Search

Support the Blog — Buy This Book!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

Twitter action

Support the Blog

Put this ad on your blog!

Syndicate

Junk Email Filter

Categories

- Animals

- Art

- Aviation

- Beer

- Business

- cars

- Children

- Column fodder

- computers

- Conspiracy Theory

- Cool Stuff

- Cranky Geeks

- crime

- Dirty Politics

- Disaster Porn

- DIY

- Douchebag

- Dvorak-Horowitz Podcast

- Ecology

- economy

- Endless War

- Extraterrestrial

- Fashion

- FeaturedVideo

- food

- FUD

- Games

- General

- General Douchery

- Global Warming

- government

- Guns

- Health Care

- Hobbies

- Human Rights

- humor

- Immigration

- international

- internet

- Internet Privacy

- Kids

- legal

- Lost Columns Archive

- media

- medical

- military

- Movies

- music

- Nanny State

- NEW WORLD ORDER

- no agenda

- OTR

- Phones

- Photography

- Police State

- Politics

- Racism

- Recipe Nook

- religion

- Research

- Reviews

- Scams

- school

- science

- Security

- Show Biz

- Society

- software

- space

- sports

- strange

- Stupid

- Swamp Gas Sightings

- Taxes

- tech

- Technology

- television

- Terrorism

- The Internet

- travel

- Video

- video games

- War on Drugs

- Whatever happened to..

- Whistling through the Graveyard

- WTF!

Pages

- (Press Release): Comes Versus Microsoft

- A Post of the Infamous “Dvorak” Video

- All Dvorak Uncensored special posting Logos

- An Audit by Another Name: An Insiders Look at Microsoft’s SAM Engagement Program

- Another Slide Show Test — Internal use

- Apple Press Photos Collection circa 1976-1985

- April Fool’s 2008

- April Fool’s 2008 redux

- Archives of Special Reports, Essays and Older Material

- Avis Coupon Codes

- Best of the Videos on Dvorak Uncensored — August 2005

- Best Videos of Dvorak Uncensored Dec. 2006

- Best Videos of Dvorak Uncensored July 2007

- Best Videos of Dvorak Uncensored Nov. 2006

- Best Videos of Dvorak Uncensored Oct. 2006

- Best Videos of Dvorak Uncensored Sept. 2006

- Budget Rental Coupons

- Commercial of the day

- Consolidated List of Video Posting services

- Contact

- Develping a Grading System for Digital Cameras

- Dvorak Uncensored LOGO Redesign Contest

- eHarmony promotional code

- Forbes Knuckles Under to Political Correctness? The Real Story Here.

- Gadget Sites

- GoDaddy promo code

- Gregg on YouTube

- Hi Tech Christmas Gift Ideas from Dvorak Uncensored

- IBM and the Seven Dwarfs — Dwarf Five: GE

- IBM and the Seven Dwarfs — Dwarf Four: Honeywell

- IBM and the Seven Dwarfs — Dwarf One: Burroughs

- IBM and the Seven Dwarfs — Dwarf Seven: NCR

- IBM and the Seven Dwarfs — Dwarf Six: RCA

- IBM and the Seven Dwarfs — Dwarf Three: Control-Data

- IBM and the Seven Dwarfs — Dwarf Two: Sperry-Rand

- Important Wash State Cams

- LifeLock Promo Code

- Mexican Take Over Vids (archive)

- NASDAQ Podium

- No Agenda Mailing List Signup Here

- Oracle CEO Ellison’s Yacht at Tradeshow

- Quiz of the Week Answer…Goebbels, Kind of.

- Real Chicken Fricassee Recipe

- Restaurant Figueira Rubaiyat — Sao Paulo, Brasil

- silverlight test 1

- Slingbox 1

- Squarespace Coupon

- TEST 2 photos

- test of audio player

- test of Brightcove player 2

- Test of photo slide show

- test of stock quote script

- test page reuters

- test photo

- The Fairness Doctrine Page

- The GNU GPL and the American Way

- The RFID Page of Links

- translation test

- Whatever Happened to APL?

- Whatever Happened to Bubble Memory?

- Whatever Happened to CBASIC?

- Whatever Happened to Compact Disc Interactive (aka CDi)?

- Whatever Happened to Context MBA?

- Whatever Happened to Eliza?

- Whatever Happened to IBM’s TopView?

- Whatever Happened to Lotus Jazz?

- Whatever Happened to MSX Computers?

- Whatever Happened to NewWord?

- Whatever Happened to Prolog?

- Whatever Happened to the Apple III?

- Whatever Happened to the Apple Lisa?

- Whatever Happened to the First Personal Computer?

- Whatever Happened to the Gavilan Mobile Computer?

- Whatever Happened to the IBM “Stretch” Computer?

- Whatever Happened to the Intel iAPX432?

- Whatever Happened to the Texas Instruments Home Computer?

- Whatever Happened to Topview?

- Whatever Happened to Wordstar?

