Senator John McCain’s campaign manager was paid more than $30,000 a month for five years as president of an advocacy group set up by the mortgage giants Fannie Mae and Freddie Mac to defend them against stricter regulations, current and former officials say.

McCain, the Republican candidate for president, has recently begun campaigning as a critic of the two companies and the lobbying army that helped them evade greater regulation as they began buying riskier mortgages with implicit federal backing. He and his Democratic rival, Senator Barack Obama, have donors and advisers who are tied to the companies.

But last week the McCain campaign stepped up a running battle of guilt by association when it began broadcasting commercials trying to link Obama directly to the government bailout of the mortgage giants this month by charging that he takes advice from Fannie Mae’s former chief executive, Franklin Raines, an assertion both Raines and the Obama campaign dispute.

Incensed by the advertisements, several current and former executives of the companies came forward to discuss the role that Rick Davis, McCain’s campaign manager and longtime adviser, played in helping Fannie Mae and Freddie Mac beat back regulatory challenges when he served as president of their advocacy group, the Homeownership Alliance, formed in the summer of 2000. Some who came forward were Democrats, but Republicans, speaking on the condition of anonymity, confirmed their descriptions.

“The value that he brought to the relationship was the closeness to Senator McCain and the possibility that Senator McCain was going to run for president again,” said Robert McCarson, a former spokesman for Fannie Mae, who said that while he worked there from 2000 to 2002, Fannie Mae and Freddie Mac together paid Davis’s firm $35,000 a month. Davis “didn’t really do anything,” McCarson, a Democrat, said.

THANKFULLY THE DEMOCRATIC SENATE WAS ABLE TO STOP ALL OF OUR FINANCIAL PROBLEMS!

Personally I think the money to a campaign manager is hardly the same as a campaign contribution like this cited here:

Anyone can play the “who has the most corruption within” game. I thought this was “Change we can believe in?” We can? Where is the change? These are the same political Democrat hacks as far as I can tell working for Obama.

Put in the “Another failed attack” category right now. There’s nothing about this story that will stick.

The most significant tidbit today is still the Bloomberg story that McCain co-sponsored a bill to require more sensible practices by Freddie and Fannie and the bill was killed by the Democrats.

McCain should be hammering them on this non-stop.

Whatever happened to campaigning on issues??

I have little faith in McCain or Obama at this point. It’s a race to dig up the most dirt on the other I guess. Are politicians real people?? Or are they ex car salesmen??

#4 – “Are politicians real people?? Or are they ex car salesmen??”

Unfortunately, we are putting the functional equivalent of used car salesmen in charge of $2 trillion a year, and they have the power to confiscate even more of it while using the threat of jail time if you don’t pay.

Sort of like combining the Mafia with Cal Worthington (and his dog, Spot).

#5 – You win the thread based on your Cal Worthington reference.

“If you need a car or truck, go see Cal.”

Then again, I think Cal could do a better job than any of these hacks.

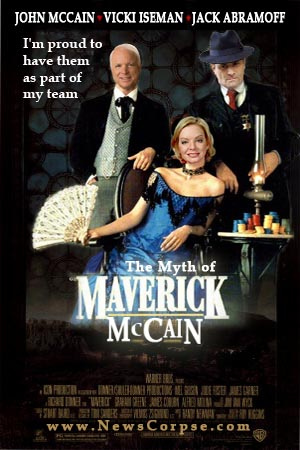

The joke of this post is summed up in the display of the “movie poster” from NewsCorpse.com. When you go to their website it states as their tag line, “The Internet’s Chronicle of Media Decay”. It’s an apparent description of their own “brimming full of their own liberalism” crap breaking through levees everywhere.

#8–cg==yes, those liberal bastards. Imagine associating McCain with his own Campaign Manager. OH the injustice of it all. I hate those bastard liberals.

Actually, I can’t take credit for it. Someone posted a few days back that it was the well regulated American Market that made investments in the USA so attractive to most world wide people. Where you gonna go–Russia or China?

So, it does say a lot that “experts” in their own industry can’t recognize what butters their bread. Or do they and they just wanted quick profits.

Would the world/should we take greater comfort in a well regulated market or in guaranteed Federal bailouts on failure?

I still think escrowing all bonuses and salary over 1MM for a minimum of 5 years for possible attachment on failure would be a good regulation. Stop the short sighted scamming.

openmarket.org has some good posts on this.

