Do it for economic survival? Don’t do it because you see it as a moral issue? Do it to get back at the bailed out bankers who profited at the public’s expense? Don’t do it because you love your house more than the money you’ll never get back on it?

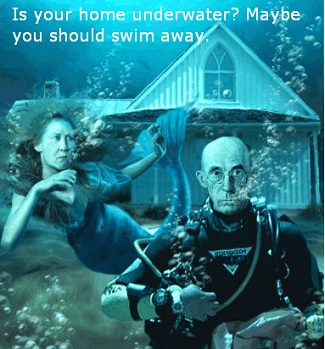

No Help in Sight, More Homeowners Walk Away

In 2006, Benjamin Koellmann bought a condominium in Miami Beach. By his calculation, it will be about the year 2025 before he can sell his modest home for what he paid. Or maybe 2040.

“People like me are beginning to feel like suckers,” Mr. Koellmann said. “Why not let it go in default and rent a better place for less?”

After three years of plunging real estate values, after the bailouts of the bankers and the revival of their million-dollar bonuses, after the Obama administration’s loan modification plan raised the expectations of many but satisfied only a few, a large group of distressed homeowners is wondering the same thing.

New research suggests that when a home’s value falls below 75 percent of the amount owed on the mortgage, the owner starts to think hard about walking away, even if he or she has the money to keep paying.

[…]

The number of Americans who owed more than their homes were worth was virtually nil when the real estate collapse began in mid-2006, but by the third quarter of 2009, an estimated 4.5 million homeowners had reached the critical threshold, with their home’s value dropping below 75 percent of the mortgage balance.

#32 Hmmmm, could be… if things get worse and you have a fixed interest rate loan, maybe you’re right…

Under normal circumstances I would have said no, but after the bailouts I say yes.

>> Lou Minatti said, It’s not a moral issue, it’s a business decision. […] in the contract that you signed.

And on top of that the banks should not make crappy loans in the first place – thats a big part of this mess.

Dump the damn thing.

If we were as crooked as the god damned congressmen and bankers we would burn the underwater houses down and let the banks settle with the crooked insurance companies.

You should have high morals and feel indebted to the very people who ripped you and your grandchildren off. They aren’t losing any sleep at night for ruining our economy and sending our children off to fight bullshit wars.

What a world full of narcissistic whiny little b’trds we have become.

This is a matter of principle and ethics. Two words that seem to have no meaning in today’s world.

I do not believe the banks held guns to anyone’s heads and said ‘you must take this loan!’

If the banks made insanely deceptive offers, maybe the buyers should have remembered the old saying, ‘if it sounds to good to be true …..’

As has been mentioned. A mortgage is a contract. The bank did not set the price, although they did set the payment. They already paid out the money for the homeowners to buy the house. No-one is blaming the previous owners for asking too much for their homes. Now people are stuck with homes they feel they paid too much for. How about people who bought flat screens when the prices were higher. Should they be able to forgo on paying for them now that new units are cheaper?

There is something called opportunity cost. These people got these homes because they were in the right place at the right time with the money that was asked for. (Ok maybe the wrong place at the wrong time…) They chose to buy. They now must live up to their end of the bargain.

If the deal they signed was bad, it is their fault. They were responsible for doing the research on loans. They CHOSE to pay the price asked. If they signed loans they did not understand, it is their fault. Again, the banks did not ‘make’ them take the loan. If the terms of the loan were illegal, then they should pursue legal recourse. If not, then again, only they are to blame.

But no-one wants to hear that. No-one wants to admit wrong. Someone else is always at fault. Someone else is always responsible.

#32 I agree that 10% inflation is easily possible in a few years, or maybe sooner.

#37 In the simple case of a non-recourse mortgage on a house with large negative equity the borrower would have significant leverage with the lending institution.

In the simple case the borrower can demand restructuring or walk. If they decide to walk there is no moral dimension to the decision.

If a bank makes “insanely deceptive offers” isn’t that fraud? If I sold a Ferrari to you and delivered a Yugo that would be wrong. Scale that behavior up a million times. Isn’t it still wrong?

“If a bank makes “insanely deceptive offers” isn’t that fraud? If I sold a Ferrari to you and delivered a Yugo that would be wrong. Scale that behavior up a million times. Isn’t it still wrong?”

“If the terms of the loan were illegal, then they should pursue legal recourse. If not, then again, only they are to blame.”

If I try and convince you a Yugo is as good as a Ferrari, and sell you a Yugo, I did not commit fraud. And you are the fool for believing me.

Chris, you are my proof. You can do no wrong. You are always right. You did not make a bad choice, it is the other person’s fault for deceiving you!

Go ahead, quit paying your mortgage and walk away.

Oh, quit your complaining when you discover your Auto insurance goes up. You can’t get a credit card or your existing credit limits get lowered. Oh, and I hope you’re happy with the car you’re driving or have the money to buy another one cash, because you’re not getting a car loan at less than 15% or so Interest.

Why?

Because no lender can TRUST YOU to may your payments!

Let’s think about this, too…

If you want another home once the market has settled, how easy do you think it’s going to be to get a mortgage in less than 7 years? Remember when I mentioned auto insurance earlier. Good Luck getting an insurance company to write a Home Owner’s policy on you. You are too high of a risk for them.

Buying a home is called an investment, but let’s face it. Investments come with risk.

I bought a home because I wanted to own the place I lived in and I liked it, and the property around it.

