Search

Support the Blog — Buy This Book!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

For Kindle and with free ePub version. Only $9.49 Great reading.

Here is what Gary Shapiro CEO of the Consumer Electronics Association (CEA) said: Dvorak's writing sings with insight and clarity. Whether or not you agree with John's views, he will get you thinking and is never boring. These essays are worth the read!

Twitter action

Support the Blog

Put this ad on your blog!

Syndicate

Junk Email Filter

Categories

- Animals

- Art

- Aviation

- Beer

- Business

- cars

- Children

- Column fodder

- computers

- Conspiracy Theory

- Cool Stuff

- Cranky Geeks

- crime

- Dirty Politics

- Disaster Porn

- DIY

- Douchebag

- Dvorak-Horowitz Podcast

- Ecology

- economy

- Endless War

- Extraterrestrial

- Fashion

- FeaturedVideo

- food

- FUD

- Games

- General

- General Douchery

- Global Warming

- government

- Guns

- Health Care

- Hobbies

- Human Rights

- humor

- Immigration

- international

- internet

- Internet Privacy

- Kids

- legal

- Lost Columns Archive

- media

- medical

- military

- Movies

- music

- Nanny State

- NEW WORLD ORDER

- no agenda

- OTR

- Phones

- Photography

- Police State

- Politics

- Racism

- Recipe Nook

- religion

- Research

- Reviews

- Scams

- school

- science

- Security

- Show Biz

- Society

- software

- space

- sports

- strange

- Stupid

- Swamp Gas Sightings

- Taxes

- tech

- Technology

- television

- Terrorism

- The Internet

- travel

- Video

- video games

- War on Drugs

- Whatever happened to..

- Whistling through the Graveyard

- WTF!

Pages

- (Press Release): Comes Versus Microsoft

- A Post of the Infamous “Dvorak” Video

- All Dvorak Uncensored special posting Logos

- An Audit by Another Name: An Insiders Look at Microsoft’s SAM Engagement Program

- Another Slide Show Test — Internal use

- Apple Press Photos Collection circa 1976-1985

- April Fool’s 2008

- April Fool’s 2008 redux

- Archives of Special Reports, Essays and Older Material

- Avis Coupon Codes

- Best of the Videos on Dvorak Uncensored — August 2005

- Best Videos of Dvorak Uncensored Dec. 2006

- Best Videos of Dvorak Uncensored July 2007

- Best Videos of Dvorak Uncensored Nov. 2006

- Best Videos of Dvorak Uncensored Oct. 2006

- Best Videos of Dvorak Uncensored Sept. 2006

- Budget Rental Coupons

- Commercial of the day

- Consolidated List of Video Posting services

- Contact

- Develping a Grading System for Digital Cameras

- Dvorak Uncensored LOGO Redesign Contest

- eHarmony promotional code

- Forbes Knuckles Under to Political Correctness? The Real Story Here.

- Gadget Sites

- GoDaddy promo code

- Gregg on YouTube

- Hi Tech Christmas Gift Ideas from Dvorak Uncensored

- IBM and the Seven Dwarfs — Dwarf Five: GE

- IBM and the Seven Dwarfs — Dwarf Four: Honeywell

- IBM and the Seven Dwarfs — Dwarf One: Burroughs

- IBM and the Seven Dwarfs — Dwarf Seven: NCR

- IBM and the Seven Dwarfs — Dwarf Six: RCA

- IBM and the Seven Dwarfs — Dwarf Three: Control-Data

- IBM and the Seven Dwarfs — Dwarf Two: Sperry-Rand

- Important Wash State Cams

- LifeLock Promo Code

- Mexican Take Over Vids (archive)

- NASDAQ Podium

- No Agenda Mailing List Signup Here

- Oracle CEO Ellison’s Yacht at Tradeshow

- Quiz of the Week Answer…Goebbels, Kind of.

- Real Chicken Fricassee Recipe

- Restaurant Figueira Rubaiyat — Sao Paulo, Brasil

- silverlight test 1

- Slingbox 1

- Squarespace Coupon

- TEST 2 photos

- test of audio player

- test of Brightcove player 2

- Test of photo slide show

- test of stock quote script

- test page reuters

- test photo

- The Fairness Doctrine Page

- The GNU GPL and the American Way

- The RFID Page of Links

- translation test

- Whatever Happened to APL?