Here’s the top right now:

Imagine if you had a $200,000 mortgage on a $300,000 house that you planned on living in for 20 years. But a neighbor, because of very special circumstances had to sell his house for $150,000. Then, imagine if your banker said you had to mark to this “new market” and give the bank $80,000 in cash immediately (so that you would have 20% down), or lose your home. Would this reflect reality? Not at all. Would this create chaos? Absolutely.

Of course people are going to just blame things on whatever policies they don’t like. Let’s just say this wouldn’t have happened if we ratified the Kyoto Treaty.

#11–Mikey==I’ve imagined as hard as I could. I tried, and tried, and tried. And I cannot imagine how at all your post is relevant to anything.

Please take another shot at making your post relevant, helpful, insightful, explanatory, interesting, humorous, reflective, or anything other than completely nonsensical?

Your devoted readers thank you in advance.

Top moneymakers from Fannie Mae and Freddie Mac

#1 Chris Dodd

#2 Barack Obama(in just 4 years)

#3 Hillary Clinton

McCain was one of 3 cosponsors of S190 to rein in Fannie Mae. Democrats, including Barack Obama, opposed it, and ended up keeping it from coming to a vote.

#13–Mikey==I went to openmarket.org and now can imagine how your post is relevant, but it takes a lot of imagination. Your post remains irrelevant as the website itself imagines a set of hypotheticals that aren’t relevant to any proximate issue.

Likewise your continuing post at #13. Are you in fact a paid shill for the repuglikan party spreading fud wherever you go? Its been reported in various places that McCain has received 10 times more than Obama fromt the Officers and Management of the Freddies.

Your partisan hackery is exactly what is wrong with Washington, our government, and our society. I’d think such an open weeping sore would be kept from public view.

#15 – “Its been reported in various places that McCain has received 10 times more than Obama fromt the Officers and Management of the Freddies.”

Where, exactly? The LA Times (no lover of McCain) reports:

“Republican nominee John McCain has taken $16,400 from Freddie and Fannie employees since 2005 … Obama is the largest individual recipient at about $112,000, federal campaign finance reports show.”

My calculator says that means Obama has taken 6.83 times more than McCain.

If you want to look at which candidate is best qualified to get us out of the economic mess we are in I’d have to say neither.

Bobbo, I’ve said it in other threads, but the post I cited above in a nutshell is why all these companies are going bankrupt. They have all these derivatives and houses, and when those values drop for lack of buyers, they have to come up with fresh cash. This happens even if homeowners are making their monthly payments. When the values drop, the banks find themselves stuck.

#18 – “If you want to look at which candidate is best qualified to get us out of the economic mess we are in I’d have to say neither.”

Bingo! That’s why the less politicians are allowed to play in the economic sandbox, the better.

Is this really the best lobbying dirt you can some up with on McCain? A guy who was a lobbyist for a group, HomeOwsnership Alliance, one of whose members was Fannie Mae? I don’t think McCain is that clean.

#19–Mike==Yes thats right, just like any other asset. If you back a loan with gold, oil, soybeans, or white slaves and the value of those assets declines below the face value of the loan AND your derivative bet requires covering the nominal value of the debt, then money is owed===JUST LIKE ALL FORMS OF LEVERAGED GAMBLING.

That is all such a given, I don’t understand what “imagination” is needed for. Well, maybe too many on wallstreet in fact do need to imagine the truth?

I think your point needed just a bit more context, and could have been stated more succinctly===but to what point beyond the obvious?

Mike, I’ll say again by way of a half apology, you do post as if you were two people. Pretty smart on occasion, way off base on others. ((Oops, some say that about me too.==oh well. Nevermind!))

#17–Geof==I heard it on tv but it is confirmed here near the bottom. The discussion above the “wide net” tally speaks against it. I think wide net is the more relevant. Others may disagree.

http://www.opensecrets.org/news/2008/09/update-fannie-mae-and-freddie.html

#21 – MikeN

>>I don’t think McCain is that clean.

He’s not. This is just the tip of the iceberg. One company paid one one underling $30,000/month.

Do you think that’s as deep as the corruption goes?

#23 – bobbo, looking at the CRP numbers from employees since 1989, added to the 2008 campaign donations from the NYT, seems to indicate McCain at $200K and Obama at $150K.

