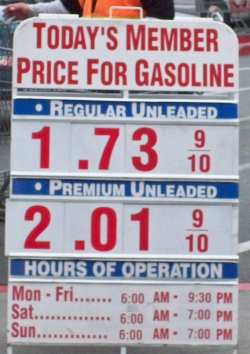

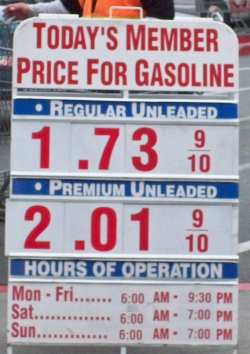

Gasoline in the Bay Area as of today.

By John C Dvorak Tuesday December 2, 2008

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

© 2008 Copyright Dvorak News Blog

Bad Behavior has blocked 10797 access attempts in the last 7 days.

It took a recession to get it. Enjoy it while it lasts.

recession??? you mean wait till after the depression is over….

lets see we will bail out the big three… so there is our tax dollars going for that… tack that on to the gas guzzlers they make..

serioulsy once the fuel efficient vehicles hit the market in volume the price will go up…

and yes this is how the market will work, consumption will go down, permantly, there the price will have to go up to make up for the lost revenue, along with the taxes levied on fuel as we will be needing less..

in the end alternative fuel vehicles with just shift the finacial burden…

To answer your question with another question:

Where are the oil speculators?

Answer: Castrated by the Democratic house over Bush’s objections to oil speculation restrictions (aka the ‘Enron Energy law’). As passed by the Republican house, oil was specifically exempt from speculation restrictions, climbing linearly since the law was passed. Funny how as soon as the Democrats expanded the law to include oil, the price started dropping like a rock. Consumption has dropped in the low teens, yet oil has dropped by 2/3rds… funny how well that worked.

But some other important questions worth asking:

Where is the Dow?

Where is the housing market?

Where are the jobs?

Where are the 700 Billion dollars?

Where are the 3.3 Trillion dollars?

Wait for it…..

Actually, the speculators finally got out of the oil market because they needed the cash to cover their margin accounts. Thank you Lehman Brothers.

#2, you clearly don’t understand economics. When demand goes down, prices go DOWN. The prices increased over the summer due to speculation of future demand. When the economy started to tank, future demand projections were significantly reduced. Demand was also reduced as a result of the high prices.

These two things happening in conjunction, and paired with over inflated prices due to speculation, lead to a huge decrease in prices. Prices will actually decrease further as alt fuel vehicles and low mpg vehicles are introduced. The worst thing that could happen to these oil producing countries is to get stuck holding a whole bunch of oil when the world economy moves on to alternatives. What they want to do is set the price just high low enough to keep demand up but high enough to extract profits.

Yup. All the problems are over, JCD.

In your neighborhood.

$1.51 in Laramie, WY and falling…

I’m glad that I was forced to retire early, now I don’t have to drive anymore! Of course, I can’t afford to drive anyway.

Health care and housing are going to be a big problem real soon.

Shitty hours, for a gas station.

#5 – Kap

Ahhh, if it were only so simple as supply and demand. Under our current concept of ‘Capitalism’, market manipulation plays a much stronger role that supply and demand.

People that think that supply and demand govern the market are naive idealists in their concept of Capitalism and the way that money is handled by the power players.

I don’t have to give too many examples to prove the point: the housing market has been governed by credit manipulation, not supply and demand. The oil market has been governed by speculation (market manipulation) not supply and demand. The banking system is about as non-capitalist as you can get, being driven by pure speculation.

It’s only when regulations are put in place to give supply and demand a role in market prices that other factors start to diminish their influence.

Supply and demand driving the oil markets… what a quaint concept!

I filled up today for US$ 1.729/gal (or € 0,36/liter for the Europeans, or £ 0,31/litre for the Brits). I still try to drive less, though, and wish we could afford a hybrid. It’s ironic: we wouldn’t be using nearly so much if one of us hadn’t found some (temp) work…

If you want the price to stay low, reining in the speculators _and_ using less are both good ideas.

its good that gas is here. but we wont all start feeling relief until diesel gets a lot lower than it is. it needs to go a lot closer to $2 a gallon for a while and then we will start to see it affecting prices on stuff in the stores. $200 a barrel oil will happen…maybe in 2012 (see adam curry!)

ACK! Where did our premium investments go? lol

It’s oil. You know…. Zaphod’s just this guy, you know?

Seriously… Cash in on the fall of Man. Why not?

Don’t forget… All those bail-out dollars will need to enter circulation sooner or later.

If there is no hyper-inflation after the Fed exhausts its interest rate and bond shortfalls, either mechanisms unknown to anyone are in effect (such as seen in the NYSE in the last two months, “President’s Council”, anyone?), or we are entering yet another stage of, “HUH?” in the organic world of economics.

I don’t know what is happening and neither do you… So STFU.