- Whatever Happened to Bubble Memory?

- Whatever Happened to CBASIC?

- Whatever Happened to Compact Disc Interactive (aka CDi)?

- Whatever Happened to Context MBA?

- Whatever Happened to Eliza?

- Whatever Happened to IBM’s TopView?

- Whatever Happened to Lotus Jazz?

- Whatever Happened to MSX Computers?

- Whatever Happened to NewWord?

- Whatever Happened to Prolog?

- Whatever Happened to the Apple III?

- Whatever Happened to the Apple Lisa?

- Whatever Happened to the First Personal Computer?

- Whatever Happened to the Gavilan Mobile Computer?

- Whatever Happened to the IBM “Stretch” Computer?

- Whatever Happened to the Intel iAPX432?

- Whatever Happened to the Texas Instruments Home Computer?

- Whatever Happened to Topview?

- Whatever Happened to Wordstar?

- Wolfram Alpha Can Create Nifty Reports

[Comment deleted – Violation of Posting Guidelines. – ed.]

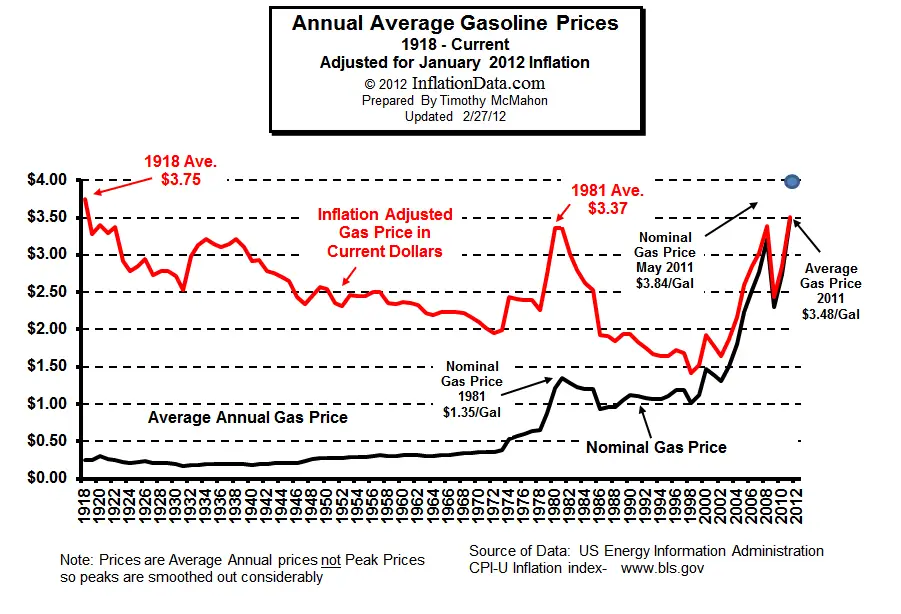

The whole “vs inflation” argument is pointless. Truth is that real wages haven’t kept up with inflation since 1977, so the pain to the working class person is higher than even the graph would indicate. The minimum wage is still pitiful at $6.50/hr, and the devaluation of the dollar makes our $4.00/gallon gasoline actually more like $8.00/gallon.

I think worker salaries should be tied to executive salaries, which have shot up 8000%.

Forget the stock market. I could have doubled my money by stockpiling petrol in 2002. Too bad I didn’t have any money, investments or knowhow then.

#1–Rick, I was thinking the same thing. That “interesting Misery Index” is really missing several factors if it shows Bush doing better than anyone else except Clinton. I’ll bet the Bushies love it?

Just who did crate the Misery Index and why isn’t median salary vs median home price listed?? Facts, statistics, charts==all interesting, just be careful which ones you use to understand an issue?

Congratulations for figuring out the obvious!

The problem isn’t gas prices, but the fact that the dollar has lost half of it’s value since the year 2000.

Nobody, in the MSM at least, wants to report on that story though. Not that the media is colluding with the government on such matters… god forbid.

Anyway, what would the government do, if people found out that inflation was really running at 6-7% percent per year, instead of the 2-3% that they report?

