Search

Support the Blog — Buy This Book!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

Twitter action

Support the Blog

Put this ad on your blog!

Syndicate

Junk Email Filter

Categories

- Animals

- Art

- Aviation

- Beer

- Business

- cars

- Children

- Column fodder

- computers

- Conspiracy Theory

- Cool Stuff

- Cranky Geeks

- crime

- Dirty Politics

- Disaster Porn

- DIY

- Douchebag

- Dvorak-Horowitz Podcast

- Ecology

- economy

- Endless War

- Extraterrestrial

- Fashion

- FeaturedVideo

- food

- FUD

- Games

- General

- General Douchery

- Global Warming

- government

- Guns

- Health Care

- Hobbies

- Human Rights

- humor

- Immigration

- international

- internet

- Internet Privacy

- Kids

- legal

- Lost Columns Archive

- media

- medical

- military

- Movies

- music

- Nanny State

- NEW WORLD ORDER

- no agenda

- OTR

- Phones

- Photography

- Police State

- Politics

- Racism

- Recipe Nook

- religion

- Research

- Reviews

- Scams

- school

- science

- Security

- Show Biz

- Society

- software

- space

- sports

- strange

- Stupid

- Swamp Gas Sightings

- Taxes

- tech

- Technology

- television

- Terrorism

- The Internet

- travel

- Video

- video games

- War on Drugs

- Whatever happened to..

- Whistling through the Graveyard

- WTF!

Pages

- (Press Release): Comes Versus Microsoft

- A Post of the Infamous “Dvorak” Video

- All Dvorak Uncensored special posting Logos

- An Audit by Another Name: An Insiders Look at Microsoft’s SAM Engagement Program

- Another Slide Show Test — Internal use

- Apple Press Photos Collection circa 1976-1985

- April Fool’s 2008

- April Fool’s 2008 redux

- Archives of Special Reports, Essays and Older Material

- Avis Coupon Codes

- Best of the Videos on Dvorak Uncensored — August 2005

- Best Videos of Dvorak Uncensored Dec. 2006

- Best Videos of Dvorak Uncensored July 2007

- Best Videos of Dvorak Uncensored Nov. 2006

- Best Videos of Dvorak Uncensored Oct. 2006

- Best Videos of Dvorak Uncensored Sept. 2006

- Budget Rental Coupons

- Commercial of the day

- Consolidated List of Video Posting services

- Contact

- Develping a Grading System for Digital Cameras

- Dvorak Uncensored LOGO Redesign Contest

- eHarmony promotional code

- Forbes Knuckles Under to Political Correctness? The Real Story Here.

- Gadget Sites

- GoDaddy promo code

- Gregg on YouTube

- Hi Tech Christmas Gift Ideas from Dvorak Uncensored

- IBM and the Seven Dwarfs — Dwarf Five: GE

- IBM and the Seven Dwarfs — Dwarf Four: Honeywell

- IBM and the Seven Dwarfs — Dwarf One: Burroughs

- IBM and the Seven Dwarfs — Dwarf Seven: NCR

- IBM and the Seven Dwarfs — Dwarf Six: RCA

- IBM and the Seven Dwarfs — Dwarf Three: Control-Data

- IBM and the Seven Dwarfs — Dwarf Two: Sperry-Rand

- Important Wash State Cams

- LifeLock Promo Code

- Mexican Take Over Vids (archive)

- NASDAQ Podium

- No Agenda Mailing List Signup Here

- Oracle CEO Ellison’s Yacht at Tradeshow

- Quiz of the Week Answer…Goebbels, Kind of.

- Real Chicken Fricassee Recipe

- Restaurant Figueira Rubaiyat — Sao Paulo, Brasil

- silverlight test 1

- Slingbox 1

- Squarespace Coupon

- TEST 2 photos

- test of audio player

- test of Brightcove player 2

- Test of photo slide show

- test of stock quote script

- test page reuters

- test photo

- The Fairness Doctrine Page

- The GNU GPL and the American Way

- The RFID Page of Links

- translation test

- Whatever Happened to APL?

- Whatever Happened to Bubble Memory?

- Whatever Happened to CBASIC?

- Whatever Happened to Compact Disc Interactive (aka CDi)?

- Whatever Happened to Context MBA?

- Whatever Happened to Eliza?

- Whatever Happened to IBM’s TopView?

- Whatever Happened to Lotus Jazz?

- Whatever Happened to MSX Computers?

- Whatever Happened to NewWord?

- Whatever Happened to Prolog?

- Whatever Happened to the Apple III?

- Whatever Happened to the Apple Lisa?

- Whatever Happened to the First Personal Computer?

- Whatever Happened to the Gavilan Mobile Computer?

- Whatever Happened to the IBM “Stretch” Computer?

- Whatever Happened to the Intel iAPX432?

- Whatever Happened to the Texas Instruments Home Computer?

- Whatever Happened to Topview?

