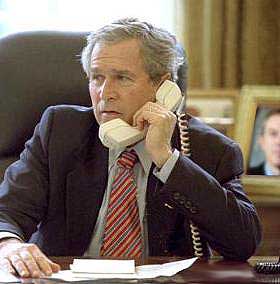

U.S. homeowners who could face crippling mortgage payments will have a hard time getting help if they call a telephone number President George W. Bush recommended on Thursday — he gave them the wrong number.

“I have a message for every homeowner worried about rising mortgage payments: The best you can do for your family is to call 1-800-995-HOPE,” Bush said…

The wrong number Bush gave out…belongs to the Freedom Christian Academy which offers religious-based curriculum for home schooling and is located in Ponder, Texas northwest of Dallas.

The correct number is 1-888-995-HOPE (4673).

What percentage of these homeowners KNEW they were buying a home they could not afford and were consciously risking that the market would continue rising to cover their rising payments, and just walk away from the home if the market went down? ((I’d say 95%)

Any bail out here unavoidably helps:

1. Calculating Home buyers

2. Greedy Banks and Investors

3. Whoring Congressmen

and of course–hurts the taxpayer and the rational honest home buyer.

Why should the market not be allowed to work its magic here?

Giving out a wrong number isn’t so bad I suppose. It’s not like he sent thousands to die for no good reason.

oh wait…. he did.

Other than using the super secure 1980’s phone handle upside down is that picture of Tony Blair on his table? That’s just creepy.

You are absolutely right ‘Bobbo’. Why must the government swoop in and rescue those who have made terrible financial decisions?

I just read yesterday (I think in an AP article) that people in this mess are also highly likely to have too much credit card debt, bad car loans and likely to default on those as well. Should we rescue people with those as well?

As far as giving out the wrong toll free number, wouldn’t the blame be more appropriately given to the speechwriters, aides, etc.? Looked to me he was reading a prepared statement. Or maybe it was a test to see if the brainiacs that took out no money down, adjustable rate mortgages without enough income can figure out the actual number.

It doesn’t even rescue them.

It delays the increase for a short time. And not enough for their incomes to then make up the difference in those years.

It not a bailout, it is a stop gap in an election year to make his party look good.

A feel good POS.

Cursor_

This whole mess was fueled by the government interfering in the private sector. The Dems forced the agencies to relax the lending requirements as to allow unqualified buyers to purchase a home far beyond their means.

The feel-good fix government always comes up with has created another financial problem where none should have existed in the first place. Oh what a happy day when they take over health care.

THE MARKET HAS TO WORK, or suffer.

YOU SHOULD NOT, buy it out…

If the banks take a HIT, ITS THEIR FAULT….

Isnt that HOW business is supposed to WORK??

What did you expect, giving 5% loans. The POOR wouldnt Jump into it?? AND THEN, in fine print that the LOAN would go up to 14%+, and THOSE POOR werent going to be ABLE to afford it.

This is as bad as BAIT and Switch. With your written permission.

ECA, you are suggesting that real estate agents are all crooks, or that poor are either too stupid to understand the conditions of their loan or too stupid to read.

The poor that lost their homes gambled just like everyone else and extended themselves beyond their means.

The government is now intervening and assisting all of the idiots that bought Microsoft Vista. Call 1-800-VISTA-SUX

>>you are suggesting that real estate agents

>>are all crooks

Pretty much. Those that aren’t crooks are too stupid to live. And the predatory lenders are certainly all crooks. They should be tased in the testicles. Each and every one.

Other than the fact that “dvorak.org/blog” suffers from a classic case of Bush Derangement Syndrome, can somebody please explain how making a mistake makes one “thuggish?”

Making a mistake by itself does not make one “thuggish”.

But come on; he WANTS to be a thug, he just doesn’t have the cojones to pull it off.

What makes predatory lenders ‘crooks’? People taking the loans wouldn’t get the loan otherwise.

I agree, the President shouldn’t be going to banks and trying to force them to rewrite their contracts.

The foreclosures are less than 1% of the market. Not worth worrying about.

