Do it for economic survival? Don’t do it because you see it as a moral issue? Do it to get back at the bailed out bankers who profited at the public’s expense? Don’t do it because you love your house more than the money you’ll never get back on it?

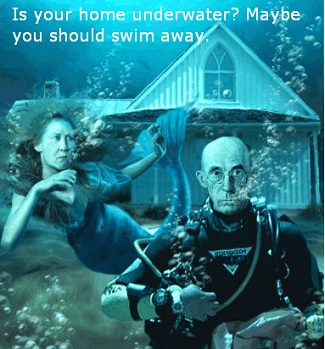

No Help in Sight, More Homeowners Walk Away

In 2006, Benjamin Koellmann bought a condominium in Miami Beach. By his calculation, it will be about the year 2025 before he can sell his modest home for what he paid. Or maybe 2040.

“People like me are beginning to feel like suckers,” Mr. Koellmann said. “Why not let it go in default and rent a better place for less?”

After three years of plunging real estate values, after the bailouts of the bankers and the revival of their million-dollar bonuses, after the Obama administration’s loan modification plan raised the expectations of many but satisfied only a few, a large group of distressed homeowners is wondering the same thing.

New research suggests that when a home’s value falls below 75 percent of the amount owed on the mortgage, the owner starts to think hard about walking away, even if he or she has the money to keep paying.

[…]

The number of Americans who owed more than their homes were worth was virtually nil when the real estate collapse began in mid-2006, but by the third quarter of 2009, an estimated 4.5 million homeowners had reached the critical threshold, with their home’s value dropping below 75 percent of the mortgage balance.

Yes.

It’s not a moral issue, it’s a business decision. If you don’t pay the money the bank takes the house back. That’s what it says in the contract that you signed.

Of course, before you do this you must discuss it with an attorney.

If you’re worried about resale value – then, you obviously bought it as an investment instead of as a satisfactory home.

That’s a tough investment decision. And I’m not especially worried about you.

What are the banks doing with these homes? They auction them off at a loss and bill the formers owners in many states, forcing the them into bankruptcy. Why are taking a huge loss, tax advantage?. Why not work more with the mortgage holders? The banks comes across as a bunch of Dickensian assholes. The classic us against them argument. Granted a lot of people were suckered into these purchases, but they are adults. The worst ones kept cashing in on the equity, because in reality there wasn’t any. But the banks pushed equity loans like crazy. It’s a sad situation and a lot of hurt will spread to all of us. Goddamn corporations have the perks of citizenship, without the consequences. I think it is Constitutional Amendment time.

No.

I’m not footing the bill any longer for those underwater suburban McMansions.

#5 – The banks prefer to take a huge loss, because we gave them huge piles of bail-out money with no conditions.

Capitalism is all about “us against them”.

As a country aren’t we upside down to the tune of something like 80% negative, can’t they just use the same accounting system the government uses? It seems to work for them and the politicians don’t seem concerned so the average homeowner should be ok.

/s

I hate to say it, but morals and ethics are for suckers. The big business guys think nothing about walking away from bad investments. Why should the little guy take it in the shorts?

#6 Dallas, I agree that taxpayers end up footing the bill, but I can’t blame the little guys for doing the same thing as the big guys do…

We are having to move from a suburb of Detroit to St. Louis this summer and just found out that we can expect to get 50% of what we owe for the house. That means if we sell it we will owe the bank $70,000 dollars…

Should we just walk away? I don’t know. Does that mean the bank will then come back and sue us for the difference when they finally sell it?

What I do know, is that right now we cannot drop 70,000 just to sell our house.

That is what people get for thinking of their home as an investment, ATM or whatever. Unless you have lost your income, taken a huge reduction in income you have no buisness just walking away from a debt. We all have to pay to live somewhere, and value is all based on whether someone is willing to pay the price for what ever the object. Now you felt the home was worth what you were paying when you signed on the line, why does that change because others now are have changed thier opinion on the value of your home.

