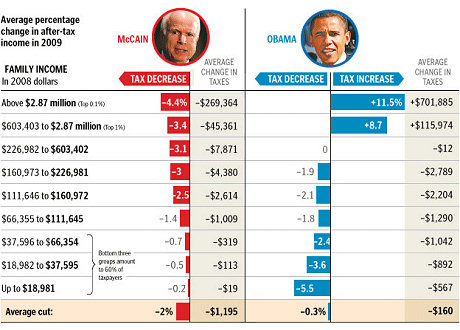

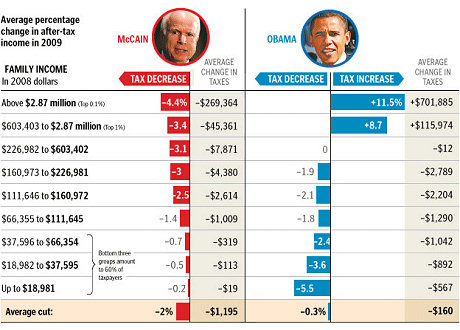

If these numbers are accurate and ignoring any other issue, this makes it pretty clear who to vote for. On the other hand…

By Uncle Dave Monday August 11, 2008

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

© 2008 Copyright Dvorak News Blog

Bad Behavior has blocked 9478 access attempts in the last 7 days.

TAX CUTS DO NOT MEAN SPENDING CUTS.

McCain’s plan will bankrupt us even more than we are now. I hope you enjoy selling apples on street corners if you vote for McCain.

Everytime there has been a meaningful tax cut, revenue paid into the Government coffers has increased. EVERY TIME. What this then does is causes the Government to start SPENDING MORE and hence why budget deficits go up. The problem isn’t tax cuts but GOVERNMENT spending and the blame lies with us who keep re-electing the idiots who want to spend spend spend…

Totally meaningless to me. Under Bush I pay more taxes than ever and he’s suppose to represent low taxes?

This election is about how thorough we bury the hijacked Republican Party by the right wing and religious fascists.

Vote McCain = Good change for the better

Vote Obama = A reawakened America for the future

#5 – Mr C. Dvorak

“The real question to ask…how many here clicked on the link to the BizWeek article and just watched the nervous writer as opposed to reading her article? And what did she actually say and what did you actually learn.”

I clicked on the link, and one important thing I learned was that Janie ought to have a big glass of Merlot, or a tranquilizer before she records those videos. Or at least have the video guy put the playback speed on 0.75!

From the rest of the post, it’s obvious that if you have any legitimate concern about financial security, you’re better off (WAAAAAY better off) voting for Obama. If you’re Bill Gates or Warren Buffett (or attend their cocktail parties), you will probably be better off, at least financially, voting for McBush. Whether or not you can live with yourself is a different matter, but the bank account will be the better for a vote for McBush.

I realize that money can buy a lot of things, but even most of the super-rich who will benefit from McBush’s policies aren’t the sort of financial whores who would vote for 4 more years of Bush just for a few more shekels in the cookie jar. After all, they’re super-rich. What do they care?

Verdict: Obama in 161 days.

I have to agree with Ben Stein, in that taxes really need to go up on everybody.

The real value of wealth to most of those who have it is the position it affords them at the top of the social order. Minor adjustments of the top tax bracket don’t threaten that relative social and economic position, since the same people will still be at the top, no matter the tax rate. Tinker with the top tax bracket percentage, and the membership at the local country club won’t change.

It seems to me that this mountain of debt we’ve created and the collapse that it has the potential to cause could have a far greater effect on the current social order in America than any adjustments in the tax code.

The purpose of the tax reductions that Bush and a very supportive Republican congress passed was supposed to be to stimulate a slowing economy. Well, it worked, but because the difference was made up by massive borrowing which added to the debt instead of coming from taxes, the whole thing was really just a mirage, but our economy still looked healthy to the unsophisticated eye.

The big question is, how far can we take this borrowing? What might it take to cause our ever-growing house of cards to come tumbling down, with a potentially huge impact on the social order that wealthy people love so much?

The only answer is, we just don’t know. I wouldn’t have guessed that we could keep it up even this long. More than anything else, America reminds me of one huge Ponzi scheme, and sooner or later they tend to end badly.

#34 The Warden wrote “Everytime there has been a meaningful tax cut, revenue paid into the Government coffers has increased. EVERY TIME.”

You are mistaken, Warden, and supporting that statement are the tax revenue figures compiled by the Congressional Budget Office:

2000… $2,025.5 billion

2001… $1,991.4 billion

2002… $1,853.4 billion

2003… $1,782.5 billion

2004… $1,880.3 billion

2005… $2,153.9 billion

As you can see, the tax revenues didn’t meet or exceed those for the year 2000 until 2005, and this does not even account for inflation.

Just wanted to throw in one statistic that I think is very pertinent to this graph. Although the $19-$66k group constitutes 60% of _number_ of tax payers, they only pay around 1-2% of tax revenues.

Not much you can really cut. Most of my family members fall in that class, and they all don’t pay taxes, at all. A couple actually get money from the IRS even though they didn’t pay because of the earned income tax _credit_.

#34 – Warden

>>the blame lies with us who keep re-electing

>>the idiots who want to spend spend spend…

Yes. “Electing” (using the word loosely) Dumbya was wrong on so many levels. We’ll be paying for that debacle for a generation or two.

