Click pic to see the full story

CARD Act Could Negatively Impact Creditworthy Consumers’ Credit Scores hurt your credit score

What’s Worse: Stingy Banks or Thrifty Consumers?

By Uncle Dave Saturday March 13, 2010

CARD Act Could Negatively Impact Creditworthy Consumers’ Credit Scores hurt your credit score

What’s Worse: Stingy Banks or Thrifty Consumers?

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

© 2008 Copyright Dvorak News Blog

Bad Behavior has blocked 13206 access attempts in the last 7 days.

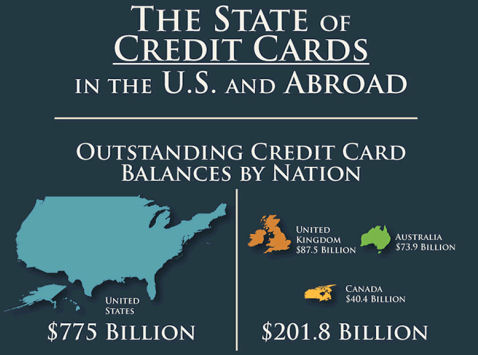

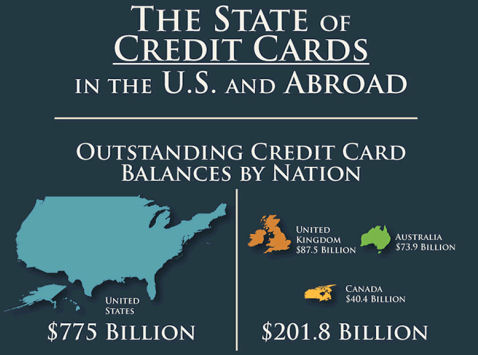

Woo! Go Team! An amazing effort on Australia’s part! – Our average balance is over USD1000 greater than the Americans (and like 3x the Canadians’)! Great work Australia. Keep it up.

Ernie knows:

hmmm, that first link to the negative impact seemed almost to be an ad for VantageScore – doing some quick research brought up this blogging http://creditbloggers.com/2006/03/vantagescorebeh.html Appears vantage score is owned by the credit reporting companies

AC

There are only 22 million people in Australia. America has 15 times as many people but just over 10 times the credit card debt. America is screwed, Australia is a prison bitch.

P.S. There are only 116 million on the right compared to 307 million on the left (America). So it still looks bad for America overall but not as much as it would seem as first.

Come on! Borrowing money to buy foreign goods is the best way to stimulate the economy. Every Keynesian economist knows that.

I guess Aussies are following the credo, if I owe you $1,000 I have a problem, if owe you $1million, you have a problem.

but really, China has the biggest problem. All that $US currency sitting in her vaults.

Per capita numbers would be more meaningful, tho not as scary, which is the desired emotion of the chart: fear.

That bubble, hasn’t burst yet. And it’s a big ugly problem. The social and political implications of this are being ignored. Young adults are disenfranchised, unable to reach those even modest aspirations of their parents, content to live lives entirely in debt. It is a recipe for rapid social and political change.

What’s going on in Germany? Is there something else that they use besides credit cards because they have 4 million issued cards for 80+ million people.

People should take cues from drug lords….all payments in cash only.

Hardly a fair comparison, when you consider a majority of Australia and Canada, is wasteland or wilderness. What’s there, that the population would spend credit on? Damn shopping malls or Walmart stores, that’s for sure. And all three have a health care system paid for by taxes. So a credit card probably gets very little use, compared with the USA. This chart appears to blame US card holders for racking up too much debt. But it doesn’t account for the government’d deficit spending, currency devaluation, joblessness, and escalating health care costs. The government can get away with spending far more than it takes in, but its citizens can’t? Who created this double standard, anyway?

Um, the total populations of those countries is 118 million, the population of the United States is 308 million. So, it’s about 3 times the population and 3 times the debt. Way to lie with statistics.

Glenn E,

US and Canadian spending per capita (clothes, food, electronics, recreation, etc) is about even with the US spending a little more on clothing. On the health, the US spends more per capita on government health care than Canada does. Ironic, no?

#10 The germans use something called an EuroCheque card (EC). It’s a debit card not a credit card.

Denmark has something similar with the DanKort, which is also a debit card associated with your bank account.