Being under water is one thing, while not being able to pay your mortgage is quite another. You lost your job and can’t pay; well you may have to walk away. If your home has gone down in value; deal with it. You were thrilled when values were going up. What ever happened to personal responsibility and personal pride. The more that walk away, the longer it will take for value to return.

Declaring bankruptcy and walking away used to be disreputable and dishonorable things to do. But starting in the go-go Reagan 80s, it became a smart and savvy thing to do. Companies declared bankruptcy to rid themselves of such things as business debts, union contracts, and pension plans. And all those retirees who lost their retirement income? Sorry, nothing personal — just business.

So can anyone blame the little guy for doing the same thing? Mail the keys back to the bank with a note: “Nothing personal — just business.”

If you can pay you should pay… a contract is a contract, just happens to be one you took a bath on.

If you can’t pay, and you’re under water, may as well voluntarily turn the house over to the mortgage holder and let them deal with taking a loss on reselling it.

I don’t think it’s right to just walk away or destroy the place on your way out. At least give the bank the chance to either work with you on restructuring the deal to minimize your loss and theirs, or at least care for the property while they figure out how to sell for the smallest loss.

For those that still have their job, you can still pay the mortgage. Sit it out and wait for the house prices to be artificially high again.

Prices go up ….. prices go down ….. then up, then down… ad nauseum

the middle class is too bag to fail, but that is not stopping this administration from doing all that they can to kill it.

#9 I see your point to have homeowners join the money giveaway alongside the banks.

However, rescuing the banking industry was and is a bitter pill to swallow to prevent the Bush house of cards from collapsing the rest of the economy – not just realestate.

If McMansion owners want to turn in their keys to taxpayers, it should come with the same conditions as when dead beat dads leave their children.

So, let me get this straight. Someone bought a house and mortgaged it to the hilt at a high interest rate or with a balloon payment. Then housing prices dropped and that balloon payment or higher interest came due, and that “homeowner” thinks it’s okay to walk away from it, so the rest of us will pay for it in higher fees and etc. because they made a poor investment decision? Do I have that right?

“Not my fault” seems to be the mantra of the last couple of decades. A little more personal responsibility might be nice right about now.

As pointed out earlier, check with an attorney about the laws in your state. Some states do not allow the bank to recover money above what they get for the collateral (the house). Some states do, which means you can get sued for the loss in those states.

Corporate America doesn’t seem to have any problem walking away from an underwater real-estate investment. The owners of the largest investment in the US just walked away last week from a huge NYC apartment complex. I find it sicking that they claim to hold us to different standards than themselves.

I hate to say it, but I think that if you are severely underwater, walk away NOW before they change the laws to prevent it. You know that is coming soon. One set of laws for the common folks, and another for corporate America.

The banks determine whether to work with a homeowner based on a formula to maximize profit.

Homeowners should work out their own formula. I have family that lost their homes because the banks refused to work with them. It ended up being a good thing in the long run.

You signed a contract to buy a house for XXX dollars, at YYY terms. If you agreed to pay too much for the house because it was overvalued, that’s to friggin bad…. you overpaid during an expensive market.

You have a debt, now pay up or pay the consequences. Buying the overpriced house was your choice.

Being “under-water” is irrelevant, since your payments are still what you agreed to originally. If you couldn’t stay in the house for long enough for the equity to match the remaining debt, you should not have bought the house in the first place. So if the house dropped 50% in value, that’s too bad… you can just imagine that your payments have gone to rent instead of equity.

There was this couple on TV that were abandoning their house because it was worth $350,000 instead of the $750,000 that they bought it for. Big 3 car garage, 5 bedroom place, kitchen bigger than half my current house. Boooo hoooo… “it isn’t worth what we bought it for”… booo hooo.. pity us… guess what… your house was worth $350,000, it was stupid you that jumped into teh bubble and agreed to overpay.

