Pencils and notebooks resembling President Barack Obama’s 2008 campaign ads have been sold in at least one Columbia school and other public schools, causing the company that distributes the materials to travel around the state yanking the supplies out of machines.

“Don’t be mad at us,” said Greg Jones, a sales representative with Pencil Wholesale. “It was a total accident.” At Mill Creek, at least one pencil and a notebook with designs similar to Obama campaign advertisements have been sold out of a supply machine. Two families have complained about the politically tinged materials.

Three Missouri schools have contacted Jones since the beginning of the school year asking that the materials be removed, and Mill Creek Principal Mary Sue Gibson this week said she also planned to call Pencil Wholesale.

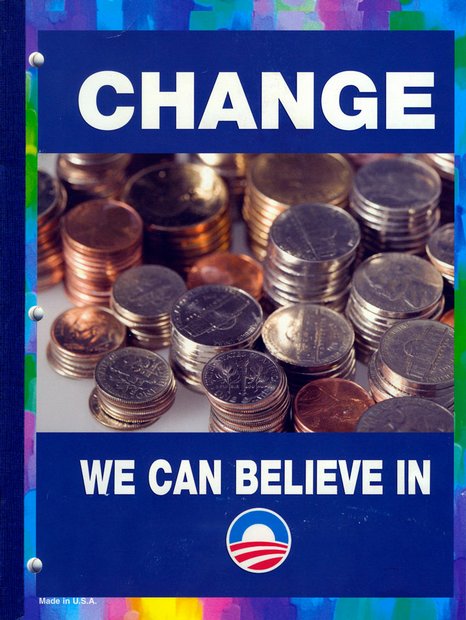

“I just don’t want to get into that political arena at all,” she said. The bound three-ring notebook bears a photo of literal change — pennies, quarters, dimes and nickels stacked into piles. Above the photo, white text reads “CHANGE” over a navy background.

Below the photo, “WE CAN BELIEVE IN” sits above a logo similar to Obama’s campaign image — three red stripes separated by white stripes in front of a white circle with a blue background arching over the circle. The supplies were designed by the art department of Harcourt Pencil Co., based in Milroy, Ind., Jones said. “The art department was trying to be cutesy,” he said. Jones has agreed to go to schools that might have received the supplies and remove them. “I wish I could do it over,” he said. “But, for now, I can just make it right.” “It’s turned out to be really ugly,” Jones said. “We’re trying to get them out of the schools as fast as we can.”

He also wants to be clear that neither he nor his company created the design. In fact, he said, he’s a registered Republican who voted for John McCain in last year’s presidential election.

“It’s a total nightmare,” Jones said.

How could he have NOT noticed something like that? I smell a rat.

guyver,

You have been listening to Limbaugh too much.

The CRA was government intervention which forced banks to lend money to risky borrowers because simply going by someone’s ability to pay was deemed racist since certain minorities in this country are disproportionately more poor than others. It’s funny how a government-created problem is somehow the fault of the greedy banks.

The Community Reinvestment Act did not force any bank to make a loan to any “risky” borrower. You simply don’t even know what the CRA was about.

The CRA stopped banks from discriminatory lending practices. That meant that equal people with equal backgrounds were to be treated equally. (Mostly) blacks could not be discriminated against when they tried to borrow money from the banks that were in their neighborhoods.

Up to this point blacks could not get banks to grant mortgages even though they willing lent money to whites under similar circumstances. That caused many homes in black areas to fall into disrepair and ruin.

*

FMs were in stable shape in 2003. When Oxley and Shelby saw what the Bush Administration wanted they dropped the hearings.

What were those proposals? To control the FMs from the White House. Even Bushes own Congress didn’t want to touch his proposals to turn the mortgage giants into his personal piggy banks. Even so, through the Treasury Department and by appointing Republican Chairmen, Bush forced the FMs to accept the toxic assets being sold by the unregulated financial sector.

Here, enlighten yourself. And quit watching Youtube for references.

35, Fusion, Good grief. The CRA made red-lining illegal because most blacks fell in the zones that were red-lined. Why? Because red-lining was one way for banks to determine risky borrowers by marking poorer / high-crime areas as off-limits. That’s not a bad way of minimizing risk.