>>What makes predatory lenders ‘crooks’?

>>People taking the loans wouldn’t get

>>the loan otherwise.\

That’s because they SHOULDN’T get the fucking loans, because they can’t afford them.

And that’s not even to mention the scum-sucking slimebags who steered people with good credit towards the much-more-expensive “sub-prime” crap.

Forget about the lawyers (they make these lenders look like Mother Theresa); those fuckers should get a taser shot right in the family jewels.

God Damn Mustard! Don’t sugar coat it, tell us how you really feel!

You say they can’t afford them, but I would guess that a large number of the people receiving their loans DO make their payments.

I also don’t think these home mortgages really qualify as predatory lending, how much interest rates are they being charged?

>>You say they can’t afford them, but I would

>>guess that a large number of the people

>>receiving their loans DO make their payments.

I suppose that depends on what you mean by “a large number”. Over 1/3 of people with sub-prime mortgages are behind in their payments.

>>I also don’t think these home mortgages

>>really qualify as predatory lending, how

>>much interest rates are they being charged?

The sub-prime ARMs start out at 7% – 10%, and when the rate gets adjusted, it goes up to 11% to 15%.

Any way you slice it, it’s predatory. And the scumbags who sold these highway-robbery loans in the first place should have high-voltage electrodes applied to their testicles.

Too bad Dubya didn’t give out the number to MoveOn.org…

THAT would have been funny!

Freeze interest rates for 5-years?? In the hopes housing prices increase by then, so these people can sell instead of losing the house to foreclosure?

How many will sell, and how many will wait to see if they get another freeze/loan extension?

1-800-IMP-EACH.

There, FIXED it.

Well if the US was really an economic and manufacturing power there wouldn’t need to be any help for people not be able to pay for their mortgages.

I guess that is stating the obvious huh?

Cheers

If I called the president about my mortgage rate, what would he do? Honestly. Could I get a loan from the guy?

10-15% doesn’t really qualify as predatory lending in my book. You might have to pay higher rates than that even with good credit to start a business.

Compare this to pawn broker rates which can be 5% a month.

So 60% of people should be without homes because you think their interest rate is too high.

More of the elite wanting to keep the poor ‘in their place’

ofcourse he gave out wrong number, there is no hope for all you pig eating obese american trash.

Pray for mercy before it is too late, this is your only hope!

You think this was an accident?

LOUDLY SUPPORTING popular programs and then QUIETLY KILLING THEM is S.O.P. for the Bush administration.

Process:Step 1

*Create Free Web Account

*Web Software Determines Qualification

*Login to New Account

Step 2

*Free Consultation with Attorney

*View Free Evaluation for Consumer

*Your account that you created for Free has a “Do It Yourself Guide” within the system to print off is offered from Attorney.

Step 3

*If you Opt In For Attorney Representation Borrower Pays ONLY $300

*Fax in required documents via exclusive Barcode Fax and the process starts. See below for details of the Recasting Process through Myrecast System.

MyRecast Requests Original Mortgage File from Lender to be Audited – Power of Attorney Agreement Faxed into System for Acting Attorney – Cease and Desist filed with Lender – Once file is received from Lender MyRecast will audit mortgage file for Predatory Lending and Deceptive practices violations from the lender. Software Program has Original Subprime Lender Matrix and Guidelines Underwriters used in qualifying consumers loans. If a Lender refuses to negotiate attorney will request a HUD Expert Professional Witness to review file and File HUD and or RESPA violations against Lender. If necessary additional fee of $250 will be required.Completion to Modify Lenders Loan for Consumer. Upon modification of note a final payment of $425 will be due. If negotiations fail attorneys will file a stay to avoid foreclosure or acceleration of the loan and litigation in behalf of the consumer will be available.

What about the lenders that promised an easy refinance, I have made every payment on time and in fact I am ahead one month, but went with the adjustable loan to keep the payments down. Now I am stuck with good credit and the homes value has dropped almost 10%. To all those scum bag lenders that make promises that they can’t keep should die a slow painful death.