A tidal wave of public outrage over bonus payments swamped American International Group yesterday. Hired guards stood watch outside the suburban Connecticut offices of AIG Financial Products, the division whose exotic derivatives brought the insurance giant to the brink of collapse last year. Inside, death threats and angry letters flooded e-mail inboxes. Irate callers lit up the phone lines. Senior managers submitted their resignations. Some employees didn’t show up at all.

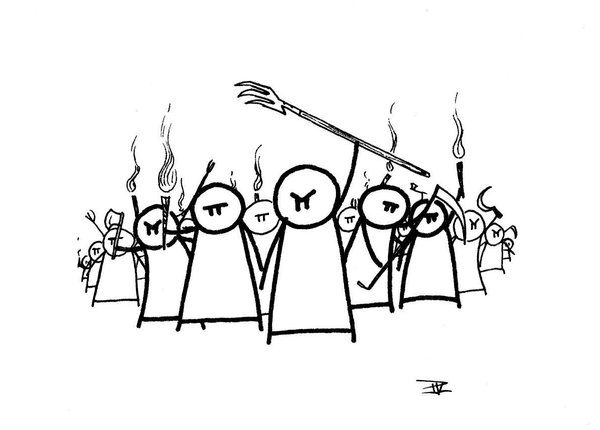

“It’s a mob effect,” one senior executive said. “It’s putting people’s lives in danger.”

Politicians and the public spent yesterday demanding that AIG rescind payouts that they said rewarded recklessness and greed at a company being bailed out with $170 billion in taxpayer funds. But company officials contend that the uproar is scaring away the very employees who understand AIG Financial Products’ complex trades and who are trying to dismantle the division before it further endangers the world’s economy. “It’s going to blow up,” said a senior Financial Products manager, who spoke on condition of anonymity because he was not authorized to speak for the company. “I have a horrible, horrible, horrible feeling that this is going to end badly.”

President Obama yesterday vowed to “pursue every legal avenue to block these bonuses.” But that pledge might have come too late. About $165 million in retention payments started to go out Friday to employees at Financial Products, after numerous discussions with the Treasury Department and the Federal Reserve. Attorneys working for the Fed had been examining the matter for months and determined that the retention payments couldn’t be touched because AIG would face costly lawsuits and be subject to penalties from states and foreign governments. Administration officials said over the weekend that they agreed with that assessment.

My heart is bleeding. The bogus argument that they need the bonuses to retain these morons is total BS. Let them leave, and try to find work elsewhere… good luck.

They can find work elsewhere pretty easily. These are big companies and not everyone made these bad decisions. They should have just let the companies go bankrupt. AIG sold insurance policies they couldn’t cover. The banks bought this insurance to hedge their bets, and still lost.

Who exactly gave you a voice in whether or not a company pays their employees what they are contractually owed?

I missed this.

And please don’t claim that TARP did this, as interference with contracted payments to executives for work prior to TARP was specifically excluded by Congress.

I think the govt is planning on taxing up to 100% of the bonuses that the AIG people received.

How come no one is screaming about the billions in US taxpayer $ that went to Deutsche Bank & SocGen?

I do not have a problem with these guys getting bonuses. I have a big problem with the people that continue to give away my tax money to AIG. Jesus but these people are making true fools of us all and damn it they work for US!

These bonuses were known almost a year ago. It’s how these guys are paid and Chris Dodd knew about it and ok’d it in the first stimulus bill as an amendment. This is all for show by the demoncrats to build manufactured anger. And all of this for 1/10th of 1% of all the money given to AIG. Just as Santelli pointed out, where is the outrage over the B’s and T’s?

Here’s the language of Dodd’s amendment

# Crack down on bonuses, retention awards and incentive compensation: Bonuses can only be paid in the form of long-term restricted stock, equal to no greater than 1/3 of total annual compensation, and will vest only when taxpayer funds are repaid. There is an exception for contractually obligated bonuses agreed on before Feb. 11, 2009.