However, when Congress saw that home ownership was dramatically lower amongst blacks, they came up with the CRA because they believed racism was somehow the root cause of red-lining. As I said before, the legislation was “well intentioned”. I don’t believe Limbaugh would say that.

What you got was a change of banks denying people loans to banks lending to people hand over fist to buy homes they couldn’t afford through ARM loans. Banks don’t like making loans knowing someone is likely to default. Nor do banks like buying loans knowing that they’re likely to default either.

But somehow Bush was responsible in forcing banks to QUIETLY take toxic assets? And Democrats quietly stood by? Riiiiiiiiiiiiight.

Guyver,

Nor do banks like buying loans knowing that they’re likely to default either.

But somehow Bush was responsible in forcing banks to QUIETLY take toxic assets? And Democrats quietly stood by? Riiiiiiiiiiiiight.

So the banks woke one morning last September and were shocked to discover that all those mortgages they had bought were really toxic. Yaa, riiiiiiight!!!

Who said Bush forced the banks to accept the toxic paper? That is a new one to me. I understand he forced Fannie Mae and Freddie Mac to accept the paper being written and held by his buddies.

In case you didn’t know. Fannie and Freddie don’t write mortgages. They buy them from banks. The bank continues to service the loan and collect a percentage of the payments, but don’t have any money tied up in them.

Freddie Mac didn’t want to accept any ARMs or Balloon mortgages under Tim Raines. That is when the White House discredited Freddie Mac’s accounting procedures and forced Raines out. At the same time Barney Frank made his speech about Freddie Mac being in good shape. They were.

Bush still appointed the Chairmen and several directors of the FMs. It was through them that these toxic mortgages were passed. Congress subpoenaed the Treasury officials several times but these were ignored. (I guess you forgot how the White House didn’t answer its subpoenas) So the answer to your question is NO!!! The Democrats and Republicans in Congress were unaware of what was happening.

Guyver,

Good grief. The CRA made red-lining illegal because most blacks fell in the zones that were red-lined. Why? Because red-lining was one way for banks to determine risky borrowers by marking poorer / high-crime areas as off-limits. That’s not a bad way of minimizing risk.

Again, you don’t know what you are talking about.

Banks were not forced to undertake risky loans.

38, Fusion, Yeah banks stay in business making risky loans all the time. LOL.

Banks were forced by the way through organizations such as Acorn.

“Critics of the notion that CRA had a major impact on the subprime crisis ask how a law passed in 1977 could have caused a crisis in 2008? The answer has a lot to do with ACORN — and the critical years of 1990-1995. While the 1977 Community Reinvestment Act did call on banks to increase lending in poor and minority neighborhoods, its exact requirements were vague, and therefore open to a good deal of regulatory interpretation. Banks merger or expansion plans were rarely held up under CRA until the late 1980s, when ACORN perfected its technique of filing CRA complaints in tandem with the sort of intimidation tactics perfected by that original “community organizer” (and Obama idol), Saul Alinsky.

At first, ACORN’s anti-bank actions were relatively few in number. However, under a provision of the 1989 savings and loan bailout pushed by liberal Democratic legislators, like Massachusetts Congressman Joseph P. Kennedy, lenders were required to compile public records of mortgage applicants by race, gender, and income. Although the statistics produced by these studies were presented in highly misleading ways, groups like ACORN were able to use them to embarrass banks into lowering credit standards. At the same time, a wave of banking mergers in the early 1990’s provided an opening for ACORN to use CRA to force lending changes. Any merger could be blocked under CRA, and once ACORN began systematically filing protests over minority lending, a formerly toothless set of regulations began to bite.”

http://tinyurl.com/4782zz

Guyver,

Which brings us back to your claim that banks were forced by the legislation to write risky loans. They weren’t. The risky loans were written for greed by the mortgage industry.

Unless you can show some evidence that they were forced, I suggest you quietly accept you lost a baseless claim.

Like the rest of the right wing nut arguments, your arguments are false and full of crap. It won’t matter how much you repeat them, they won’t come true.