- Wolfram Alpha Can Create Nifty Reports

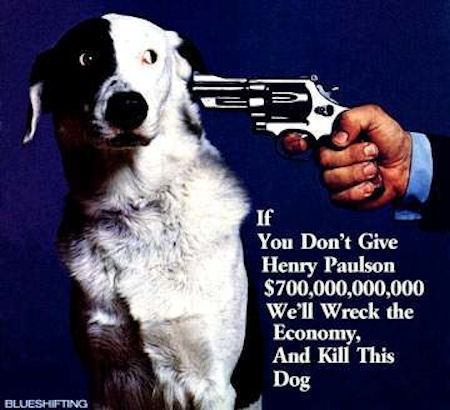

Poor dog.

At least tip the hat to the National Lampoon from whom this was stolen.

Racist Republicans.

Pussy… can’t even point it at a human. Still, hard times are survivable. I am not impressed.

I still have that National Lampoon issue!

If you are the kind of person that should be loaned money my as of today experience suggests you can still borrow as much as they should loan you.

I don’t see a credit crunch.

The problem is to many people have been loaned more than they can pay back now. Keeping that system going will bankrupt the nation and everyone in it.

It’s OK. We’re from the gub’ment. We’re here to help. Please place your freedom in the bag and no one gets hurt.

Oh yea… one of the better National Lampoon covers. Did you all see the letters in the following month’s issue? There was one FROM the editor with a photo of a dead dog. It said “We held the gun, but YOU pulled the trigger”. Brilliant.

Here is where it was originally used:

And still the idiots don’t get it. The problem was:

1. The community reinvestment act which REQUIRED companies to loan money to BAD CREDIT RISKS. Thanks Carter, Clinton and Current Dems, who would not allow Bush to install any controls over handing out money,

2. What the Dems at the time called Financial Innovators, who packaged these loans and used 95% borrowed money to “leverage” these to get outstanding returns. You could make 30% for loaning money to poor people. And they had the graphs to prove it was safe. Some people who “invested” $1 million in these products, lost $16 million in a matter of months. These weren’t stocks, they are collateralized debt obligations and you shared in the risk.

3. The Financial Accounting Standards Board, who in their infinate wisdom, required the companies who invested in these loans, to write them down to firesale prices and reflect this in their financials immediately.

Banks, Insurance Companies, Pension funds and many regular companies, invested excess cash in these products.

If you have a pension, be worried.

If you have a balanced mutual fund, be worried.

If you worked for a company that considered itself sophisticated, and had excess cash, be worried. If you are retired from one of these companies, be worried for your retiree medical benefits.

If you breathe, be worried, as there may be soup lines forming in a neighborhood near you.

3rd quarter reports will start coming out next week when this begins to come to light.

Now do you understand?

If you don’t that’s OK as you will clearly be one of the first to be made redundant.

I think it’s interesting that people are saying this is an example of why the free markets don’t work. In fact, what caused this mess is the government intervention in these markets combined with political corruption in those responsible for oversight. That said, we need better regulations that don’t provide a structure where foolish greed is rewarded.

It’s also ironic that a politically Republican government presided over a gigantic increase of government spending and the necessity of this huge bailout. Obviously, being a Republican doesn’t mean what it used to.

#10 – Brock

>>The community reinvestment act which REQUIRED

>>companies to loan money to BAD CREDIT RISKS.

Are you really that ignorant? Have you ever even looked at the Community Reinvestment Act?

It’s people like you that are the reason we have school shootings.

#12, We’ve been through this before.

You state the CRA’s purpose is to prevent unfair lending practices.

I agree. That is its purpose.

However, as will all social programs, the unintended consequences and the slow move to “tweak” it have been a major cause (note I didn’t say the only cause) in our problems. Another cause (not the only other cause) was the MAC’s statement it would back any high-risk loans made under the CRA the banks didn’t want to maintain.

The CRA also opened the door to predatory lending practices by making it easier to charge higher rates to high-risk borrowers — another unintended consequence.

The CRA, through subsequent revisions, gave districts who felt they weren’t getting a “fair share” of the lending the ability to interfere with a bank’s ability to do business. This interference ranged from merging to investigation by the Justice Dept, and if found “guilty,” heavily fined/shutdown.

Do you realize what this means? This means that either a bank gives out the loans or it has to spend millions justifying their reasons in court.

So, I ask you — Was it cheaper to give the loan and pass it up to the MAC’s or to fight it in court?

If this isn’t “requiring” banks to make bad loans, I would like to know what your definition is.

“Economist Stan Liebowitz writes that community activists intervention at yearly bank reviews resulted in their obtaining large amounts of money from banks, since poor reviews could lead to frustrated merger plans and even legal challenges by the Justice Department.”

a b Stan Liebowtiz, The Real Scandal – How feds invited the mortgage mess, New York Post, February 5, 2008

Am I blaming the dems for this? No. Am I blaming the pubs for this? No. It was a product of a two party system.

Blame the troubles all you want on the current administration but this problem has been building for decades. You don’t sink a world in six years.

GREAT! I love it! Thanks for finding this HHopper. But I can’t help thinking I inspired you with a prior comment of mine. So here’s a little something of my own. Crude though it may be. If only the dollar amount was just $400 Billion.

http://www.youtube.com/watch?v=VKwd7leQPdg