An interesting point made in the full article deals with the lack in confidence in the Fed which prevents them from doing what they could to stimulate the economy. Which means we are screwed. Again.

For simplicity, let’s assume that the Fed’s policy instrument (now that the federal funds rate is stuck near zero) is the 10-year Treasury note. As an example, suppose the yield is 4%. In that case, it’s all but certain that the Fed, if it chooses, can do something to stimulate the economy and raise the inflation rate.

For example, suppose the Fed were to bid the 10-year note yield down from 4% to 1%. It would take out a whole slew of marginal noteholders in the process. Banks that had been satisfied with a 4% return would be unsatisfied with a 1% return and would lend more aggressively. Domestic investors that had been satisfied with a 4% return would be unsatisfied with 1% and would bite the bullet and buy stocks. International investors would be unsatisfied and would shift their investments into foreign assets, thus weakening the dollar and making US products more competitive. Households would refinance their mortgages and spend some portion of the increased cash flow. Others who previously couldn’t afford houses could now afford them, so demand for houses and home furnishings would go up. And so on. With such a huge policy action, it’s virtually certain that business activity would accelerate enough to reverse any deflationary pressure.

For a government that is dependent on borrowing cash to pay for itself, reducing bond yields to the point where potential lenders would rather put their money someplace else is a dangerous gamble.

The goddamn cookie jar is EMPTY! Period!

Wake the fuck up.

Isn’t this precisely what lead to the financial collapse in 2008?

Interest rates near zero meant that investors (such as pension plans) looked for better returns on the stock market. Near-zero interest rates lead to banks loaning money to anyone. Sub-prime mortgages were packaged into securities and sold as “investment grade” to investors. And when it all collapsed, the government borrowed more money and bailed out the banks and everyone (except me) got fat bonuses.

That worked out so well — so they’re suggesting we try it again?

Of course they (Wall Street) want to try it again.

Let’s see… make banks make less money = more lending…

huh, sounds suspiciously like “trickle-down” (pissed-on) economics.

Or, for those who don’t remember:

Give the rich another chance to hang onto MORE money to make up the short-fall from lowered profits.

The ONLY thing that will work is (drumroll, please) PROGRESSIVE LAWS MAKING BANKS STOP HANGING ONTO MONEY TO “ENHANCE” THE BOTTOM LINE! And if these Arrogant Assholes even TRY to throw a hissy-fit and threaten to take the country further into the hole, BOUNCE THEM SO HARD EVEN THE HOLE IN THE CEMENT WILL HAVE HOLES!!!

So the solution is to have the Fed monetize the entire debt, or at least threaten to? How is this anything other than absurd?

No it would not. There is just too much uncertainty in the market right now, especially with small businesses. These businesses are frankly scared for their very life right now. The government has become very anti-business in the last 2 years, and these small business (the driving force of our economy) have no idea what kind of new expenses they will have in the coming years with Obamacare, tax increases, cap and trade, almost any business would be mad to try to expand right now with so many unknowns on the table. Better to wait for 3 or 4 years for things to pan out before trying anything new.

This of course effects the middle class, who see the business stagnating, read stories about layoffs, and probably know friends who don’t have a job. These people are hording their cash, and I can’t blame them. Allot of them are scared they may be next to get laid off. So they aren’t spending, they are saving as much as they can in order to build a safety net in case the worse happens.

This leads to a vicious self sustaining cycle, as people spend less, business see even less reason to expand, or they have to lay people off. More people see job losses of stagnation in their business so they begin spending less themselves.

weakening the dollar right now, which would drive up prices and discourage consumer spending….

thus requiring more government bailout and acquired control…

I’m guessing they’ll actually go with this ridiculous plan and try to ram it through before November.

Interesting to watch liberals stumbling around, trying to discover that one can not dig their way OUT of a hole.

Incredibly sad for the nation and for our children who will suffer lowered standards of living.

It’s hard to lend when borrowing is out of fashion … even at 1%.

It is hard for politicians to accept that we will just have to take our financial lumps. I can’t wait to hear their howling when they find they can no longer finance our global empire and military. In the future our government is going to get a lot smaller. They don’t have a choice in the matter.

Let’s see taxes/fees on business and business owners, especially the owners of small business, are going way up and most people including most business people think the people running Congress are tax crazed, spend crazed, beg and borrow until you can never pay it back loons and you want to know if more of the same will fix it?

Insanity is thinking more of what got us into a devastating mess is going to fix it.

Here’s Obama business magic. On the one hand he wants to push through a bill he claims will allow small businesses to borrow more money while being absolutely determined to let the Bush tax breaks expire which is going to slam the crap out of most people who own/run what is called a small business because they make over 250,000 a year which isn’t a heck of lot for a small business.

He has slammed them with health care costs. He’s going to slam them with the tax expiration. He wants to slam them with higher energy cost. He just slams them.

So far as I can see the only way Obama and the liberal/progressives know how to give people jobs and put them to work is to have the government hire them which ultimately does 0 for the private sector. I also figure the real rate of unemployed and badly underemployed is about one in five adults.

To cap that off Fanny and Freddie are, at government insistence, still doing what caused them to turn belle up: insuring home loans to people whose credit ratings make it clear they can’t pay off that loan.

