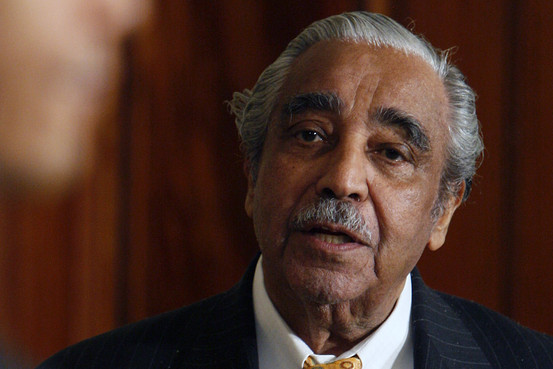

Earlier this month the Chairman of the tax-writing Ways and Means Committee “amended” his 2007 financial disclosure form—to the tune of more than a half-million dollars in previously unreported assets and income.

When you’re a powerful Congressman and working diligently to increase tax rates to pay for President Obama’s health-care plan, we suppose it’s easy to lose track of one of your checking accounts. That would be the one at the federal credit union with a balance somewhere between $250,001 and maybe as high as $500,000. And when you’re crunched for time and pulling together bills to pass in a rush, we guess, too, that you might overlook several other investment accounts, even if some of them are sizable, such as the ones Mr. Rangel missed at JP Morgan, Merrill Lynch, Oppenheimer and BlackRock.

Oh, and those vacant properties in Glassboro, in southern Jersey? Everybody in Manhattan tries not to think much about New Jersey, so those lots and their as-much-as-$15,000 value must also have slipped down the memory hole. (The New York Post reported yesterday that Mr. Rangel failed to pay property taxes for two of the lots, according to the county clerk’s office.) The Chairman probably isn’t doing a lot of dining at KFC, Pizza Hut, Taco Bell or Long John Silver’s, either, which may explain why he didn’t disclose the $1,001 to $15,000 in stock he owns in Yum Brands, the conglomerate that runs those chain restaurants. Compared to his undisclosed portfolio stake in PepsiCo—$15,001 to $50,000—that’s practically a rounding error.

Cut the guy a break, I’m always misplacing things, car keys, sunglasses,…….. it’s just stuff.

You know, you would think after all the problems the dems have had over the last year with tax returns they would relize that the code is just too damn complicated. Go to a flat tax with no deductions, or a fair tax system.

A tax return should never be over a page long, and require an MBA to fill one out. Put your total income down, take a percentage of that give it to the government. It should be that easy.

Instead we have sliding scales, and a million different deductions, with more being added every day. The day we were in trouble was the day the average person needed to hire an accountant just to do his taxes.

Seems to be a sudden pandemic of ‘I’m too (busy…important….liberal?) to pay taxes like the sheep’

#34, Bob,

A tax return should never be over a page long, and require an MBA to fill one out. Put your total income down, take a percentage of that give it to the government. It should be that easy.

Good point.

Originally that was the way Income Tax was calculated. Successive governments though have added little bits here and there to stimulate the economy and the realization that life isn’t fair.

Without the tax break, most retirement plans wouldn’t exist.

Without the tax breaks, most companies wouldn’t have health insurance.

Without the tax breaks, much charitable giving would dry up.

Without the tax breaks, Stock Market investments would lose their appeal.

Families with several children have much higher expenses than singles.

People that must supple their own equipment, clothes, tools, cars, offices, etc would end up severely disadvantaged.

And what is your favorite tax deduction?

#31, MikeN said, “Shouldn’t Congress’ tax returns be made public, so people can spot these sooner.”

Great point. There is a wonderful saying I’ve heard “On the job, on the record” They want power over people, a little transparency is not too much to ask.

The only difference between congressional tax cheats is that democrats get embarassed and apologize when they get caught. Republicans blame their tax attorney and the liberal media.