Here’s a radical idea for Obama/McCain: why don’t they simply eliminate taxes for all but the top 1%? So if you make less than about $600K, you pay no tax and keep it at the top 1% based on say the previous years figures. That way, in 50 years, we don’t end up with a monstrosity like the AMT. As James Hill said, the liberals idea of “taxing the rich” is flawed because they simply redefine rich to include almost everyone. The original plan was for income taxes to only apply to the super rich. Why doesn’t he simply return to that same idea?

#42 – Thomas,

Please don’t mistake Democrap for Liberal. True liberals are few and far between in government. Certainly neither Clinton nor Obama qualify. Kucinich leans toward liberal, though not more so than Edwards leans to the right.

The Democraps killed the real Liberal party because they didn’t like the competition. However, even in a two party system, the Liberal party held considerable sway for a while.

Giuliani would not have been elected mayor of New York at that time had he solely been running on the Repugnican ticket. It was the Liberal ticket that gave him the ability to win here.

It was also the Liberal party that allowed him to endorse Cuomo over Pataki saying “vote for Cuomo on the Liberal ticket.” This was a party to which both were members.

Repugnican Liberals and Democrapic Conservatives were far less common than R/C and D/L, but definitely existed and often were indicative of more centrist and bipartisan candidates, though Giuliani was not a particularly good example.

Anyway, the real problem with defining the level at which someone is rich is that it varies based on region of the country. AMT kicks in at $150K everywhere.

In East Bumfuck, $150K may well be quite wealthy. In New York City, it may not be enough to make ends meet and certainly won’t be enough to buy that small 2 bedroom coop with only one bath and a “courtyard view” (a.k.a. cave).

So, perhaps part of the problem is that we need to define rich by zipcode.

Personally, I am becoming more and more convinced that we need to tax things like CO2 and consumption (i.e. sales tax) rather than income. Income is good; don’t discourage it. Consumerism is bad, i.e. not sustainable; let’s discourage waste. We must* change our throw away economy eventually.

Why not start now?

* I don’t mean should. I do mean that we will have to; there is no choice. The earth has limited resources. We will either go to a system where everything we produce, literally everything, will be recycled. Or, we will die. In fact, one day, we may have to mine our old landfills for materials to make new stuff. The planet is finite.

Yes, we do have energy coming in from the sun. For the most part though, it helps to think of our natural resources as finite. Some resources are renewable if harvested slowly enough, unlike the way we do today. Mostly though, there is only so much stuff on/in the planet.

Isn’t this rob from the rich and give to the poor? I think it should play big to the poor.

Barack Obama said he would raise taxes even if it meant collecting less revenue.

#39 you proved his point. The real Bush tax cut was in 2003 with a cut in capital gains taxes, as well as dividends, investment tax credits and repatriation tax amnesty.

The first tax cuts were phased in and had tax rebates as a major element. Rebates do not help economic growth.

This table shows just how VICIOUS AND GREEDY THE REPUKES ARE !!! They propose to give MILLIONAIRES A TAX CUT OF A QUARETER OF A MILLION DOLLARS, while give someone earning less that 20,000 dollars a TWENTY DOLLAR TAX CUT !!! Gee, what SWELL FELLAS THOSE REPUKES ARE – NOT !!! And as for Obama’s table, I won’t spill any tears over the Millionaire who pays an additional 700 Thou because HE’S STILL A MILLIONAIRE !!!

#46 MikeN, Actually, you’re mistaken as well. Delving deeper into the figures only increases the margin by which the assertion is shown to be false. If the totals I cited are broken into subcategories, and irrelevant items like excise taxes and Social Security taxes (which skew the totals) are discarded, leaving only personal and corporate income taxes (which the claim says will increase), the “less is more” premise falls apart even further.

I didn’t want to bury you with too much data, but when you factor inflation and actual economic growth into the picture to calculate an expected increase for tax revenues, the actual tax receipts since 2000 have consistently fallen short of that expectation. Hey, not to worry though, because America apparently has a very high limit on our credit card. The ability to always borrow our revenue shortfall is truly priceless!

#43

I made my recommendation somewhat tongue n’ cheek. If the marginal tax rate on the rich is raised substantially the effect will be a huge drop in tax revenue because the rich will hire armies of lawyers and accountants to find ways of putting their money in places that will not be taxed. As you noted, the problem is that there is a big difference between wealth and income and location makes a big difference.

A consumption tax has the benefit of taxing everyone including the rich equally. There have been numerous plans proposed for replacing income tax with a consumption tax. The key is doing it in such a way that the poor are not taxed and dealing with VAT issues.

#45

Exactly. It is not about maximizing tax revenue. If raising taxes on the rich actually increases tax revenue, then fine. However, if tax revenue goes down, then what is the point?

i’m still gladly voting obama. tax those rich bitches

Obama’s tax plan will destroy the Social Security system.

Obama says his income tax plan will lower taxes for 95% of Americans. There is just one problem with this, 40% of Americans already pay no income tax. Obama’s response to this is that these people pay Social Security tax. Well, that’s not income tax, but a contribution to their retirement plan. So if he wins and implements his tax plan, for the first time in the history of Social Security, 40% of the people who will get retirement benefits will have paid nothing for them. Social Security will then loose all pretext of being a retirement plan, and will become a national welfare program.

This will cause Social Security to lose public support in a massive way. Leave Social Security contributions out of income tax plans. If you take some peoples income taxes to pay others Social Security taxes, Social Security will be destroyed forever.

http://strategicthought-charles77.blogspot.com/2008/10/obamas-tax-plan-will-destroy-social.html