- Whatever Happened to Wordstar?

- Wolfram Alpha Can Create Nifty Reports

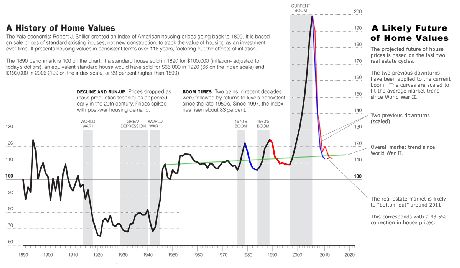

Great chart. Very telling!

[Sarcasm On]

This chart can’t be right. It shows the false housing boom, which many people have attributed to our current president, to have started in 1997.

[Sarcasm Off]

It can be amazing the amount of distortion present in the peabrains of nutball defenders. #2 being rather typical.

Take a good look at the chart and you see the rise from 1997 to 2000 in line with many previous rises associated with economies coming out of recession. Since that occurred in the Clinton years, it must not be worthy of praise. But, it is OK to take the usual and blame it for the truly awesome distortion in the market that followed through the Bush Reich.

I think neocons have all had a permanent brain chemistry alteration. They are destined to spend the remainder of their lives whining about the good old days when the rich got richer and screw the rest of the world.

You can blame the banks and Wall Street on Bush (lax regulation). The mortgage crisis was caused by Alan Greenspan (turned on the money tap).

#3, You crack me up. You really think I’m a neocon? I am voting Other.

I was pointing out the increase in housing costs were not a result of Bush’s policies. These increases in house prices start years before he was in office.

People seem to think it is the pres that gets all the credit and/or blame for what Congress does. The pres can’t spend a penny without Congress’ approval.

Trust me, my comment from #2 wasn’t a slight on Clinton. Of course, like all good donks, you immediately jumped to his defense at the first wind of anything resembling criticism.

I think they are miscalculating the rate of inflation. If you go to wikipedia and look at the chart of the total money supply. It pretty much follows their “corrected” curve of home values. Also, it suspiciously follows the “rise” curve of the stock market over time. If you stare at the curves long enough the only conclusion that can be drawn is that real things aren’t losing value. The dollar is losing value, because dollars seem to multiply like rabbits. Gee, I wonder how that happens?

I find the chart displays well the reality.

Think of other high-priced goods, that don’t fluctuate other than inflation.

– cars

– rv’s, boats, snowmobiles

– chainsaws, snowblowers

If you compare apples-to-apples as close as possible, you will notice that cars haven’t tripled in price since 1990.

Yet houses did. In fact, if you correct for inflation, many “goods” that are priced above 1,000$ (other than electronics) have come down in price.

Yet houses are built out of many materials, many of which have come down in price.

China, automation, pre-fab plastic joints, wall jacks at 0.79$, etc.

So a house selling for 110k$ in 1999 should sell at 120k$ in 2010, makes perfect sense.

Also, home prices, in CA recovered their fall by ’92. Maybe the rest of the country was 5 years behind that curve.

Wouldn’t a more relevant chart be housing prices as a percentage of median income for head of household?

That chart should show a steady rise well above inflation==ie, the slow death of the middle class.

#9 “Wouldn’t a more relevant chart be housing prices as a percentage of median income for head of household?”

I’ve seen that one. It’ grim.

embiggen???

Y’all speaks a different english than me.

The chart is great, but it indicates something very telling: The long term trend line won’t shift either way by the bubble.

As for trying to inject politics in this, that’s laughable. You can either blame politicians, lenders, or lendees. Personally, I blame all three.

#10–Paddy==I’ve never seen one, looked before, but can’t pull one up==so I just looked again and found one tracking back to 1965:

http://drewdelahoussaye.com/blogart/disconnect.gif

Along the way I found some good blog entries about how the divergence couldn’t last forever==years before the crash we are in now.

If anyone has a chart going back even farther, please post it?

#12–James==the smaller the group, the greater the responsibility==much less those having been directly charged with controlling the activity.

I see NOTHING WRONG AT ALL with individuals risking their unqualified purchase of a home hoping it will double in value before the balloon happens. Just not the same responsibility or effect when lenders and polls do the same thing.

The next big bubble will be caused by spiking demand for soup and cat food. Unfortunately, I say that only partly in jest, because I still have 10 easy monthly payments to go on my Gucci Classic loafers, and I don’t know where I’m going to find the cash.

By the way, the graph actually may be ending on a “high note” of sorts, because it merely shows a return to historical norms without making any prediction of overshooting that return, as often happens in severe corrections.

Anyone notice this chart is two years old??

(not that it would be much different, I’m just saying…)

#13 I put this together just now:

Median home prices

Adjusted to 2000 dollars

2000 $119,600

1990 $101,100

1980 $93,400

1970 $65,300

1960 $58,600

1950 $44,600

1940 $30,600

URL

I would like an ADDON..

reflective of the Affecting devices for housing..

