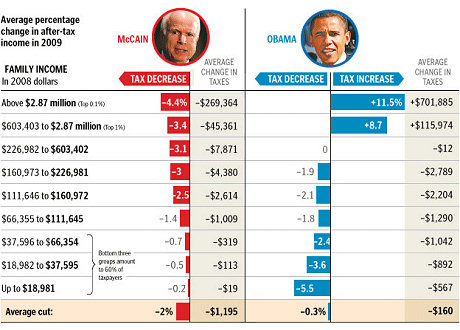

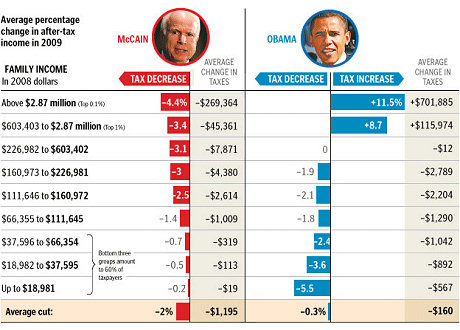

If these numbers are accurate and ignoring any other issue, this makes it pretty clear who to vote for. On the other hand…

By Uncle Dave Monday August 11, 2008

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

© 2008 Copyright Dvorak News Blog

Bad Behavior has blocked 9500 access attempts in the last 7 days.

OBAMA: CHANGE…the kind you aren’t going to like…or, too little for vending machine mints.

I guess it would be obvious who to vote for if you are making over $ 266 k….otherwise it looks like the handling of the deficit might be in better younger hands.

I’m not even sure what the intent of the “If these numbers are accurate…” comment is, but I can say that according to these plots, I won’t get any tax break under Obama (but I’ll get to pay for whopping breaks for those who pay almost no taxes–i.e. more charity), or I can vote to get a modest tax break under McCain, which offsets the welfare income distribution that was titled a tax “refund” this year (of which I got nothing, but those who paid no taxes got $1200–an interesting way to “refund” taxes).

So…I guess if we are going only by this table: GO MCCAIN!

we are in the middle of two wars. yes more tax cuts is what we need. really? really?

doesn’t matter which side of the fence you are on when it comes to taxes, tax cuts during a war is just stupid.

The real question to ask…how many here clicked on the link to the BizWeek article and just watched the nervous writer as opposed to reading her article? And what did she actually say and what did you actually learn.

Does anyone is US care about the debt? Not just the politicians, but the regular voter?

These graphs don’t really mean anything at this time.

What are the spending plans? Obama wants to implement a very costly healthcare plan. McCain may continue wanting to spend on a stupid war.

Increasing %’s on the bracket doesn’t necessarily increase total Treasury tax revenue…

Uncle Dave==thanks for the link. Yea, the Deficit Spending plans of the candidates certainly should be part of the evaluation==or given that so many here are only interested in their personal tax rate today, would it matter at all?

James is exactly right. You can’t cut taxes for people who aren’t paying taxes. Cutting taxes on the rich stimulates the economy because they then spend more, thus giving more jobs to people and making more money for the companies the rest of us work for.

As far as the “deficit”. Here’s an idea! Quit spending money the govt doesn’t have!!!! You don’t have to be an economics major to figure that out. Quit sending aid to foreign countries for one. that will pay off the debt quite quickly. Cut free healthcare and wages for life, of the house and senate members. That should be the second cut made.

@James Hill #9

I am afraid you, along with many Americans live in a dream, the American dream, a place the rest of the world knows doesn’t exist.

Those that earn more money have worked hard and have been successful. Those that do not pay taxes live on the bare minimum they need to survive. This is a fact.

You believe though that we should cut the taxes of those that earn a lot, since they deserve more of the money they make. A fair point. However, with less taxes on the upper brackets there is far less money to spend on things the country needs.

A decrease on tax for the lower bands creates a much higher standard of living for the poorest people in your country.

I wonder, if you earned $10 a day, and had to support a family would you be so quick to give someone earning $3million a year some more money?

The system is the way it is, because it is the only fair system. Those that earn more have to spend more on taxes as they already enjoy a very high standard of living, those that earn less require more of their income to sustain a reasonable standard of living.

The United States needs a Health Care system, which is paid for with a dedicate national insurance tax. A health care system which is available to everyone, and the care you receive is based on you needs not your wallet.

While you believe that the United States has the best health care system in the world, you are sadly mistaken.

I do not live in the United States, but myself and others continually wonder, what on earth is wrong with you people. Every election, every bill you pass, every single day, you allow your country to fall down the gutter even further.

To even be considering a vote for McCain, who cannot even make a decision he stays with for longer than a day only indicates you to be the most dangerous nation on earth. As another reject president will likely send your’s and every other country on the earth into total disaster.

I could see voting Republican if they were still using it a tactic/tool to reduce the size and authority of the federal government. But since they’re not doing that anymore they’re just as irresponsible as the other side now.

Cutting taxes on the rich stimulates the economy because they then spend more,

Is there any independent financial analysis that supports this argument?

@11: “The system is the way it is, because it is the only fair system. Those that earn more have to spend more on taxes as they already enjoy a very high standard of living, those that earn less require more of their income to sustain a reasonable standard of living.”

Also known as Communism, and I escaped that crumbling system to come to the land of the free… The only fair system would be flat tax. Everyone paying fixed and equal percentage of their income.

