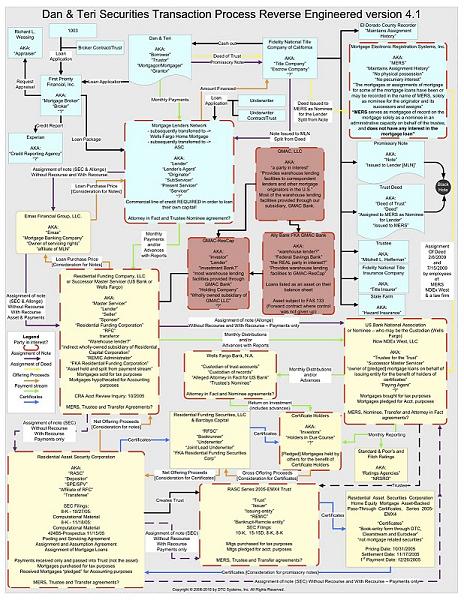

Click pic to embiggen

Dan Edstrom is a guy who is in the right place at the right time. His profession? He performs securitization audits (Reverse Engineering and Failure Analysis) for a company called DTC-Systems.

[…]

The following flow chart reverse engineers the mortgage on the Ekstrom family residence. It took Dan over one year to take it this far and it clearly demonstrates what happens when there are too many lawyers being manufactured. Take a look at this chart and then decide how long you think it will take for Barney Frank and Eric Holder to sort everything out.

How much you wanna bet those in the mortgage biz testifying before the Senate today won’t be 100% sincere in their mea culpas?

Lawyers, accountants, and bankers should be a year round quarry for black powder enthusiasts.

Some Pyrodex and a lead ball would solve many problems nationally.

Hey, somebody has to keep all you assholes straight.

So STFU and hand over the money peon.

How come Barney Frank and Chris Dodd aren’t at the top of the chart?

This makes me glad I got my mortgage thru my credit union, who still hold the note.

Complete separation of risk from reward.

A recipe for irresponsibility and disaster.

Ding… dinner’s ready.

That’s it, I’m studying law.

It has amazed me over the years HOW agreements for anything/everything have gotten longer and longer and LONGER.

and if you read 90% of them, everything FALLS ON TOP of you. not the maker of the agreement, NOT the others concerned..

Making ANY agreement with Stores, PARTS, Mortgages, RENTALS… removes ANY AND ALL your rights.

the QUOTE…”its a standard contract” is a SHAM/LIE.

where’s the “start”?

Even if your mortgage is still held by the Credit Union, most of those boxes still apply (i.e., title search, insurance, appraisal, deed assignment, etc.). Dan and Teri are the “start”.

All I know is if I walk into my bank and say I wanta borrow a hundred k to buy a car they’ll say sure fill out this application and a week later they’ll say come get your money. But if I walk in and say I wanta buy a house all of a sudden I’m looking a points, loan origination fees, title insurance, appraisals, termit etc. etc. and I’m out several thousand dollars. Something wrong with this picture…

Mortgage “Lenders” are like men having sex:

“F’ Em and forget Em!!!”

No loan process charted with “Black Hole” leading from “Promissory Note” AND “Deed” can ever be described as functional.

Whoever is taking out a mortgage with this for a process is an idiot as s/he never actually get to owns the property.

I’m so glad I was able to pay off my mortgage before the whole debacle and actually get to hold onto the deed to my own property.

Be sure to check out Matt Taibbi’s article in the current Rolling Stone.

http://www.rollingstone.com/politics/news/17390/232611

Sorry, WordPress wants:

http://rollingstone.com/politics/news/17390/232611

Why aren’t people going to jail over this?

About a thousand people got jailed over the savings and loan bust-up, why not now?

Once institutional buyers stopped buying synthetic debt the banks themselves started buying. This went for almost a year. That’s why so many banks went down, they ate their own poison. If you are buying your own goods to create the impression of a market it’s criminal.

The really crazy thing is that you could apply this thesis to the fed buying Treasuries.

BTW, I have started to hear suggestions that the GOP might intentionally try to start a US sovereign debt crisis in March by blocking a 2011 budget, and blocking continuing resolutions as well.

No, no, no, no!

It is OBAMA SOCIALIZM that caused all the housing problems we have.

That and letting poor people buy houses.

What good is a mortgage anyway?You never really own your home because of the property taxes.America is not the land of the free and more we are all slaves to the dollar.