Those of us fleeced by Bernard Madoff are looking to get some of our money back from the government, which taxed us on money we never earned. In my case, I not only lost $5 million in the Ponzi scheme, but I paid almost $75,000 to the state of New Jersey and $275,000 to Uncle Sam in taxes over the past three years on income reported by me, which, as we all know now, never existed.

We Madoff investors, creditors, survivors—please call us anything other than victims—realize we will get back pennies on the dollar from Madoff if we’re lucky, but getting back the money we paid the government and which we’re entitled to apparently won’t be easy.

Madoff robbed me of $5 million and New Jersey now wants to rob me of $75,000.

Take New Jersey, for instance. On Feb. 20, the New Jersey Division of Taxation came forth with a “Ponzi Schemes and Amended Returns” notice on its website acknowledging that “many people with investments managed by Madoff are likely to have paid taxes on income that was never actually generated by them (phantom income).”

Rather than urge taxpayers to amend their tax returns to get a refund, the division does the exact opposite. “The Division of Taxation is not accepting amended returns with regard to the Bernard Madoff or other alleged Ponzi schemes,” the notice states. It goes on to advise taxpayers to claim a loss of investment that can be taken against capital gains in the year of the loss. Since almost nobody has a capital gain in 2008, the net effect of this notice is simple—Madoff robbed me of $5 million and New Jersey now wants to rob me of $75,000. The state might be reconsidering. On March 2, the notice was gone, replaced with: “The page you have requested cannot be displayed because it does not exist, has been moved, or”—and this is the part I like best—“the server has been instructed not to let you view it.” Things got even more interesting on March 3, when the reference to the notice disappeared entirely. The Madoff investors living in New Jersey have no clear instructions from the state, but come hell or high water, we will submit our amended returns. We are not asking for a bailout, just for our money back.

The federal government hasn’t given such mixed messages—it has given no guidance whatsoever. Although thousands of investors across the country are eagerly awaiting some pre-April 15 instruction, the IRS remains eerily silent. If transparency and communication are the linchpins of the new administration, the folks over at the IRS haven’t gotten the message.

This is a story seemingly without end. With this quick conviction…I’m sure the IRS would just like to forget about the whole thing.

That is outright theft by the state.

This sounds silly to me. Tax returns are modified/refiled for various reasons all the time.

What gets me is that “anyone” would pay taxes on money retained within the Madoff investments. That doesn’t sound like the income was fully recognized. Taxes are due when the dividend check is paid or the investment is cashed out==ie sitting in your local bank in green back dollars.

I guess thats why high finance and the “need for it” escapes me.

Isn’t there a process to file an ammended return if you did not earn the income reported?

Or does that only work the other way around?

What of those who took funds out and bought personal property? Should they be forced to sell that property now? Who would they give any monies received? I can give an address to send checks! 😉

Its actually a violation of IRS tax law to overstate your income. If those forms aren’t amended soon, no telling how many victims could be subject to prosecution.

I mean, afterall, the law is the law.

Anybody foolish enough to invest with this guy doesn’t deserve to get their taxes back. They should consider it to be a stupidity tax.

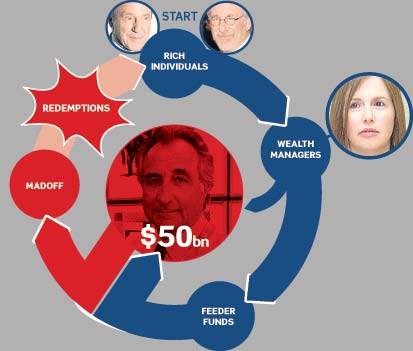

The graphic looks like a porn tape cover.

whatever happened to Caveat Emptor?

-s

All the emptors who caveated came out ahead.

bobbo: if you get dividends, even if they are reinvested, they are reported as income on a 1099. i’m guessing that madoff issued statements to clients (and the IRS) that indicated these dividends or capital gains distributions, and they therefore paid taxes. it seems clear to me that they should file amended returns – just as if a bank sent you a 1099 with an error.

arous: for those people that bought property, they had to take out the money from madoff. in that case, that seems way more complicated. on the one hand, they did get some money out. lets say they invested 1 million, and madoff said it went to 5 million, if they took out 1 million, depending on their accounting, one might say that each 200,000 they invested went to a million. and so they might have claimed 800,000 in capital gains. now that they have nothing, can they claim an 800,000 capital loss. probably not, because the govt will say it was theft, not a loss. tough situation.

#10–Dan==thanks.

No tax recapture for theft huh? Even in an “investment scenario?” I can see the rationale for the different possible treatments.

The law can be a harsh mistress.

If you paid taxes on gains that didn’t exist I’d think you could get those back. Beyond that…

Find a rich person who pays taxes, then let’s debate the matter.

# 13 sargasso said, “Find a rich person who pays taxes, then let’s debate the matter.”

Better start debating. The “rich” pay most of the taxes collected by the gov.

if you had that money to invest then the risk goes with it.. you could wind up losing that money, it is an investment, not a guarantee,

one death and taxes are guaranteed, refunds are not..

lemme see youy $75,000 is worth about 15 years of crappy healthcare coverage to me…

i just can get into your problem…it has not bearing on relality for me..