PS As an educator, my income is on the lower rungs of the ladder in that image…

@13: From USA Congress, Joint Economic Committee:

“High marginal tax rates discourage work effort, saving, and investment, and promote tax avoidance and tax evasion. A reduction in high marginal tax rates would boost long term economic growth, and reduce the attractiveness of tax shelters and other forms of tax avoidance.”

psst…. I hate to break it to you but the president doesn’t set the tax rates, congress does.

#14 Most of the old eastern bloc has a flat tax along with Mongolia, Iceland, and Iraq.

Anyway, do you favor the elimination of other taxes coupled with a flat tax structure?

#11 “a place the rest of the world knows doesn’t exist.”

I guess that’s why the rest of the world tries to sneak in to the US to live. LOL!

“A decrease on tax for the lower bands creates a much higher standard of living for the poorest people in your country.”

These people pay nothing or almost nothing in income taxes already. So it won’t effect their standard of living…

“you be so quick to give someone earning $3million a year some more money?”

Umm, it’s not “giving”. It’s is TAKING less.

“The system is the way it is, because it is the only fair system. Those that earn more have to spend more on taxes as they already enjoy a very high standard of living,”

Umm, no. The proven failed Marxist economic theories is not what made the US the most successful country in the world. Try again.

“I do not live in the United States, but myself and others continually wonder,”

So, what paradise do you live in?

McBush – EVEN MORE TAX CUT FOR THE RICH !!! Whodda Thunk It !!! Voters don’t want what the Repukes are peddling !!! Sayonara, John !!!

There is something quite disturbing about how many people don’t realize America is in serious trouble economically, socially and politically. I’m not so naive as to believe any one person can change the situation, but it’s obvious more incompetence will make it worse. The naked greed and complete disregard for the future of this nation and the planet is tragic. I’m too old to be greatly impacted by the rapid decline of this country. Any American under the age of 40 however should wake up to reality.

Has everyone forgotten that the (arguably) greatest economic miracle of the 20th century, that is the United States economy between 1945 and the early 1970s included marginal tax rates as high as 94% with a low of 70%? Back in the days when we had a real economy based on actually making things besides lattes?

Even if we can’t trust them to do what they say, we have to go by what they say. This is their plan, at least for the moment. If we ignore it, we may as well not bother voting.

Obama wants to tax the wealthy to pay for health care. McBush wants to leave the taxes for the next generation, borrow until we go bankrupt, and fund

Haliburtona war.My choice is clear. My conscience will be too.

# 10 JOE said, on August 11th, 2008 at 8:15 am

You can’t cut taxes for people who aren’t paying taxes. Cutting taxes on the rich stimulates the economy because they then spend more, thus giving more jobs to people and making more money for the companies the rest of us work for.

Thanks for the lesson in

Voodoo Economics 101Reaganomics. I wasn’t aware anyone still believed such crap. It’s obviously done very well for us thus far (cough choke gag).#22 – Dave W,

No. Some of us remember. Excellent point!!

Overtaxing the rich is not a good thing to do. Society should be structured so that such disproportionate incomes/wealth accretion do not happen in the first place. Many simple changes in capital gains/exclusions/tax dodges/corporate benefit plans could be made to bring this about then class warfare around the tax rates could more easily end to focus more closely on “what works?”

To that end, its always amusing to see those folks claim the minimum wage cannot be raised .25 an hour because the economy can’t afford it but if you cut the pay of a $35 Million executive to $20 Million, he will no longer be motivated to work.

Silly the right wing bat shit people lap up as ice cream.

#24 – bobbo,

Silly the right wing bat shit people lap up as ice cream.

Yum! Bat-guano iced-cream, the latest flavor from Ben & Jerry’s.

#4, Maybe we shouldn’t go to war then.

#11, Those that earn more have to spend more on taxes as they already enjoy a very high standard of living,

By what standards do you measure this with? Communism?

#22, I hate to burst your bubble, but those rates were on “net income” which differed significantly from “taxable income.” Income received has held steadily around 30% of GDP, regardless of the income tax rate (that includes federal and other).

In a nutshell, it doesn’t matter who cuts what from whom — 30% is what they want. By 2075, that percentage will be around 40% but that’s another problem.

Speaking of graphs:

If Ron Paul had been in that graph, it would have had one bar:

$0+ — 0% Tax

Sign of the apocalypse:

James said: I’m actually for an increase in taxes on the upper brackets…

Or he just lost his right-wing conservative ID card. Either way, at least you’re not totally nuts. 🙂

Maybe instead of debating why the “rich” shouldn’t be able to keep more of their income, we should ask why it is that this government costs us 2.5 trillion dollars a year in the first place.

Maybe instead of debating why the “rich” shouldn’t be able to keep more of their income, we should ask why it is that this government costs us 2.5 trillion dollars a year in the first place.

I’ve just developed a man-crush on Sea Lawyer.

#29 – TomB,

I just have to ask, did Sea Lawyer ever say s/he was a man?

Um . . . ah . . . ahem.

I’m a single guy who doesn’t have more money than God, has to work for a living and didn’t have a gaggle of kids he couldn’t afford in the first place. Translation: I’ll be getting screwed under either of these “plans” while everyone else goes to the bank.