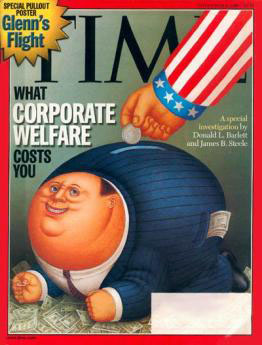

WASHINGTON (AP) – Two-thirds of U.S. corporations paid no federal income taxes between 1998 and 2005, according to a new report from Congress. The study by the Government Accountability Office, expected to be released Tuesday, said about 68 percent of foreign companies doing business in the U.S. avoided corporate taxes over the same period.

Collectively, the companies reported trillions of dollars in sales, according to GAO’s estimate.

“It’s shameful that so many corporations make big profits and pay nothing to support our country,” said Sen. Byron Dorgan, D-N.D., who asked for the GAO study with Sen. Carl Levin, D-Mich. An outside tax expert, Chris Edwards of the libertarian Cato Institute in Washington, said increasing numbers of limited liability corporations and so-called “S” corporations pay taxes under individual tax codes. “Half of all business income in the United States now ends up going through the individual tax code,” Edwards said. The GAO study did not investigate why corporations weren’t paying federal income taxes or corporate taxes and it did not identify any corporations by name.

More than 38,000 foreign corporations had no tax liability in 2005 and 1.2 million U.S. companies paid no income tax, the GAO said. Combined, the companies had $2.5 trillion in sales. About 25 percent of the U.S. corporations not paying corporate taxes were considered large corporations, meaning they had at least $250 million in assets or $50 million in receipts. The GAO said it analyzed data from the Internal Revenue Service, examining samples of corporate returns for the years 1998 through 2005.

1

And I have to explain this and the corporate welfare system to all the fools that harp on personal welfare being a burden on the US.

What corporations do to us is far worse than a small percent of people using food stamps to buy cigarettes!

Cursor_

This sure makes the other one third of corporations look like real suckers.This country will not be fixed until we outlaw all political donations by business.I doubt whether this will ever happen.England doesn’t allow and we shouldn’t either.

come on, everybody knows that if they had to pay taxes then they would have to raise prices to pay for those taxes. they are not paying taxes for us! they’re doing it to keep the value of goods and services down so the american people can more easily afford them.

won’t somebody please think of the children!

This is such a crock of bull.

100% of corporations employ people who most of which pay taxes (unless your Wesley Snipes).

Also, a lot of profits go to shareholders who are normal people who have things like pensions and investments.

So let’s get this straight. Tax the hell out of businesses that employ people so they employ less people. Reduce profits so the normal American can’t ever retire, and give the money to the government to redistribute to someone who I’m sure is not me.

Yeah, this makes sense.

“It’s shameful that so many corporations make big profits and pay nothing to support our country,” said Sen. Byron Dorgan, D-N.D”

No, you stupid sack, what’s disgraceful is the tax code YOU and your cronies in Washington perpetuate which allows this to happen. If there was any sanity in the US tax code, they wouldn’t be wasting time demonizing the very companies which employ the people, produce the products, and create the wealth which give us the lifestyle we enjoy

Put Dorgan up against a wall!

BTW, I wonder what Dorgan’s percentage of tax paid was last year? I’ll bet he’s not getting 30% or more of his earnings confiscated for his pals to play with. Bastards!

#4 – absolutely! since employees pay taxes on money given to them by corporations and shareholders pay taxes on money given to them by corporations then corporations shouldn’t have to pay taxes at all. that just wouldn’t be fair in the least. in fact, perhaps the government should subsidize companies by giving them monetary and property incentives from money the government gets from taxpayers so companies will do more business here in america and our economy will grow!

This is leberal spewing to create envy. Corporations pay no taxes. That’s why they exist. The money goes somewhere, and whatever is left at the end of the year used to get paid to shareholders as dividends.