FTA: “Others who previously couldn’t afford houses could now afford them”

This is not *always* a good thing. There are many people who are barely making it past the approval stage. This is important, because it is an indicator of not only their ability to buy the home, but their ability to maintain it (or pay for maintenance, as you would with a condo or town home). The inability to maintain the property is a brand of hell all its own- It’s like a systemic cancer that can lead to the gradual (but decisive) degradation of the quality of an entire neighborhood.

now if everyone would just wake up to what is really happening, the bank and business failure while helped along by the ham handedness of the banks and businesses, it is really about one major player in the US, the baby boomers.. the baby boomer boom, IS COMING TO AN END!!!

the boomers have their money in the stock market.. and now they are retiring, needing medical treatments, etc… etc.. so they are taking their money out!!!!

Surprise! the market starts to tank! (gee i wonder why?)

this is only gonna get worse… there is no corresponding after baby boomer boom.

Remember the growth after WWII, 60’s 70’s, those markets all catered to the boomers, and now that market is dying….. literally! no replacements either..

this is to be the new standard for america economics, one without the baby boomer potential.

Reducing bond rates to 1% would be extremely destructive to the economy as it would eliminate the only safe liquid investment left in America. Investments would not head to the Stock Market, they would probably all move to precious metals instead.

If the fed made such a move it would mirror a similar event during the Great Depression, which led to massive DEFLATION and pretty much destroyed the banks.

At least one prominent economist has said that the Bond market is similar to the canary in the coal mine in this kind of economy, the lower the rate the worse off we are. Why would the FED purposely destroy the bond market?

The newly passed banking laws will have an incredibly positive effect on the economy, but the reason has been barely discussed. One of the rules recently passed severely restricts the ability of banks to use “internal desks” to use bank money to do their own stock and derivative trading. The first big banking company announced just last week that their desk internal stock trading desk is being closed. So instead of playing with depositor’s money in the exchanges, the banks will be required to start lending again. Banks are sitting on record amounts of cash, and they will need to start doing something with it… no exotic trades allowed… go back to basics again, and that is lending. And with individual lending severely restricted, that means business lending.

You can send a thank you to Nancy and Barry for getting the economy rolling again… a year from now things will be very very different (much better) and that will happen in spite of obstructionism and corporate cock-sucking on the part of republicans.

Inflation is our only friend with a fix.

What we really need is people to get back to work again. No under employed either.

If the administration would stop giving the money away and instead employ people as once it did back during our last depression, we would be better off than handing out dribs and drabs of money to buy homes or switch to solar.

This has been a consumer driven nation since the end of WWI and that is how we can get out of this by returning to people having money and spending it.

People need to be employed and if businesses will not do it, then the government should. Perhaps after the people have money to buy things they will hire more and then the government can hire less, returning things little by little to the private sector again.

Confident, consuming citizens are what we need.

Cursor_

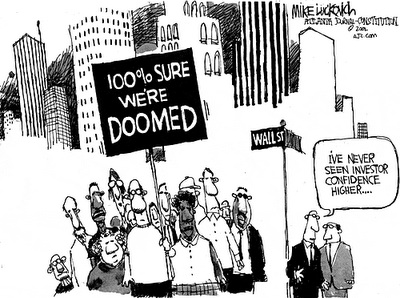

#16 Agree with your last point. It’s consumer confidence what we’re battling.

It is not in the Republican’s best interest to improve confidence for obvious reasons which is why we’re seeing an perpetual onslaught on negativity.

We have one party promoting growth, confidence, the light at the end of the tunnel. The other party is promoting doomsday, Muslim war, Mexican invasion and the president is communist.

So we have competing government leadership working against each other. Glad I’m on the right side of that equation.

#16, #17 — mega fail.

“Consumer confidence” ?

“This has been a consumer driven nation” ?

This isn’t an imaginary semi-Depression. It is a REAL one.

There are no jobs because we do not make anything here in the USA. There is no money because it leaves the country via paying for imported goods.

There is no tax revenue because the money leaves and there are no jobs to tax.

Only domestic production will regenerate the economy and Americans are not used to working in factories. And with treaties like NAFTA, there is no business incentive to ever build factories here.

Due to government inertia and clueless politicians and clueless people like yourselves, this nation is in for a very long and hard dry spell.

#16#17 Anybody that actually thinks putting everybody to work for the government will fix jack needs their head examined because they are delusional. Giving people make work jobs from the government is no different than putting them on the dole. Putting people on the dole is not going make this nation an economic power house again.

This is nothing more than the old joke that everybody in a community made a living by doing each others washing applied to real life.

When you think something that is ludicrous on the face of it is going to solve the unemployment problem you meet my definition for an incompetent ninny.

#18, #19. Trying to be nice here….

While I agree with you diatribe, it is of no relationship to the points I made. Not sure why it was in response to my post.

It seems you both wanted to pass some common knowledge as being something insightful. Nothing wrong with that and a good thing!!

All money comes from the fed.

It only gets lent to some banks, not to people like us.

The fed can lower rates all it wants.

But the ONLY people who get the benefit are the banks who have access to the money that the fed hands out.

The banks are just going to get money that they borrow at one rate and use it to pay off money that they borrowed at the older higher rate.

They can even make a case that it only a proper risk reduction strategy.

Me and thee can just go suck eggs. The economy can just go suck eggs. The capital markets (like Wall street,) can just go suck eggs.

The banks won’t lend it out any more than they’re lending out money right now. (Too high a risk, don’ tcha ‘no?)

The only thing you can do with cash money is try to hang onto it; which is why we have companies reporting enormous, and growing. cash balances, cause they’re not lending it out either.

What’s the answer? Lear to live without credit!