TAX, MATERIALS, Price comparison with STOCK prices of materials, LABOR, Profit margin.

Thanks, #18 Paddy-O. Putting those figures into further context in a comparison to median family income (pulled from a different census table), the median home price compared to the median family income seems to have increased by a little over 7% between 1950 and 2000. That’s not way out of line considering that the average home size has probably increased by much more.

#18/20, Another interesting factoid — gold has increased in value at about the same rate as housing (my numbers are from 1968 to 2006 — gold didn’t change in value much until the late 60s, though) ~3.4x. All things being equal, gold is a benchmark in this regard.

What concerns me is the income increase. The country has come to rely on credit to survive day to day — not just families, but companies as well.

Had this boom ended when Clinton left office it would have been just about the same as the 70s and 80s booms what changed?

#20 & 21 Thanks. #20 can you post that link?

#22 Fascinated, this is a toxic stew, and many different people put many different ingredients into the pot at different times. Easy credit with low interest rates was certainly one of the main ingredients. To give you an idea of the drastic reduction, in May 2000, the Fed Funds rate was at 6.5%, and by June 2003, it had been lowered to a paltry 1%. Unregulated financial investment (gambling) instruments like credit default swaps was another ingredient in the stew, and the proliferation of new and potentially much riskier (explosive) loan types was yet another.

Broadened securitization of mortgage loans, often carrying undeservedly high credit ratings that reflected little true risk assessment, added fuel to the fire and helped spread the credit problem worldwide. As each new ingredient was added, the positive feedback loop was exciting and the aroma of the stew became more intoxicating, even as some people were pointing out how toxic it would ultimately be for those who feasted on it.

Welcome to America’s withdrawal and rehab program.

$$$$$

#23 Paddy-O, here’s the page at the census bureau. Their median family income figures are adjusted to 2006 dollars, but the consistency makes for a fair comparison. I calculated the ratio of the 1950 (inflation adjusted) home price to the 1950 (inflation adjusted) income, which came to 1.879. That same ratio for the year 2000 came to 2.014. The increase is then 2.014/1.879 minus 1, or 7.18%.

And frankly, the number of decimal places I’m using implies way too much accuracy in a calculation that’s so greatly affected by so many other factors 😉

One factor was the (illegal) US duty on Canadian softwood lumber, an ingredient in the cost of houses. Psychologically, it might have supported the dangerous notion that the price of housing could be manipulated just like the price of wood.

Nailed or screwed. Take your choice.

I have a belief that illegal immigration created the cheap labor for new homes, as well as the increased demand for homes overall, to create a inexpensive build but more competitive local seller’s markets. Once the comprehensive immigration reform failed with a xenophobic thud, illegal immigrants were less confident of their ability to stay in the country long-term and took away the competitive market allowing the bubble to burst.

Also, I have not seen many reports on the effect of gentrification/house-flipping on the housing value bubble. Buy a crack house for $40,000, add a Viking stove for $10,000 and sell for $150,000. Talk about a pyramid scheme.

Bear in mind that the dollar has lost over 40% of it’s value since the year 2000.

That means that if you bought a home for 400k in 2000. It went up to 600k by 2006 and is now probably went down to 500k, it’s current value in year 2000 dollars is 300k.

blame whoever you want. I blame the bubble on shifty home flippers, shady real estate tatics, and emminent domain. I moved out of my parents home around the start of the bubble in the Atlantic.city area. As soon as ed came out everyone called every area you could think of as a tourist location. The northeast riviera if you would. So what did people do? House flip. Buy a house with 5 of your buddies , paint a few walls with no experience, and raise the price 50k. My uncle’s house was sold 3 times in 2years in this manner. Last guy holding the deed paid over 4″0k where my uncle paid 225k. And realtors ask why I rent

If the partison nuts would shut up and look it strongly suggests that the current prices may actually be about right and the boom was doomed to become a bust from day one.

Okay inflation should have driven house prices up in devalued paper some but nothing like as high as the run up was.

The seriously bad news is that anything other than inflation that gets prices up to recent highs is going to lead to another bust.

Of course high prices due to inflation don’t mean your property is worth more. It means your money is worth less.

29

the prices WERE influenced…

1. METAL to china. the corps wanted MORE money, they Raised the USA price(not international) which forced up prices for tools and NAILS, and ROOFS

2. WOOD to china. YEP, same thing, THEN we imported wood from CANADA and put a tariff of 25% on top of it.

3. REAd 26..

NOW, take DOUBLING of prices due to GOODS going to china. ADD in that Corps want more money, and pre-fab housing GETS CHEAPER QUALITY so they can be sold. ADD the speculators taking Older homes and Fixing NOTHING and getting HIGHER prices for OLD HOMES.

The STATE dont really care, as they can NOW!! raise the TAX on the house to MATCH.

So, who was looking out for the consumer?

NO BODY!!