These stories are written by people who have never owned a business, especially congress and “news” reporters.

#7 – that’s right! because all corporations pay divdends!

“Chris Edwards of the libertarian Cato Institute in Washington, said increasing numbers of limited liability corporations and so-called “S” corporations pay taxes under individual tax codes. “Half of all business income in the United States now ends up going through the individual tax code,” Edwards said.”

There is your answer. These corps aren’t supposed to directly pay taxes. The Dems that asked for the study told the GAO to give them the overall numbers because they knew what the answer would be because they wrote the damn law in the first place.

That would be nice if the companies only employed people who worked in the USA. Why tax the people and not the companies? Why give tax breaks to companies and not people? Why bail out failing banks and not the people who are losing their homes? Why value people who put their money into a company (investors) over people who put their lives into it (employees)?

Congratulations! Everyone has taken the bate and as always is talking about who to tax or who not to tax. The reality is no one is paying enough taxes because we collectively allow (and actual encourage) our elected representatives to spend money without collecting enough taxes to pay for it. Without addressing spending talking about taxes is smoke an mirrors, and as we can see from the last 8 yrs.,neither side is willing to decrease spending. Some day we will no longer be able to borrower enough money to fund everyone’s “free lunch” and it won’t be pretty.

#9 – “These corps aren’t supposed to directly pay taxes.” What? Since when aren’t they supposed to pay taxes, you know, by law and all?

and

“The Dems that asked for the study. .. because they knew what the answer would be because they wrote the (gosh darned) law in the first place.”

well that completely invalidates the study. no one should know what the answer should be before hand. those tricky dems and their fancy book learnin’ and thinkin’ and stuff.

ah yes shareholder dividends… money for people with money, who want more money……. and dont diddly to get it…

The truth is 100% of corporations don’t pay tax: their customers pay the tax.

So when Obama talks about a windfall tax on Big Oil profits – he means a gas tax, which you pay.

When any politician talks about raising taxes on corporations, they mean a tax on the shareholders. And if you have a pension plan, then you’re a shareholder.

To: jccalhoun: ultimately all taxes are paid by people – you either pay them directly with an in your face tax like income or sales taxes or you pay them indirectly through hidden taxes that are built into the cost of products you purchase. I prefer in your face taxes that way the true cost of Gov spending is apparent to everyone and actual makes it acceptable for the average joe to limit Gov spending.

By many accounts, the age of the corporation is almost over, so this is probably irrelevant or maybe 20 years late. Globalization and trade agreements are killing them. They’re dinosaurs, unable to adapt. Tax payers are sheltering them, basically we’re running a zoo for endangered species.

Lets see..

Corps cut costs by going over seas for goods.

Corps sell Goods that cost $1 to you for $100.

Corps pay out money to POOR people to WORK for them in the USA, because they cant afford Foreign billing services and TIME delays.

Corps pay on individual taxs to each person, UP the chain, but NO tax on GOODS sold?

Corps rent/lease property as its a TAX DEDUCTION, insted of paying STATE PROPERTY TAX which ISNT.

Corps farm out renting of goods to FAKE companies, to rent/lease most equipment/desks/computers/tables/chairs as its a TAX deduction. Buying them, you get 1 deduction in 5 years.

Corps RENT/LEASE cars as its a TAX deduction, insted of BUYING cars and paying maintenance..

Corps get to DEDUCT fuel costs, Air travel, research and development, advertising, ….

Corps pay NOTHING, you do..

They find the cheapest and sell at the MAX price point.

I’m laughing. Not at the GAO study. I’m laughing at the trolls that suddenly show up ready to throw out some stupid comment with no factual sense to it. Where the hell do they come from and what are they imbibing?

#4, backhole,

100% of corporations employ people who most of which pay taxes (unless your Wesley Snipes).

Also, a lot of profits go to shareholders who are normal people who have things like pensions and investments.

Or you can afford to pay a tax accountant to hide the money and avoid taxes. Then the argument is that that that money has already been taxed and so they shouldn’t have to pay again.