Folks, we’re talking about _taxes_ here–specifically, income taxes, which are arguably unconstitutional to begin with. And since when do we expect government in its current incarnation to refrain from confiscating as much of our wealth as possible, let alone to give some of it back?

I find it just a little bit funny that we’re even discussing such trivialities, given the trillions of dollars of _additional_ wealth that government is in the process of taking from us as we write these comments. Maddoff? He’s a piker when it comes to Ponzi schemes, compared to the federal government.

which are arguably unconstitutional to begin with.

As long as you ignore the 16th amendment.

Biden should explain asking the government to refund these taxes would be extremely unpatriotic. Unless of course the majority of the “victims” donate to the Democratic party. In that case, there will be a bailout for these poor fools.

I gave my friend $10 to get in on a group purchase of lottery tickets. We on so little I got less than $1 back. Is there any reason I can’t file an amended taxes and claim this loss?

The author earned that money. They, like me, paid income tax on that money. Whether you piss it away drinking fine booze, expensive women, or ponzi schemes will never change the fact that you did earn it.

$5,000,000 income. $275,000 income tax. That is less than 6%. And you want to convince me that I’m not paying enough or that your rate is too high?

#2

I suspect he was taxed on dividends that were reinvested. Since those dividends nor the original investment actually exist, they were taxed on phantom money.

#15

We are not referring to people that took a risk and actually made real money. We are referring to people that took a risk and the government took money on supposed gains from that risk when there were no real gains. This is a form of governmental theft. For example, if you go to Vegas with 10,000 of after-tax dollars and lose that 10,000 and then subsequently win 10,000, the government wants to tax you on the 10k you “made” but will not let you balance that against the 10K you lost.

#21

A better analogy would be:

1. You give your buddy $10

2. He claims he won $100 with your money and, as a law abiding citizen, you pay taxes on the $100 of phantom money.

3. You then find out he made nothing on your money and oh yeah, your $10 is gone too. Fine, you lose $10. However, why should the government get to keep the taxes you paid on the vapor $100?

#23, Thomas,

Phantom money? And you think I wouldn’t want to see it? 🙂

The point is, you gamble and lose, too bad.

We Madoff investors, creditors, survivors—please call us anything other than victims …

OK, how about losers for not investigating your “investment” a little deeper. Every one of Madoff’s losers should have been sophisticated enough to do a preliminary investigation. Instead, they act like they are victims.

@24, Be careful there. You are starting to sound like a Libertarian 🙂

#25. Fusion: These people had a reasonable expectation that the SEC would protect them from fraud. I think they should be returned any taxes to them that resulted from this. Or be able to sue the IRS/SEC for this….in which case they will have an uphill battle. Do you really think it’s fair that they should pay taxes that support the very same institution that failed them???

#28, McCullough,

These people had a reasonable expectation that the SEC would protect them from fraud.

And I have a reasonable expectation the FDA will protect me from poisoned toothpaste, or that the OCC will keep a close eye on my mortgage holder, or that the CIA will stop terrorists, or AT&T won’t listen in on my telephone calls.

Oversight agencies have NEVER guaranteed total freedom from those who would break the laws. Last month someone stole my neighbor’s car. Should he ask the county to refund his portion of the police budget?

Again, these were not unsophisticated investors. They were either professional money people OR sophisticated enough they should have known the basics. Madoff refused to take any (ahem) investments from ordinary people.

No. This is wrong.

It is not the IRS or State tax agency’s fault that Madoff was a crook. At the time the tax was collected, the income was a real as real can be as far as everyone knew. Money was paid to the account holder, who opted to reinvest it.

Now I could see the investors being entitled to a large capital gains loss for 2009 since the value of their investment went kaput. They would also be entitled to sue Madoff and the fund for losses.

Sorry… I think that money long gone.

#29. Ha! Then you agree that we shouldn’t pay taxes to our consistently failing Gov’t entities. We are on the same page brother.

They should just file an ammended return without the Madoff money with a letter stateing the 1099-div for the Madoff investments was fraudulently issued. I would like to see the state and Feds try and argue that the Madoff 1099s are really legit.

The investors in the Madoff scheme are definately SOL as far as their original capital is concerned. But I see no reason why they have to pay taxes on money that we now know never actually existed.

Don

Anyone find it interesting that the resident CEO Paddy-O is only commenting on 1 point? That of the rich paying taxes.

This just further proves that his only executive power is over the larder, which power is granted by the board, i.e. his mommy and daddy.

I thought bobbo #2 was a good question and I was waiting for Paddy-O to respond. Oh well…

@ Paddy-O

“The “rich” pay most of the taxes collected by the gov.”

I love how Rush Limbaugh constantly says both “Most taxes are paid by rich” AND “Taxes are passed on to the consumer.”

So, um, which is it?

In a nutshell, that’s why the Republican party is so fucked up.