Gordon Hageman couldn’t believe the credit card offer he got in the mail.

“My first thought, it was a mistake,” Hageman said.

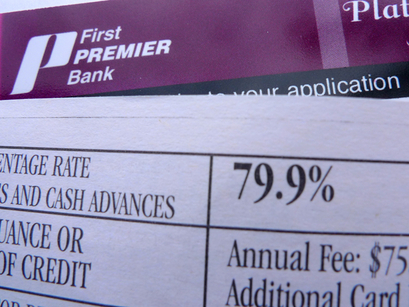

The wine distributor called the number on the offer, gave them the offer code and verified his information. Sure enough, it was right: the pre-approved credit card came with a 79.9 percent APR. The offer is for a Premier card from First Premier Bank, which is based in South Dakota. On its Web site, First Premier says it is the country’s 10th largest issuer of Visa and MasterCard credit cards. The site also says it “focuses on individuals who have less than perfect credit but are actually still creditworthy.”

“I think they’re trying to take advantage of me,” said Hageman.

Ya think?

Hageman acknowleged that his credit isn’t perfect, but he said it’s about average. He said the pre-approved offer didn’t mention the actual interest rate on the card — for that, he had to read the enclosed fine-print disclosure. The California Attorney General’s office said there’s nothing it can do about the cards since they are issued out of state and out of its jurisdiction.

Again the do-nothing govt. is there to protect the consumer.

I find that hard to believe. How can you call them scum? what if you loaned me $500 and I never payed you back…wouldn’t you call me and politely ask me to pay? If not the whole thing, maybe a part of it?

I’d be an idiot to loan you money..unless you agreed to MY TERMS (which I can change on whim, MY WHIM).

If I loaned you money it would be with the terms of 50% interest per month, a $100 fee for “handling the loan”, and another $5.00 per day for each day the loan is outstanding and if you pay the amount in full, there is a $200 penalty. (And, remember, these terms may change if I decide to change them, and you’re going to agree to do that. Plus, if you want to take me to court, it must be ARBITRATION, and the arbitrators are those that I chose, and pay to find in my favor.)

Do you AGREE?

Where do you want me to send the check?

WOW! I have never heard of a card with that high of an interest rate! What is really said is it looks like that card has an annual fee attached to it and no rewards to speak of. I guess if one had super bad credit and that is the only card that they could qualify for then it may be smart to get the card to use just for the sole purpose of boosting your credit score (assuming that they pay off the card balance in full every month of course!)

the joke of it is…the credit card companies do whatever they CAN to make sure you miss payments, or the payments are posted late (short billing cycles, delayed in “processing” — up to 15 days to “process”) so the credit card is only sucker money. It won’t help your credit report….but it will keep you in the group that gets the worst credit interest rates, highest health and car insurance rates, and makes it near impossible to get a loan that isn’t a rip-off, plus it will bleed you dry.

My advice….get rid of all credit cards, stop buying anything — until the bastards figure out how to play nice. (Which will never happen. And government isn’t going to help matters any, either.)

What kills me is that stores like Macy’s are crying how no one is shopping….duh, they charge some insane rate of interest on their “charge accounts” (citibank handle it, I think.)

Maybe if Macy’s had thought about valuing the customer instead of gouging the customers…. but, nah, that isn’t how they think.

How about we quit blaming the government and start blaming banks.

Your ideas on this topic is very captivating and I hope to see more articles on your blog about it. I have bookmarked http://www.dvorak.org/blog/2009/10/15/got-bad-credit-no-problem-have-we-got-a-card-for-you/ so I can avoid missing on any future pieces related to this matter.