#5, gibbon,

No, you stupid sack, what’s disgraceful is the tax code YOU and your cronies in Washington perpetuate which allows this to happen

No you arsewipe. What is admirable is that someone is looking at the tax code with a mind to reform.

If there was any sanity in the US tax code, they wouldn’t be wasting time demonizing the very companies which employ the people, produce the products, and create the wealth which give us the lifestyle we enjoy

Hhmmm, ya, right. Lets give all companies a free pass. Their trucks tear up our highways. Their plants pollute our air. Their use of energy depletes our limited resources, their bribes taint our political life, …

BUT, where did you get the idea that Dorgan was demonizing anyone?

#7, pdc,

This is leberal spewing to create envy. Corporations pay no taxes. That’s why they exist.

No. Corporations are structured to differentiate from a group designed to produce a product, goods, or services from a person who consumes products, goods, or services. Corporations are there to return a profit on the investment of their shareholders.

These stories are written by people …

At least they aren’t written with the literary aptitude a of a fifth grader. Grow up. Kid.

#9, Gig,

The Dems that asked for the study told the GAO to give them the overall numbers because they knew what the answer would be because they wrote the damn law in the first place.

No. The GOA is prohibited from reporting individual companies simply because IRS law prevents it. The IRS also does not publish the numbers Dorgan asked for. In order to assess the impact of legislation, periodic audits and overviews are generally required.

#11, atta,

Everyone has taken the bate and as always is talking about who to tax or who not to tax.

I would think we are discussing why some are not paying their fair share of taxes.

#14, chuck,

The truth is 100% of corporations don’t pay tax: their customers pay the tax.

Wrong. The corporations are responsible for paying the tax. They are the ones who benefit from being in this country. They have the protections American military can provide. They have the protections of our Judiciary. They have the advantages of using the American education system. There are a host of other advantages, benefits, and prerogatives available to American corporations.

Their customer is just where they make their profit. Just like the mine that sells their ore to the steel company. The steel company is the customer. When the steel company sells their steel, the auto manufacturer is the customer. When the auto company sells their trucks to the mine, the mine is the customer.

They deserve to pay their share.

#18

>> #14

>> The truth is 100% of corporations

>> don’t pay tax: their customers

>> pay the tax.

> #18

> Wrong.

Actually, #14 is exactly correct. Corporations do not really pay taxes; consumers do. When the government imposes a tax on an American corporation, they have three choices:

1. Accept lower profits due to higher costs,

2. Cut costs somewhere else to compensate for the higher cost due to tax

3. Increase revenue through higher prices.

Since the goal of a business is to maximize profit, #1 is the least desirable and will generally be avoided. Instead, they will look to cut costs elsewhere of which labor is usually the first victim or they will raise prices meaning that the consumer pays the additional tax. “Deserve” has nothing to do with it.

# 18 Mr. Fusion: I hate to break it to you but taxes are just like any other expense – they have to be paid for from the sale of what ever product the company is selling. Thats called passing the cost on to the consumer. It is really simple in the long run a business has to make a profit or it goes out of business. We are much better off taxing people directly, instead of having the cost of everything we buy inflated to cover all the taxes the business pays. Everyone thinks the other guy should pay more taxes and that they are paying to much – but most people have no idea how much taxes actual cost them because we hide taxes in the cost of goods and keep trying to give everyone a “free lunch” by borrowing money instead of collecting taxes. This has to stop and direct in your face taxes are the best way to get people to actually support reducing Gov spending.

“Congressional Report: Two Thirds of Corps pay No Federal Income Tax”

No, but the people who own them pay MOST of the income taxes in the U.S. The info in the title is useless. Jennifer Kerr wrote the article, figures.

Ok, that was my longest rant to date.

Sorry!