Bottom line, I guess they got McCain in the right pocket and Obama in the Left, and the taxpayer gets stuck with the bill. Great.

Reinforces my original opinion that, beyond guarding against fraud, government meddling in the economy is a net loss to the public.

#25–geof==you can’t make that position stick with any logic. I feel like I’ve posted that opinion about 5 times in the last few days. In this case, as with most cases, you only choose between the pro’s and con’s of different regulations==usually who’s ox get gored in what situation.

Its rather hard think about what regulations actually exist except those that prevent fraud, some less directly than others. This bailout goes to a totally different issue and has nothing to do with regulations. It goes to maintaining confidence in view of the governments FAILURE to meddle sufficiently.

I defy you or anyone else to define an activity that is “over regulated.” What you are really complaining about in such cases is the applicability of the regulation, its wisdom, its ability to reach its stated goal.

Lets put only one regulation on a bottle of booze. A tax of $1000. Is alcohol over regulated or misregulated? Should the alcohol also be required not to contain poison? So–is that a fraud regulation, over regulation?

etc.

#26 – “I defy you or anyone else to define an activity that is “over regulated.” What you are really complaining about in such cases is the applicability of the regulation, its wisdom, its ability to reach its stated goal.”

OK, if we go by this definition, I think the stated goal should be a free market place where fraud and theft is not allowed.

That means that the government would not be “sponsoring entities” which are making loans. Social engineering should not enter into the decision making process.

#27–geof==thanks. Think about it for a few days and post back. Does my quibble make any change in your thinking about the subject. Words Matter. Ideas flow from words. Use different words, you should get different ideas.

I guess if you can afford a house, then no government meddling is just fine==or do you mean no meddling after imposition of property taxes? or after interest deductions?

I enjoyed a VA loan guarantee on my first house after military service. That, along with educational benefits helped bring me into the middle class. I can’t say that meddling was all bad and after military service==I think I even deserved it.

So, again, we’re back to of course the government should meddle==but only in a good way, not an incompetent fraudulent way.

Big thorny messed-up world. Easy rules may feel good, but living in the real world is more complicated.

#28 – I wouldn’t call VA benefits meddling, you earned that. While I believe in minimal taxation, I’m not an anarchist. If you are going to live in a community where the members decide they want to pool resources for fire protection, that is a choice those people make when they set that up. When you buy that house, you agree to that contract.

None of this is what I would call meddling. Feel good rhetoric like “a chicken in every pot,” to quote Henry IV, is the kind of meddling I think the government has been engaging when they try to control the credit markets.

Years ago, signs of impending problems were evident, yet congressional Democrats failed to act. On Sept. 11, 2003 the New York Times ran an article that stated: “The Bush administration today recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago.” Democrats in Congress blocked any actions and by their failure prevented a solution to the predictable future problems.

In response to the Bush Administration overhaul plans, Rep. Barney Frank (D-Mass), chairman of the Financial Services Committee, and then ranking Democrat on the Financial Services Committee said: “Fannie Mae and Freddie Mac are not facing any kind of financial crisis,” and “The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing.”

Other contributing factors are the result of President Carter’s Community Reinvestment Ac, which forced banks to lend to un-creditworthy borrowers and prohibited redlining. Banks were required not only to lend to un-creditworthy borrowers but were required to loan in blighted areas. Thus banks were forced to make loans that contradicted sound banking practices because they incurred significantly higher risks.

President Clinton disregarded warnings from congressional members and instead moved in the opposite direction by requiring lenders to make even more subprime loans. Failures to do so caused lenders to be subject to being closed by the federal government.

When sound business principles are violated either through mismanagement or government intervention the result will eventually be financial disaster.

So in the end, McCain’s advisor may have taken a job representing Fannie May and Freddie Mac, that’s what people who pay bills do. But it is abundantly clear the Democrat party created the environment that resulted in the bust. Started with Carter, advanced by Clinton, and any attempt to put boundaries on the problem were prevented by Democrat controlled congress.

Regulations are simply law-and-order for corporations.

If conservatives had abolished all laws, would they be surprised if crime went up?

So, why are they surprised at this economic meltdown?

It is the TOTALLY PREDICTABLE result of their anti-regulation obsession.

They want to privatize the profits but socialize the losses.

Yep. And Obama is supporting them. Both the donks and the pugs are supporting this plan of action. One solution to both platforms.