Gordon Hageman couldn’t believe the credit card offer he got in the mail.

“My first thought, it was a mistake,” Hageman said.

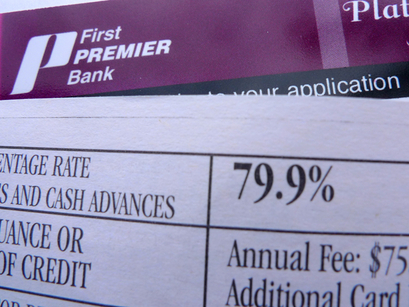

The wine distributor called the number on the offer, gave them the offer code and verified his information. Sure enough, it was right: the pre-approved credit card came with a 79.9 percent APR. The offer is for a Premier card from First Premier Bank, which is based in South Dakota. On its Web site, First Premier says it is the country’s 10th largest issuer of Visa and MasterCard credit cards. The site also says it “focuses on individuals who have less than perfect credit but are actually still creditworthy.”

“I think they’re trying to take advantage of me,” said Hageman.

Ya think?

Hageman acknowleged that his credit isn’t perfect, but he said it’s about average. He said the pre-approved offer didn’t mention the actual interest rate on the card — for that, he had to read the enclosed fine-print disclosure. The California Attorney General’s office said there’s nothing it can do about the cards since they are issued out of state and out of its jurisdiction.

Again the do-nothing govt. is there to protect the consumer.

Offers like this make you want to go back and see who sponsored the legislation that removed the cap on interest rates that banks could charge on credit cards. And you just know it was described as a boon to consumers.

Libertarians rejoice! Deregulation at work!

(In 1980, Congress passed the Depository Institutions Deregulation and Monetary Control Act exempting federally chartered savings banks, installment plan sellers and chartered loan companies from state usury limits. This effectively overrode all state and local usury laws. The federal government has never had a usury law.

Isn’t postal fraud and usury investigated by the US Secret Service?

#5

Were you born stupid or does it take a lot of propaganda and self loathing to be that stupid. The people getting all the free money are charging those stupid rates. Heads Up, they outright own your golden child Obama who’s happely haindg them money because he knows your stupid enough to praise him for selling your kids.

If Shakespeare were around, I think he’d re-write the line in Henry VI, and either add or change “bankers”.

I had one of their cards once. To make an online payment, they charged a $7 fee.

#5 – Breetai – The self loathing just has to stop.

#5 Breetai, that’s the funniest thing I’ve read all day.

Or..you could do the most sensible thing and stop using credit cards all together. I gave them up in the late 80’s along with the TV.

-Eyes wide open.

#2:

“Deregulation and Monetary Control”

-um, isn’t that an Oxymoron??

#1 & #2

-the irony of course, is that some of the major crooks who pushed for the removal of banking safety’s that facilitated the current financial fiasco, have been hired on as obama’s economic advisers. (rubin, summers et al )

Still think this economic team is planning to restore America to it’s former glory?

-their going to fix it but good. :s

-s

I had dealings with this company too, received the card and it had like $175.00 in various charges and I had not even activated it!!

Scoured the net with their name and contacted a friend whom works in finance about them.

If you ever get a card from these people call them up right away and cancel the card and state that you had no idea that the fees where this high. Whatever you do, do not activate or use the card or pay them anything. Their high fees and activation scams are only part of their ripoff, they will hammer you with late and overdraw fees by not posting your payments on time.

Check out rippoffreport.com and look for their name.

If they give you any hassle on the phone tell them that you will report them to the attorney general in your state and theirs and the Federal Trade Commission.

There is a special place in hell for these people.

I don’t understand… It says 1st Premier Bank.

Aren’t they just the best??

as I know it is a case to case basis. 🙂

Let the buyer beware? Sorry, I see this offer show up in my mail, it goes right to the shredder. Or maybe I post it on my FB account so others may laugh as I shred it. Why should the government have a say in it? Defend the borders, not stupidity.

And health insurance companies are on your side too…

Libertarians and their deregulation… the biggest fools born, unwitting stooges to corporate interests.

What’s so hard… just cancel the damn card. For crying out loud, this isn’t rocket science.

#12 for the win

Stupid government passes a law that supposed to protect consumer’s. Of course they gave everyone plenty of time to rewrite their credit agreements and raise interest rates and lower credit limits. Mine is going up I found out the other day. Only about 5% from 14.99 to 19.99 but still. How is my government protecting me? The meatheads in Congress are so stupid I guess they never thought through on this one. But then again when do they think?

