(ALBANY, N.Y.) — New York smokers have been sent outside in all kinds of weather, coughed at in disdain, and now they are burdened with the most expensive cigarette taxes in the nation. Now, to add cost to injury, the state is declaring its highest-in-the-nation cigarette tax a success. The number of calls to the state’s Smoker’s Quitline quadrupled to nearly 10,000 calls during the week of June 2, when the full $2.75-a-pack tax kicked in, New York Health Commissioner Dr. Richard Daines said. Fewer than 2,300 people called for help during the same week in 2007.

“Not everyone that tries, quits,” Daines said. “We estimate about 140,000 New Yorkers will successfully quit smoking. We may have more than a million try to cut down or stop, but this is how you get people to try: give them multiple chances and multiple reasons to stop.”

The increase that took effect June 3 sent the tax from $1.25 to $2.75 per pack. In most of the state, cigarettes range between $6 and $8 a pack, depending on brand and store price. They can cost as much as $10 in New York City, which has its own tax. Smokers calling the Quitline requested nearly 7,900 kits the week the new tax was introduced compared with 1,722 requested the same time last year.

Look for a huge increase in black market cigarettes from North Carolina.

Still room to grow on those taxes. The average price for a pack of cigarettes in Alberta, Canada is $11, and people still buy them by the truckload.

How about cutting out taxpayer subsidies to those North Carolina tobacco farmers while we’re at it?

When you have no ideas.

Go back to the old scapegoat smokers.

NY Sucks !

The tobacco support program has ended. The farmers are receiving a multiyear settlement. It’s all sold by contract now, no more auctions. The big tobacco companies are counting on Asian sales in the future.

Thats incredible. People pay that much to smoke? amazing. I wonder how high the tax could go on marijuana? Given the ease of self grow I suppose it would be much lower?

So–should the tax policy be set to maximize revenue or to maximize quitting? Fun little issue.

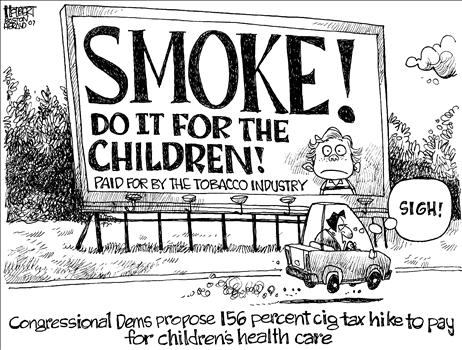

the real reason for the tax increase is because tax revenues from cigarettes have gone down for several years thanks to anti-smoking campaigns. less tax revenue means less money for “Childrens health” which in turn means they have to raise the taxes. Once taxing smokers isn’t enough to fund children’s health, I suspect they’ll target other easy marks, like fast food. after all, its all for “children’s health.”

Since smokers are a source of pollution which contributes to global warming, they should be required to purchase carbon credits from Al Gore.

I’m fat, like to eat and continue to pay for rising food costs. A Subway, loaded with double meat can run you $10. It might be cheaper for Jared to smoke instead.

I quit smoking three weeks ago. My whole house was supposed to. My parents were here on vacation and my father had a heart attack (quintupple bypass), so everyone had to quit. Only my father and I accomplished it so far.

I say all of this to explain that I understand the difficulty in quitting smoking. I quit cold turkey, my father used Chantix.

However, I detest the idea that the government is using taxes to dictate behavior. According to the government in the article, the tax is a success because more people are trying to quit. However, I thought the purpose of taxation was to increase government funding, not to dictate behavior. Why don’t we encourage higher education…the higher your education, the lower your taxes. Isn’t that a behavior we should encourage, staying in school?

As Mr Mackey would say, “Cigarettes are bad. Don’t smoke cigarettes.”

I’ve always wondered how the government would pay for all the sin Tax stuff if there were massive deceases in use? The number of smokers is rapidly decreases with each generation. Soon we’ll be seeing smoking tax shortfalls in state budgets…

#10–Calin==do you prefer the government just flat outlaw the sin involved then or are you completely naive and uninformed?

A lot of cigarettes are sold in TX without tax stamps of any kind, especially by the Mom and Pop convenience stores. Apparently they are sold for less than the competition and so far not one store has been busted.

I’m amazed they’d take the risk — don’t mess with the tax guys, they have more money than you do (and ironically it used to be yours).

Don’t care … quit smoking two years ago.

People don’t realize the purpose of this tax – it’s not to encourage people to quit smoking.

The purpose of this tax (or any tax) is to raise revenue for government to spend.

If this tax actually resulted in a significant number of people quitting smoking it would be a financial disaster for the state.

The same applies to the gasoline tax, and carbon credits.

The trick with taxes has always been figuring out how much you can strangle the goose without killing it. (Not to be mistaken for choking the chicken or spanking the monkey.)

If you raise taxes too high, you encourage smuggling, and people find other things to spend their money on.

Say, for instance, I raise the taxes on chocolate milk in my state. The following behaviors will be observed: People will pay the tax, people will buy white milk and stir in Hersey syrup, people will buy chocolate milk in neighboring states and bring it across, and people will stop drinking chocolate milk.