What about all the benefits and pensions that are tied to inflation for increases?

We wouldn’t want the wealthy elite to part with any more of their hard earned cash than necessary… would we?

It’s just easier to blame it on greedy oil companies and Arabs… isn’t it now?

bobbo said

That “interesting Misery Index” is really missing several factors if it shows Bush doing better than anyone else except Clinton. I’ll bet the Bushies love it?

The Bush administration stopped counting the price of food, fuel and health care, as of a few years ago.

THAT’S what’s missing from the index.

Be careful who you show that chart to in person… you might just end up with a piece of paper shoved waaay up your ass…

Heating, cooling, gasoline, food, daycare, healthcare… except for cheap chinese imports everything has gone so far up that people are really hurting. People that were living paycheck to paycheck (75% of American families) are suddenly finding themselves living on the edge.

But I have to grant the Bush administration one success: the have managed to control illegal immigration. ‘Conservatives’ have managed to screw up the American economy so bad that foreigners are going back to their countries in droves in search of better economic opportunities. It started with the educated (Indian, Chinese), now even the farmhands are leaving. Makes you wonder how soon before Americans start to jump our new Billion $ border fence heading north or south in search of a better life.

One would think the facts that support the chart would wake up Pelosi, Reid and the Democratic congress to permit drilling and exploration in the USA.

#7–jbenson==what would greater domestic oil production do except transfer excess oil profit to a few US Oil Companies instead of foreigners?

capiche?

Oil is so 20th Century. If we want to survive the 21st==renewables are the only way to go.

I pity those people that were misled into buying cars with poor mileage because it was the American thing to do.

Car that are only sold in the US for the most part, made & assembled elsewhere.

Oil, 1979: Experts say “it’s different this time.”

Real estate, 1979, 1989: Experts say “it’s different this time.”

Nasdaq, 1999: Experts say “it’s different this time.”

Real estate, 2005: Experts say “it’s different this time.”

Oil, 2008: Experts say “it’s different this time.”

POP! goes the bubble.

#9 “I pity those people that were misled into buying cars with poor mileage because it was the American thing to do.”

OK, I’m not American, but I think the American thing to do would be to invest your money in companies that are developing solutions to the problems we’re facing. I’ve put my money mainly on stack scrubbing technologies but increasingly been putting the bet on solar – especially nano collectors. I’m hoping the price point for nano-solar will be 5-10 years out.

1) Real Wages “keeping up” is bogus. The fact is that cost of energy as a percentage of income has continued to drop over the period so that’s why oil and gas prices have not until very recently begun to have an effect.

2) What’s wrong with high Oil and Gas prices? Isn’t that what the high priest of Global Warming asked for in Earth in the Balance?

3) 1/3 or more of this price is specualtive and driven purely by fear. Imagine if we had zero presence in the Mideast? Better? I think not.

Finally. all of these things are self-limiting and in that, Gore inadvertantly had it right ( ala a stopped closck being right twice a day ). Higher energy costs spur/force conservation and innovation which leads to lower energy costs in the long run…of course in the long run, as was famously said, we’re all…well you know.

The good days when there was a manufacturing class who could buy a home with a one person income. Now economy is in a void between a service industry and a service to service industry.

Just for the fun of it – Bush Job Approval Rating vs. Gas Prices.

There’s not enough detail in the chart to tell for sure… but it looks like, since 1970, the results of Presidential elections (i.e., whether the party of the incumbent is re-elected) in several cases depend on how the price of gas has been going. For example, in 1976, the incumbent Repubs were defeated when the gas price had passed 50 cents a gallon. Four years later, the Dems were defeated because the price had passed 80? 90? 100? cents a gallon. After that, you have to look at the slope. If the black line slopes up, the incumbent party is defeated. If it slopes even or down, they get re-elected. So now I’m wondering what’s going to happen to gas prices around election time, because who could be more cynical and pragmatic than the President’s back room boys?

I remember 1980-81 gas prices. I was a teenager working a part time job and quickly found that after going on a date each weekend and paying for the gas to drive my car to my part time job, I was not getting ahead. Although, I make more now decades and a couple of college degrees later, I see the same thing happening. For some, it won’t pay to go to work when an hourly wage after social security, etc…, is only slightly more than a gallon of gas again.