Wow! thats a new one…I’ve gotten offers from them in the past, and everyone had brutal terms.

Actually I would always read the offers and laugh like crazy. I can’t believe people take this card. I’ve never had anyone card company top this.

These 1st premeir defines bottom feeders.

It’s simple. If this is the only credit you can afford, you can’t afford credit. Just don’t sign up. They tell you up front they’re going to stick it to you.

I only wish the government were that honest about when they stick it to you….

Sure, it’s a do nothing government at the urging and legislation pushed by neocons and neolibs plus the anti-regulatory crowd fostered in office by Nixon on.

I am becoming a true conservative in that I think we should go back to the 50s and 60s in terms of much legislation and regulation. This would provide us with several benefits. Aside from such credit practices being instantly illegal and the highest incomes and largest corporations actually paying their way in taxes again, my tv commercials wouldn’t be so loud anymore!

this is a federal case.

Why do you need the government to protect you from credit card offers that have a 80% APR? Isn’t the high interest rate a DETERRENT enough? You can just simply NOT apply for the credit card! Duh.

Banks lately really don’t care if your credit is good or not, they will dole out credit cards like a poker dealer. They don’t care if you can afford it or not, as long as you’re in debt; your ass belongs to them till you’re dead, and your life insurance pays the bank off.

Poor you, it must be so difficult to reject that 79% APR, that you need to have government involved to do it for you.

Listen, I will help you out here, and it won’t cost the taxpayer a thing. Take the offer, place it in the shredder, now push the shred button. Look at that, problem taken care of, and we didn’t have to cost the government millions to create yet another program.

If you are too dumb to reject and offer like this, you probably are too dumb to own credit cards in the first place.

Good to see all you tough manly men LIEBERTARIANS out in force on this topic. Screw those who don’t speak/read english well enough to see the traps. Screw those poor and destitute who just got told they need a credit card in order to transact some business.

Yea–screw everyone but me. I’m god and you all should worship my prowess.

the fact that any one of you thinks this is either “just business” or not illegal — morally if not actually illegal — and you are not outraged and ready to burn down the government makes me really wonder about the health of the country.

This is NOT fine, and we should NOT be quibbling over it. We should each be putting pressure on our local legislators and raising hell.

At what point is too much?

Health care insurance costs going up 600% in 20 years? Oil costs manipulated? Banking without usury laws? Predatory collections, predatory lenders, predatory scam artists — roaming freely and with no restraint? Our Senators and Legislators having nothing, until they start getting elected, then suddenly having millions (how does that work? Think about it….do WE pay them that much?). At what point do we wake up and realise we are the peons and the cash cows for a bunch of corporations?

When do we get fed up?

“Again the do-nothing govt. is there to protect the consumer.”

Somebody call a Waa-ambulance.

How about the individual consumer getting a clue, like Mr. Hageman did, look out for their own best interests, and tell these parasite banks to EFF OFF, instead of expecting the nanny state to always wipe their butt!!

.

Hey this is kinda cool, Premier bankcard is from my home state. I actually have many friends that work at collections in the town I’m from. All I ever hear is about how stupid the people are that they collect from. Things like saying they sent their bill to Obama to take care of, and just stupid excuses in general. The others they collect from usually have relatively small amounts owed and pay it on the spot b/c they had just forgotten about it or something. Point is, it sucks giving credit to people who lack the mental capacity to be responsible with their money but someone has to do it, and the way to level out the risk is to jack up the APR. I also know the owner of the company and he is a pretty well known philanthropist in the area and a really nice guy in case anyone wanted to know.

SD,

yeah, there are some fleas that are really cute when they’re in a flea circus. Doesn’t mean they still aren’t parasites.

Collection companies should be jobs for child molesters other ex-cons. Fits right into the mindset.

The reality…banks that are set up for no other reason than to make millions on high rates, fake fees, and other unregulated activities (and the collection scum that do their nagging) should be rounded up and punished (tar and feathered or peeled would work for me).

What happened to an honest days work for an honest wage? Moral bankruptcy is nothing to be championed.

meetsy,

I have never had to deal with collection “scum” because I have never spent more than I can afford. Your general negativity towards these companies and collection agencies leads me to believe that you have to deal with them. Maybe take some time to make a budget….

no..used to work for them