#

# For institutions that received assistance totaling less than $25 million, the bonus restriction applies to the highest compensated employee; $25 million to $250 million, applies to the top five employees; $250 million to $500 million, applies to the senior executive officers and the next top 10 employees; and more than $500 million applies to the senior executive officers and the next top 20 employees (or such higher number as the Secretary determines is in the public interes

I’d still love to see the TERMS of the bonus program and how a company/division that went bankrupt can still legitimately have qualifying bonuses.

Very rare to give bonuses based on the volume of defaults experienced?

Where is the outrage that AIG gave Goldman Sachs ~9 billion or so to cover their bets when Goldman told the government they needed no help? Why is Goldman getting 9 billion to play with when they don’t need it?

If you want to see who is behind all of this besides the boneheads in congress, look at Goldman Sachs. There have been a lot of ex GS and current GS people lobbying behind the scenes and it turns out GS ends up being the last firm standing.

>The prohibition required under clause (i) shall not be construed to prohibit any bonus payment required to be paid pursuant to a written employment contract executed on or before February 11, 2009, as such valid employment contracts are determined by the Secretary or the designee of the Secretary.

I thought Obama was going to go line by line thru the budget?

The good news is that the stimulus is unconstitutional, and that eliminates this provision as well.

oh no Colbert suggested we take up pitchforks and torches just yesterday what power

#2

RSweeney I’m sure you felt the same way about the auto workers contracts right.

This wouldn’t be an issue if AIG was just allowed to fail. The 170 million is only about $1 per taxpayer, but the 3 trillion Obama wants to spend is about 18,000 per taxpayer. But thanks to the idiots in the media, all you hear about is the AIG bonuses, which is exactly what Obama’s cronies wanted.

Magicians do this all the time, they call it misdirection.

#2. Who exactly gave you a voice in whether or not a company pays their employees what they are contractually owed?

When that company can’t stand on it’s own 2 feet, and comes begging for a handout, and it comes from the taxpayer, we get a say in the matter.

So Fuck You

One of my favorite Senators is Charles Grassley from Iowa, who said, “But I would suggest the first thing that would make me feel a little bit better toward them if they’d follow the Japanese example and come before the American people and take that deep bow and say, ‘I’m sorry,’ and then either do one of two things: resign or go commit suicide.”

Chuck is from the old school, where people still had a sense of shame. These days, if it isn’t illegal, it apparently isn’t wrong.

I like the idea of a 100% tax on anyone who accepts the money. That is the best solution.

AIG no longer sponsors Manchester United. They just decided not to renew their contract last month. I guess things are really going bad. So when these pigs go belly up what happens to the $85 Billon they got in US taxpayer money last september?

I couldn’t care less about their employees, lot’s of people going jobless, why should they be different.

Despite the uproar and the false “outrage” from the cult leaders in Washington, this is going to continue.

The only way it will stop is with a full on tax revolt by the people. Which wont happen since the majority of the slaves out there have their taxes taken out of each pay check and rely on the IRS sending it back to them each year.

#13 These days, if it isn’t illegal, it apparently isn’t wrong.

These days it doesn’t matter if it’s illegal or not, if you don’t get caught it ain’t wrong, and even if you do get caught it still ain’t wrong if you invest in lobbying.

The big picture here is that this all keeps coming back to GS. It readily apparent the GS is the biggest benificiary of this whole fiasco. Im surprised that the whole of America isnt waking up to this fact yet, that GS seems to keep smelling like a rose in all this. Suspicious to say the least.

As far as AIG and CDS/derivatives. Who isnt to say that this is all a set up. I mean if you bet against something, and stand to make a hell of alot of money if it does fail. Seems logical to me that maybe there would be whole lot of incentive to, well , make/let things fail.

