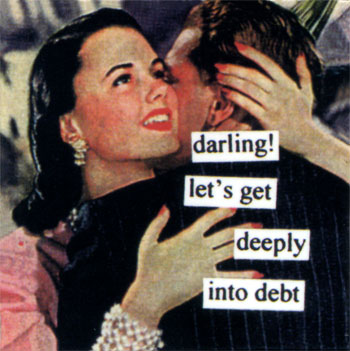

Student, car debt quietly added to bailout plan

In the dark of night over the weekend when most people were snoozing, the Treasury dramatically expanded its bailout plan to include buying student loans, car loans, credit card debt and any other “troubled” assets held by banks.

The changes, which were included in draft language that also opened the bailout program to foreign banks with extensive loan operations in the United States, potentially added tens of billions of dollars to the cost of the program.

Although it was a major addition to what was already the nation’s largest-ever bailout, it did not become part of the debate between Democrats and the Treasury over details of the program. A Monday counterproposal by Senate Banking Committee Chairman Christopher J. Dodd included such consumer loans as well as mortgages, just as the Treasury’s draft did Saturday night.

[…]

“Such a large takeover by the government will surely be accompanied by adverse, unintended consequences,” said Pat Toomey, president of the Club for Growth, a conservative advocacy group. “Already, other companies and industries are lining up at government’s door asking for their own bailout.”Treasury Secretary Henry M. Paulson Jr. stressed that the additions were needed to ensure that student loans and credit cards – which have become indispensable to the spending habits and career plans of many Americans – do not become victims of the widening credit crunch.

I owe for the new, shiny computer I just bought. Can I get that covered, too? It’s “indispensable” to me!

Uncle Dave, we’re screwed. There’s only a couple of repub & dem holdouts. Everyone else on the Hill has jumped on the bandwagon.

Debts incurred by the people who will have to pay for all of this. .. The last great rape of the country, just in case Obama wins and they lose that ability.

I think they even want to include debts to loan sharks in this deal.

Talk about highway robbery, these guys are not going to be satisfied until they have our last penny!

Should I hide my first born from the Paulson and Bernanke?

Bring back business regulations!

These goofball conservatives who demanded that we dismantle the safeguards put in place AFTER THE LAST GREAT DEPRESSION need to have their voting cards rights taken away.

#6 “These goofball conservatives who demanded that we dismantle the safeguards put in place AFTER THE LAST GREAT DEPRESSION ”

Are you really this stupid or, do you just play an idiot on the web?

There are FAR more regs now than there was in 1940, for instance.

This isn’t a Democrat/Republican thing. It is the single largest nationalization of the economy ever and both sides have a hard on for it.

It is time for the revolution. They all must be lined up against the wall.

The debt is not being discharged, it’s being bought – like when Citibank bought my mortgage from Pulaski. I still owe the house note.

#8: Oh, yeah, like these guys expect the banks, etc to pay the government back. Riiiight!

woohoo the libs are gonna pay my student loans off, well actually all of you guys are in reality. So thanks mr mustard and fusion for paying off my student loan debt ( I’ll bet this makes you two throw up in your mouth just a litle bit doesnt it )

still wont vote for ya but I will shake your hand

“Bail-outs” will ENSLAVE GENERATIONS YET TO BE BORN” !!! Great “Family Values” on the part of the REPUKES LOOTING THE UNITED STATES OF AMERICA !!!

#6 – O’Furniture

>>There are FAR more regs now than there was

>>in 1940, for instance

Yeah, watered down ones that allow the right-wing oligarchs to do pretty much whatever they want to, make all the blood money they can, and not pay any taxes on it.

MISSION ACCOMPLISHED

Now, let’s see if Obama can reverse the tide of Fascism.

Only 119 days to go!!

This can’t really be true. I have not heard from any reputable source that they are now going to buy out bad credit card debt. If they plan to do that, then this monster should just be stopped in its tracks and if there’s a great depression in our future, so be it. I’m serious.

