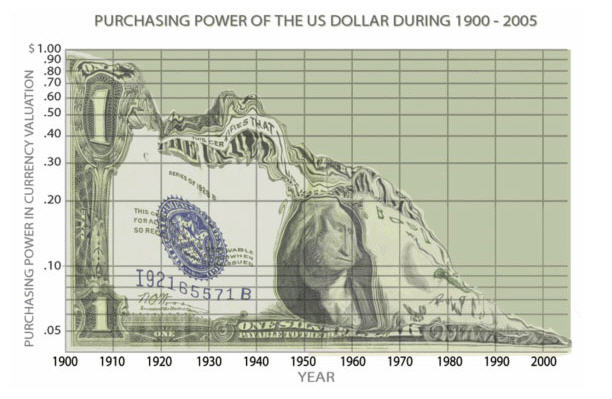

I think it’s interesting that this wonderful graphic reveals that the decline of the dollar started almost immediately after the establishment of the Federal Reserve and Federal Income Tax system in 1913. The two are linked because the government borrows the money at interest from the big private bankers of the Fed and pays it back (to whatever extent) with the tax dollars of the ordinary citizen. That’s why the bankers wanted a Federal Income Tax at the same time as establishing the Federal Reserve – the two go together.

Let’s abolish at least one of them.

>> OvenMaster said, on November 25th, 2010 at 3:51 pm

>> Obama has openly worked toward his goal of the United States being no more powerful than any other country.

You need to step away from the Right Wing Media.

The fall in the dollar started long before Obama. It had a good rally with Clinton but the real decline started with Reagan.

Look at this chart.

http://tinyurl.com/24aq9mq

Using your standard, we can only conclude that it was Reagan who was working fulltime to lower our standard of living to that of the Third World.

Alfred Persson,

Where did you get that Obama quote?

It seems like a legitimate quite and I actually agree with much of it.

But I’m also aware that you, like most conservatives, just make stuff up. So, I have to vet EVERYTHING you guys say.

It didn’t show up on Google. What is the link?

@Greg Allen

Are you just bad at Google searches? I found it right off the bat: President Obama Addresses the U.N., Wednesday, September 23, 2009.