The bailout was a rush job, these oversights were bound to happen. Honestly we’re talking pocket change here. They should have let the company declare bankruptcy, then clean the mess up. Then a judge could tell them to stuff the bonus, or get in a long line.

#10 I think that government can’t arbitrarily suspend private contracts.

Yes, that’s why I support Ch11 bankruptcy for GM and Chrysler. They need to break their union contracts to survive, the cost structure is simply unsupportable.

Bankruptcy how one changes contracts legally, not by executive fiat or extortion.

Apparently a lot of people have forgotten that the Constitution forbids laws aimed at punishing specific individuals (“bills of attainder”) without trial.

Scenario:

1. Guy in Detroit gets laid off, pension is gone, 55 years old

2. His wife has cancer and is terminal

3. Gun owner

4. Car ride to New York

5. Dead AIG exec

If I was in Vegas I’d bet money on this scenario.

Never mind the billions of dollars AIG gave away to foreign banks, the guy in Detroit is going mano-a-mano.

Maybe something “very bad” should happen to these pricks. Laws are far-sighted deterrents, these people obviously have no foresight and care very little about how things will turn out further down the line.

WTF!Obama is a lawyer.You punish people in this country by taking them to court.He knows that and so do the creeps at AIG.We are all so screwed.We are solving our debt problem and our balance of payments problem by destroying our currency.Look for 20 percent inflation by 2011.

#20

RSweeney I’m sure you felt the same way about the autoworkers contracts right

RSweeney said,

snip

They need to break their union contracts to survive, the cost structure is simply unsupportable.

#10 I think that government can’t arbitrarily suspend private contracts.

yup they should put a precondition on any bail out moneys that those kind of private contracts must be renegotiated before we give them the cash.

aww bankruptcy not realy an option here, to bad the lack of regulations let AIG get so big as it is to big to fail without bring the house down now they can just go on extorting us.

Personally I think the UAW and GM have been locked in a death spiral for decades we could all see it coming now they are about to hit bottom.

LISTEN YOU GUYS

Stop arguing. We’re all in this together. Now look, we all want this problem to be resolved but turning against each other won’t make it happen any sooner. Did any of you stop to think that these execs have families? Children? People they care about?

The children will be the easiest, because they can’t run very fast. If there are women involved, they may lose a shoe in the melee which buys us enough time to overtake them, especially if they are caring after the little ones. Security guards should be pretty easy to bribe, which leaves any kind of home invasion protection. Is anybody good with circuit breakers? Panic rooms may pose trouble though I’m not sure how commonly these are installed. A blow torch could provide just enough of a hole in the side paneling to insert a tube whereby caustic inhalants can be blown into the space, forcing the well-offs to either surrender or suffocate. Ensuring safety in exchange for cooperation will be key in gaining a false sense of trust. They make walk right out.

Then it’s just a matter of constructing some sort of rudimentary head-chopping device or “guillotine” and we’re off to the races!

# 12 Jim said, “When that company can’t stand on it’s own 2 feet, and comes begging for a handout, and it comes from the taxpayer, we get a say in the matter.”

Actually, you have NO say. The legislators & Pres do. They already said it was okay when they passed the legislation…

#24… Congress DID put a pre-condition in the TARP bill.

They said that bonuses for 2008 (paid in 2009) were fine.

Hard working dedicated executives need retention bonuses to keep them in the company, but paying retention bonuses to executives who have already resigned or have been fired and have left the company, is probably a good reason to get angry.

http://tinyurl.com/dkntc9

I don’t like the idea of the government taxing these AIG people to recoup the bonuses. Once the government sets a precedence, they’ll keep doing it, eventually to us.

As for the AIG people getting the bonuses, the government needs to examine each person’s contract as to what it says and act on a case by case basis. Some of these guys may be entitled to the bonuses (legally speaking).

This is just more frickin distraction from the real problem. While we are bitching about a 100 million dollars the big guys are absconding with 100’s of BILLIONS!