>>What’s wrong with high Oil and Gas prices?

Nothing, as far as I can tell. A catalyst for a better future.

>>Isn’t that what the high priest of Global Warming

>>asked for in Earth in the Balance?

Yep. The man is a prophet. That’s why he got the Nobel Prize.

Take a look around you. The roads are clogged with traffic. The driver lives in a single family detached home in a subdivision. The land that was countryside is an ugly sprawl. The chumps that live there spend more on gambling than all other forms of entertainment combined. Gas has been cheap. When most vehicles sold in America were not cars but pickup trucks and sport utility vehicles what happened? Did the idiot alarm sirens go off? Of course not, because the government stooge did not press the panic button.

Looks similar to a runup in gold prices. Can we bring Paul Volcker back?

Price is information and information is power. As fuel prices go, so goes food. Local farms are going to see more business. There’s always an upside. Grow local, eat local.

1. MEDIAN?? where in the USA was the price BELOW $1 in 1972??

2. I love the idea that wages arent shown, compared to CEO/directors Pay scales..

3. I WISH they would show MARKUP/PROFIT margins.

Lets do a candy bar price compared to Wages chart.

Who remembers the .10 candy bar and the SIZE OF IT?? Compare that with the Current SIZE and .60-.80 candy bars.

NOW lets add wages..

$1.80 an hour..when candy was CHEAP. AND now its <$6 per hour…STILL.

Thats about a 4X increase in wages, and an 8X in the price of candy(not including the reduction in size).

comparing SIZE…candy bars LOST about 1/3-1/2 in size. But, we have to work HARDER to get current wages..NOT less.

So the candy bar has gone up a comparative value of 10-12 times, and wages only about 4 times..

The “vs. inflation” chart is always valid, regardless of what is being discussed.

The question becomes if one line is reacting to the other in a given case. With oil, since it is the (pun-intended driving force of the economy, we should look for prices on other goods not to come down while oil does.

#18 – An honest question: If the price of natural resources goes up, there by taking away from the total amount of expendable income, where does the money to research alternatives come from? In other words, what are you willing to give up for this research, because you don’t get it for free.

jbenson2

One would think the facts that support the chart would wake up Pelosi, Reid and the Democratic congress to permit drilling and exploration in the USA.

Yeah, that would really help the cost of food and health care, both of which are going through the roof too.

[Rest of comment deleted – Violation of Posting Guidelines. – ed.]

A high percentage of the oil price increases of late have been driven by speculation and emotion. If an ayatollah farts, the price jumps up another dollar!

How do we get this under control? Ban all trading in oil futures for 6 months and watch the price plummet.

Well done. You just demonstrated that the price of gas today, when adjusted for inflation…is the price of gas today. It’s interesting, but meaningless, as the price of oil is spiking right now, no matter how you chose to look at it.

We need to tighten regulation on speculation, and ditch the colonialist policies of Bush. Oil is just a product. It’s a lot cheaper just to buy it than to go to war over it, and the speculation over it is hijacking the basic supply/demand balance of a healthy market.

24 sounds like your classic democrat voter.

The graph shows oil prices going down with increased demand. Automobile saturation could not have been very much in 1918. It also shows the affects the middle east has on our prices with the embargo of the 1970s and instability of today. I can only assume that prices would have continued to drop with a stable middle east.

The big shame is this country sitting on it’s ass for 30-40 years with thumb up bunghole.

Have we built more nuclear power plants? No.

Raised fuel efficiency standards? No.

Allowed exemptions for SUVs and light trucks? Yes.

American car makers continue making gas guzzlers? Yes.

Did government encourage use of said gas guzzlers? Yes.

This country was really fucking lazy and we deserved this problem.

Okay everybody, repeat after me.

1) Oil supplies have no relation to the cost of gasoline

2) Refinery output has no relation to the cost of gasoline

3) Chavez, Ahmadinejad and the rest of the middle east’s anger towards us have no relation to the cost of gasoline.

4) Drilling in Alaska will not influence the cost of gasoline.

Summary – oil is a purely speculative market. Its valued at what the market traders think its valued at. The whole idea of supply and demand balancing out prices is bunk, it always was.