It’s not like the people who have these debts are being bailed out. It’s the companies who have rolled these into types of bonds which are not performing as well as they were rated.

[QUOTE]It’s not like the people who have these debts are being bailed out. It’s the companies who have rolled these into types of bonds which are not performing as well as they were rated.[/QUOTE]

Well, that would be bad enough. But here’s how it’s going: They’re all sorts of provisions for “main street” into this already scary bill. What is a provision for “main street”? That’s Hill speak for the ability A) for the government to forgive/renegotiate any of that debt they’re buying and B) for judges to change the terms of mortgage debt in bankruptcy.

What does that mean, bottom line:

A) the government is going to overpay for bad mortgage debt with your tax dollars.

B) Now the government is going to take that overpriced bad debt and they are going to make it even LESS valuable by changing the terms of the debt agreements in a fashion that is unfavorable to the debt holder (that’s you again, the taxpayer).

C) By doing so, the government is going to try to keep the mortgage market artificially propped up (since fewer homes will be available if they write off debt to keep people in those homes), which means that if you don’t already own a home but are a taxpayer, you get to pay a third time!!!!!

As someone who has had a mound of cash in cash equivalents for a few years instead of buying a home, waiting for the inevitable crash (yeah, it was that obvious) I am getting boned seven ways from Sunday: Artificially low interest on my money, artificially propped up housing market, taxes to bail out everyone else.

I say: close your eyes, say not to the bailout, and let the chips crash where they might.

I just lost $50,000 on red-23 on roulette at Caesar’s Palace. If I don’t pay they break my legs (then my wife will kill me).

Uncle Sam, can you help me out?

No, people, your debts will not be payed off! What they are proposing is that they will buy the paper off of the banks; in other words, you still owe your (credit card, student loan, housing ect.) debt, you just have to sign your check to Uncle Sam rather than to the bank.

Let’s face it, this is the complete nationalization of our banking system, and now we all get to pay off our debt, -and- pay off the commercial value of the loan itself.

This is enslavement.

Thank you, Li. I know this bailout is controversial, and I certainly can’t say I agree with everything that either the feds or congress are proposing. But the government sure as hell will try to recoup as much of this money as possible. That means you now have the federal government on your ass if you have defaulted or plan on defaulting on your loans.

The upshot is that eventually a good portion of the $700 billion should be paid back.

On the down side, with dangerous global warming, the end of oil, and water shortages looming in the relatively near future, this isn’t the last bail out your going to see. Cap and trade CO2? Coal industry collapses. Oil runs out? Automobile industry will need to retool for alternative fuels.

If we didn’t already have trillions of dollars of national debt, maybe this wouldn’t be so terrifying.

Hey #15. Hope your “cash equivalents” and investments are safe.

I like you am very conservative. I saved my money, payed cash for my home, and invested my money in a way I thought was conservative. Foolishly, I trusted my financial advisor and bought gov’t backed and high rated corporate bonds. As it turns out, much of my retirement was in 4 bonds, guess which ones? Fannie Mae, Freddie Mac, Morgan Stanley and a wholly-owned subsidiary of AIG.

As much as I hate it, I have to support the bailout. As I see it, I was defrauded when I bought them. These were high rated bonds that didn’t pay some exorbitant interest rate.

How firm can anyone be about what would happen if the government did nothing? ie==”let the market work?”

Evidently there would be bank failures and loss of jobs in the financial sector.==OK. Sounds like there are too many of them already.

Evidently there would be a big draw back on credit availability and people could not get loans easily.==OK. That needs to be part of the solution anyway.

What exactly is the real downside there that can actually be avoided?

#13 – the proposal comes straight from on high – the White House. Guarantees tawdry.

Where can I get in line?

Even Franklin Roosevelt is spinning in his grave.

I have been studying this bailout for a few days and all I see for us reguler folks is they want to give me access to more credit.WTF that is how folks got in this mess to begin with. I like # 15 was prudent with my money now I feel like a fool. I still feel credit is the 21st century version of slavery.