The tax rate determines what percentage of people will do what.

No #13, I’d rather the government not dictate what a sin is or isn’t.

It isn’t for the church to dictate to the government, nor for the government to dictate to the people. No victim, no crime.

Or are you so naive you think the government knows best what you should do with your life?

#18–Calin==thanks. Yes, we would both prefer that, but the government thinks otherwise. Naive to think they shouldn’t when they always have, and always will?

John Marshall famously reworked the argument of Daniel Webster to remind us that “That the power to tax involves the power to destroy…”

Wow bobbo…in favor of sin taxes now. Who decides what is sinful? Tsk tsk..you of all people…^_^

Who knows the profit margin on Cigs??

Lets see…

$2+ per pack to State and Feds..

0.25-0.40 to the seller..

0.40-0.60 to the tobacco corps..

NOW I ask a stupid question.

30% of the nation smokes at LEASt 1 pack per day.

100,000,000 people TIMES $2..PER day TIMES 365 days..$73,000,000,000(thats not millions) per year.. WHERE IS IT?? What is it being SPENT on??

#21–ECA–not a stupid question, but doesn’t your math indicate your assumptions are wrong? Why doesn’t it???

Anyhoo–nice little report here showing that EVERY tax increase has increased tax revenue WHILE decreasing the number of smokers.

Also shows a huge variation in tax rates. Americans are too lazy to smuggle?

I used to live in a dry county with the worlds largest beer cooler/store right across the state line.

I’m thinking people are going to cross state lines to make purchases and sell to friends.

Push this tax a little more and organized crime is going to have a new revenue stream.

At $11 a pack if people aren’t smuggling this product I’m shocked. Of course other products may be worth more but still. If there is a demand somebody should be trying to meet it.

#22–Here is that interesting quick review of state tax revenue:

http://tinyurl.com/5fzcus

The Tobacco Companies can’t be DRIVEN OUT OF BUSINESS FAST ENOUGH !!! They have KILLED MORE AMERICANS THAN THE ARABS !!! Why don’t we have a SHOOTING WAR WITH THE MARLBORO MAN ???

So here you recognize that higher taxes leads to more evasion, and maybe even lower revenues. Why can’t you apply this to income taxes?

@26–Dipshit Mike==do facts mean nothing to you?

Go read the link at #24–if you disagree, say so and provide a link? Otherwise, you really are worthless.

Too bad my China and Swedish mail order connection not allow to ship to US no more. $2/pack and get to the states in 4 days.

Bobbo, sorry if I wasn’t clear. Look through your chart again. The state revenue gains are not even close to the increase in taxes. Kentucky raises its rates by a factor of 10, and only doubles revenue?

This is what is predicted by supplysiders on income tax cuts. Dropping tax rates from 40% to 30% won’t drop revenues by a quarter as predicted, but by a smaller amount because of new growth and less tax evasion, and in some cases will increase revenue.

Unfortunately, your chart’s number’s don’t add up, and they are missing something.

# 25-JimD: you sir are a smoke bigot and an imbecile, Don’t compare smoking to the war, it has been going on for longer and teh timeframes cant be compared… and Smoking isn’t the leading cause of death as the government often states.

Obesity and all its health related problems are far greater contributers (hey lets increase the tax on upsized meals? or increase tax on obese people in general as they consume more, use more gas to get around, and are a burden on the health system in a number of ways), and so is alcohol but hey we already tax that heavily,

It’s just that a lot of overweight people also smoke (to reduce their weight) and their deaths are “counted” as smokers vs non smokers. Governments bend statistics to suit their agendas.

Taxing cigarette’s is fine to an extent, i’m sure we pay for a lot of health funding that goes to help non smokers. Just don’t go too far in the “name of helping people” via over taxing which in lower socio economic areas (where many people smoke) will encourage black markets, and crime to pay for the extra tax or smoking of other illicit substances. (or a worst case scenario, them growing tobacco themselves and cutting the government out of the loop.

Everyone has the right to smoke, as they do to drink or pray to whoever you want or to no one for that matter, although some cultures avoid these pastimes we are not one of them. Its only fair to not to pass your smoke on to others by smoking in designated areas.

Don’t take away what is a simple life’s pleasure for a lot of people.

As far as being a health epidemic or burden on society, get over it , everything kills you in the end. Actually HFCS, Obesity, Alcohol and CELL PHONES/WIFI in particular will be of far greater consequence.

On another note I suggest that people roll their own tobacco as there are less chemicals than manufactured ones. I can vouch for this as I have no smokers cough whatsoever, I also have anecdotal evidence of roll your own smokers not being affected as greatly as smokers of normal cigarettes which contain extra chemicals to keep them burning. sure my fitness may not be as good a certain non smokers but i do get regular exercise which is more than i can say for a lot of non smokers.

Suck It and enjoy it, but not around kids or in enclosed places or around others who are eating…

>>I also have anecdotal evidence of roll your own

>>smokers not being affected as greatly as smokers of

>>normal cigarettes

Heh. Heh heh heh. Yeah, those roll-your-own smokes are excellent. If we could only legalize them.

http://tinyurl.com/yserl