AMERICANS, got the cheapest gas on earth and still can’t stop bitchin’ about gas prices. Try public transportation, oh thats right suburbia doesn’t have any, so 18 year old Johnny’s got to have a vehicle or Susie won’t be his girlfriend. American lifestyle has more to do with this situation than OPEC or anything else.

The US stabbed the brakes and shocked the market right back. The politicos just started talking about drilling here and now and that was it, kaput. When will you weenies pay attention to the demand curve? Oil was not at “peak” and not in short supply.

The bottom line is the world can’t operate on 150 oil, let alone 200.

Oil will go up when the USD bails. Thats coming sooner than most would think.

Just proves the Democrats rigged the prices to make the Republicans lose the election. Now that they have what the want, gee no surprise– prices are back down.

# 13 scorpusmaximus said, “Don’t forget… All those bail-out dollars will need to enter circulation sooner or later.”

Most people don’t realize what this is about. The pols in DC aren’t about to announce this to the US pop.

#17, while I don’t agree with you, I do have to say that makes as much sense as some of the other theory put forth by the left about Bush over the last 8 years.

As liberals weep over low prices yet again.

#3, your statement makes no sense, Enron has been gone for years, so a Enron Energy law wouldn’t pass now. Paddy-O nailed it. Plus there’s the expiration of the ban on offshore drilling.

I seem to remember that oil prices started to slip just after Bush retracted the Presidential ban on offshore drilling and Congress started talking about the Congressional ban, couple that with the American people shouting “Drill, drill, drill..” I think this caused the spectulators to take flight and then we really started seeing the price fall.

I sure the “Greenies” are having fits over the price of gas under $2/gal. They seem to think the only way to get people to go green is to jack-up prices. I say wrong, make green tech cheaper…

Oh! $1.63 for regular at a ’76 station here in Los Angeles

The oil crash was easy to spot, considering demand leveled off at $140/bbl and nose dived after $160/bbl. While we won’t get down to the historical average of $25/bbl, I don’t think it will go far past the Saudi goal of $75/bbl.

Sorry hacks, this has nothing to do with politics, and is only indirectly linked to our recession.

Quite frankly, we should be rooting for $75/bbl. We don’t need the ExxonMobil’s of the world asking for a bailout, too.

Once the U.S. dollar is officially devalued, then we’ll get $200 bbl oil.

If you can’t wait until then I’m happy to sell you as much oil as you want, right now, for $200/barrel.

..some random thoughts..

hmm…

oil was manipulated high then crashed to:

-foster more support for the global carbon tax/cap and trade scam.

-to re-bankrupt the oil states in south america

(esp venezuela) that just finally payed off their debts and stall their efforts to create their own oil cartel. -as well as slow progress with its oil for arms trades with china and arms purchases with oil dollars with russia.. (this kind of applies to all the oil states below the equator)

to try and create civil unrest and bankrupt Iran and slow progress of the The Iranian Oil Bourse

(iran has to import petrol products because it severely lacks enough refinery infrastructure to produce its needs.) -this was a “Plan B” of sorts

when the false flag Ops failed to produce a war

between USA and Iran..though i do not think it was our idea..(bankrupcy))

-to fund some covert fun

-to make bank on shorting oil when it was announced

in july that is was going to $50/bbl

-so those with storage capacity can stock up on oil

before the dollar collapses.

(the only reason the dollar even still has value

at this point is because King Paulson, JP, GS, IMF & Co. has leveraged the bailout money (amongst others) to literally rally the market up and down in parallel to scripted news leaks and buy/bail outs. -as well as keeping disconnected, the gold/silver market from all logic, reason and prior history.

–anyway, i could list plenty more, but whats the use. you can google up most of the information yourself.. use Ixquick.com’s search to yield “different” results…google is showing signs of political influence. -hope i’m just being delusional.

-s

#5, kap,

#2, you clearly don’t understand economics. When demand goes down, prices go DOWN.

Not exactly.

When demand decreases, the price decreases UNTIL the supply decreases to the point of stabilization. Producers will not produce when the cost of bringing to market is greater than the expected sale price. The effect that speculation had was the same as monopolization has on the market in that the true market forces were not allowed to exist.

When the price of oil is less than what it costs ($40 to $50) to mine the Canadian Tar Sands then look for the first stabilization. The Tar Sands are the most significant source of oil with a high production cost. National Oil companies will continue to pump oil as their economies require the foreign cash to survive. This flood of oil will continue to depress the price.

As the economy starts to rebound, look for the price of oil to fluctuate between $60 and $100. At that price it will become cost effective to produce alternative energy supplies and poorer economies to survive.

#4 has it exactly right. The credit crunch is stifling would be buyers, and sellers need the money.

Hence more sellers than buyers, and hence a price drop.

But this is a temporary deal. Oil production has been at a stand still for over 3 years now and the market has been showing signs of volatility for the past two.

Just wait until the current recession/depression is over. The drop in exploratory investments due the the crash in oil prices will make future demand increases impossible to supply.

$1.459 in Roanoke, VA (for what it’s worth)

The price of oil/gas will go up.

It doesn’t take a psychic to see.

When stocks level out

the price will be over $6.93