If I buy stock “on margin” (borrow money to buy the stock) and it goes from $50 / share to $20 / share… booo hooo…. pity me.. I’m walking away from that debt… yeah right…

I think the only people that are answering “Yes” are a) underwater or b) too stupid to realize that when someone walks away from a house, the rest of us get stuck with the bill.

Remember, those mortgages are someone else’s savings accounts. When you tell someone to bail on their house, you are basically telling them you don’t mind that they just took money out of your savings account and threw it to the home’s previous owner or builder.

The banks signed our economic death warrant years ago by giving hundreds of thousands of dollars to people with no documentation (no doc loan), the ridiculous adjusted rate mortgage, and emphasizing profit before selling with crazy ill advised equity loans. Can you really expect the people that got these loans not to take the easier road? Really?

If you have a knife to cut yourself out of a python that is slowly digesting you than I’d suggest you do it.

Banking and banking ‘laws’ are a total con game.

#21: You have a debt, now pay up or pay the consequences. Buying the overpriced house was your choice.

I’ll pay the consequences, thank you very much.

Lending me the money – with only the “overpriced” house as collateral – was the lenders choice.

Both parties gambled the price of homes would continue going up.

Both parties lost that bet.

Both parties pay the consequences.

#5: Goddamn corporations have the perks of citizenship, without the consequences.

Agreed.

Its what I was thinking when the “new” GM pulled-out of their partnership with Toyota at the NUMMI plant in California- and everyone was complaining when Toyota shut it down… as if having their partner [ the “old” GM ] walk away from a joint-venture wasn’t to blame for Toyota’s inability to keep the plant open by themselves. 🙁

http://www.nytimes.com/2009/06/30/business/30auto.html

“G.M.’s withdrawal from the venture, which is half owned by each of the companies, creates an uncertain future for the Fremont plant, which has more than 4,700 employees in five million square feet of assembly space.”

Everyone should do what ever they think is best for themselves. Period

Staying and walking both have costs, use what ever criteria you feel you should use and figure out what is best for you and then do it.

And for the record I don’t owe a penny on my house.

I remember Vietnam – do the right think go fight the commies. Die if you have to, no problem you are doing the right thing, body parts blown off no problem you are doing the right thing, went nuts from watching your buddies blown to bits no problem you did the right thing. What you made it home and need help? Tough sh** we just want you to go away.

What is “right” or “moral” is to protect yourself and your family.

@ #11 – You’ve answered your own question!

i.e.

“That is what people get for thinking of their home as an investment… why does that change because others now have changed thier opinion on the value of your home?”

Because we have been indoctrinated to believe that home ownership is the “American dream”, and the biggest investment most of us will ever make in our lifetime.

Coupled with the move from pensions to IRAs, 401ks et.al. means we’ve also been taught that there comes a point where we’ve got to manage our investments instead of just letting them “tank”. We’ve been trained to “cut our loses”.

Lenders have ben trying to up-sell us the “American Dream” the same way DeBier’s has been indoctrinating people getting married that a diamond ring is the only way to go, and that it should cost ~20% of your income… 🙁

Well if you have negative equity the house is already over 100% NOT YOURS. If you want to rent a building go ahead.

People who refinanced to take money out of their house almost certainly have a recourse loan, which means the bank will chase them for the remainder.

If you bought a house with a traditional mortgage and paid it properly it’s a very different situation. If you have a non-recourse loan and face serious negative equity you’d be insane not to drop the house if the bank refuses to write down the loan a bit.

Strictly speaking no taxpayers are out because someone walks out on a loan. The investment banks weren’t killed by foreclosures. It was high leverage and a fragile cash flow model that really got them.

Only a fool would walk away now (if he has the income to make the payments).

I expect inflation to reach 10%+ in the next five years, and stay there for 10 years. Your house payment is fixed, you did get a fixed 30-yr loan didn’t you, so you’ll make out like a bandit in a few years.

While stupid me keeps renting while I have the cash to buy.