I have sympathy for folks that have lost their jobs and then lose their homes. I don’t have sympathy for someone who can afford to make their payments, but choose not to. They deserve to be poor for such actions.

#39 Just so I understand you. You don’t think that intentional misrepresentation in business matters is a problem?

So you seem to think that people can be lied to in business dealings, because they should be smart enough to protect themselves.

At the same time an individual has a moral obligation act against their own self interest when there is no legal obligation to do so.

People who took equity out of their houses and now want to leave are constrained. Banks will try to collect all the extra debt.

If your loan is secured only by the physical property why should a person not act in their strict personal best interests?

#22 You misunderstand how money works. Money = Debt. The money for a mortgage does not come from savings and investing, it actually is created by the bank as new money. When the loan is paid back, or if the loan is defaulted on, the money disappears from existence.

People walking away from their mortgages caused the money supply to get smaller, which leads inevitably to deflation and recession, but it does not hurt investors. Some investors actually win.

My grandfather built his house in about 1910 and lived in it for the next ~60 years, until his death. This was no “investment,” there were no “home equity loans,” this was his family’s home, a concept that seems to have gone out of fashion.

The American economy has become like a jungle — lots of activity, color and variety with zero depth. There are no savings, no reserves, only debt and every possible “asset” is continually “invested” (put at risk for profit), no one owns anything, no one thinks any farther ahead than the next quarter.

Personally, I prefer a temperate forest, where there are strong, long-lasting trees; where even the ground has a deep layer of biomass just in the snags (fallen trees and branches) and leaf litter; where just the stuff that falls into streams and the plants that grow there support all kinds of water creatures — crayfish, trout, etc.; “where the deer and the antelope play.”

I sure hope we can get out of this depression without another war!

I am upside down about 80 thousand dollars in my home because I repeatedly ran up debt and used my home as a piggy bank. You would have thought after the first time I would have learned my lesson, but I did it again and the mortgage company was more than happy to refinance. Well, now I am filing for bankruptcy because I ran out of money from my home. Now I have learned my lesson. Unfortunately my credit is now ruined and I will be forever a deadbeat unless I can figure out how to pay this debts off.I’m keeping the house though and have no intentions on leaving even though I will never be able to sell it for a profit. I’m happy just to have my job and home and to start anew.

houses… under water. Hey! I saw that on LOST !!

#43 said, “People walking away from their mortgages caused the money supply to get smaller, which leads inevitably to deflation and recession,”

Of course, when gigantic corporations walk away from their mortgages on rental properties, no one thinks it’s such a bad idea. It’s just a good business move. (Think Donald Trump)

When a homeowner does it, he or she is morally bankrupt, and is tainted forever.

Welcome to America, where corporations are treated like people and people are treated like prey animals.

The Tishman-Speyer company just walked away from the mortgages debt on their Peter Cooper Village and Stuyvesant Town properties, perhaps the largest default in real estate history. They are not bankrupt either – far from it. Read the article at:

http://www.nytimes.com/2010/01/26/nyregion/26stuy.html?scp=1&sq=%22peter%20cooper%22&st=cse

“the law, in its majestic equality, forbids rich and poor alikes to sleep under bridges, beg in the streets or steal bread.”

– Anatole France

It depends. Force the lender to drop part of the principal on the mortgage and threaten them to leave four walls and a roof if they don’t comply. The banks got their bailout and can now pay their millions in bonuses just like they used to. Don’t give into them and this economic scam by letting them have your house. They are able to stay in business because they borrowed your money at literally no cost to them and they want to be able to take your house and sell it too. Double scam. Bull.

#40 Well said, I couldn’t have put it any better. When you’re the only one playing by the rules and everyone else is cheating, there’s no sense in playing by the rules.

#47 Exactly… the rules are for the little guys, not the big guys…

So, if others are cheating, then one’s own personal integrity is pointless?

Cool!

Now I have a blanket excuse to be a totally dishonest d-bag, because that’s what all the cool kids are doing!

Thanks!

LETS TRADE! MY HOUSE FOR YOUR?

It’s all oprinted money. There is no gold. Roosevelt made sure of that. When we are all camped out on the green in D.C. (again!), I guess someone will get the point. We don’t have a need to build new highways. We don’t need to go to the moon. There are 300M of us now with PHD’s, MD’s, BA’s, etc., etc. to reason with. We are smarter than the generation in the 1920’s, and some of them are still around as well to keep us honest. So before you decide to keep the money printers running, or turn them off, please understand that there are more of us now than ever, and we will survive with or without your help, and with or without a roof over our heads! We don’t need new oil reserves overseas, or fixes(“Fallacies”) for sticky gas pedals(leave the jap cars alone Obama it will not help the GM Union). We need jobs on our terf with our money terms for bartering. A mere tragedy that the only generation smarter than we are today fought within this country for 4 years to resolve this very conflict. Their grandchildren were left to walk aimlessly in your direction for 2 generations to come. But perseverence and strife has brought us together! I wonder what they would think about the towns and farms they fought for. There is no Mason Dixon line this time to separate us. Only a circular pattern of ants doing the death march around D.C. pointing to the problem, because it stinks so bad! Please clean up your act and give our troops something to come home to. You will not be able to hide behind a bank lobbyist and the money. They are extreme capitalist and have already replaced you with someone willing to do the job cheaper and more discreetly from overseas. Yes, believe it or not the IRS has now outsourced their call center and agents to taxigastan! Yours truly,

Middle America

I JUST never enjoyed bernie madoff! how can most people like a human being so phony? i believe might as well go back to trying to be pretty.