#18, in a global economy it will be impossible to accurately impose a tax on each global corporation. If 60 governments want a share of your corporation, there will never be agreement as to how much each country is entitled to, resulting in over taxation and stifling of business, increased prices for the consumers, inequitable competition with non-global corporations, and failure to pay taxes to less powerful governments that can’t sue with the force available to larger governments. Much easier to tax the income of the employee who lives and works (generally) in one location.

Therefore, to level the field, all corporate taxes on income must be abolished.

Your numerous red-herring arguments are ludicrous. Road taxes, environmental standards, and all other regulations can easily be imposed on a facility that operates within a region (intra country, or trans country) or by international agreement (such as maritime regulations).

I have to assume you wish to appear ridiculous to stir the pot.

It seems a lot of you dont know anything about corporations. See below:

“The S Corporation has shareholders and is taxed like a sole proprietorship or a partnership rather than like a C Corporation, which is taxed as a separate business entity. Income is passed through to the shareholders, who report their pro rata income, or losses, on their individual tax returns.”

Source

I don’t blame you, the only reason I know is that I had an S corp once. Then again it took me all of 10 seconds to look it up to source/verify.

#21 – “No, but the people who own them pay MOST of the income taxes in the U.S. The info in the title is useless.” darn it all to heck, i absolutely despise it when the people who make the most money pay the most taxes. freakin’ poor people not making enough freakin’ money to pay their fair share of freakin’ taxes!

rich people have it very hard, financially speaking.

#18 = fatuous twaddle

#22, #23 = right on the mark

Don’t worry, #18 will come right back with even more fatuous twaddle. Bet you a devalued dollar.

#22 – “Why had the GDP of China grown at 5 times the rate of the US for the last decade? … Do you understand the consequences of this low tax rate?”

you betcha it’s the taxes. since the majority of u.s. companies don’t pay taxes of course they outsource their labor to chinese companies who don’t pay taxes. do you know what this means? no? well, i’ll help you. the taxes that u.s. corporations aren’t paying here are directly subsidizing the taxes that the chinese aren’t paying over there! competition! incentive! taxation!

Back in the 19th century, when companies operated within a country (mostly), it made sense to have corporate income provide the tax revenue (in addition to tariffs, etc). The world has changed.

The problem with taxing individuals is the cost of accounting for each individual’s debt is relatively high.

But back in the 1800s, that cost of accounting for each person’s tax liability would have been untenable (before the age of inter-networked computers). It was cheaper to go through the books of businesses.

As I’ve already discussed, globalization has changed the problem of identifying and assessing tax liability.

#19, Thomas,

Aren’t you the guy that claimed he knew economics? Gee, what happened, did you forget everything?

Corporations do not really pay taxes; consumers do.

And every Corporation in the world is also a consumer. Herz doesn’t get their cars for free, they leased them. Ford does not get their components for free, they have to buy them. Tower doesn’t get their copper for free. They have to buy it. Anaconda doesn’t get it’s copper ore for free, it had to pay for the land. That makes every single one of those companies is a consumer.

The difference between a Corporation and a person is the intent. A Corporation is set-up to run a business. Both have rights and obligations under the law.

When the government imposes a tax on an American corporation, they have three choices: …

Bullpoop !!! All your “choices” are internal business decisions. Every Corporation has the option of whatever business decision to make on any expense and how to address it.

Since the goal of a business is to maximize profit, …

Wrong. If that was the case every company would be selling itself off to the highest bidder.

The intent of a Corporation is to create a product, good, or service that a consumer will pay more for than it cost to make. That profit is used for such diverse things as paying taxes, replacing worn out equipment, researching new methods, developing new products, advertising and marketing, and expansion.

Maximizing profit is a very short term gain with long term losses. The most successful companies plan their business to afford a reasonable return for investors over the long haul.

#30 There is only one customer. That person is us. Everything is ultimately created to create something for us.

We, the tax payer, are also the same customer(ultimately) of government expenditure. The difference is the government steals money from John to make Paul feel richer.