A Palm Inc. buyout could be finalized by Thursday this week, demanding $20 or more per share, according to sources close to the situation. Nokia is seen as the leading vendor bidder; while Palm’s management is said to prefer a private equity buyer.

“They really want to get it closed on the 22nd,” a source told Unstrung on Monday morning.

Nokia is the key bidder in the vendor world. The number one handset vendor is said to be considering a bid at $19 to $20 a share.

What may surprise some, however, is the talk that Motorola has been reconsidering its position and may try to block Nokia with a bid.

A private equity buyout is still said to be Palm management’s preferred option, however. Motorola, Nokia, and Palm haven’t yet responded to calls for comment.

Take the money and run!

I am surprised that Dell is not bidding:

http://www.sramanamitra.com/blog/642

Who’d want to buy a brand that’s about to be passed by Apple (not to mention every foreign handset maker)?

1 – That’s interesting. And it makes sense.

There are also rumors of Google wanting a Blackberry/mobile-phone type product (see http://tinyurl.com/322ygc for cio.com take on it) – maybe they’d be naturals for a bidding war here too.

If Nokia buys it you can forget about any more CDMA Treos. Nokia seem to only want to play GSM.

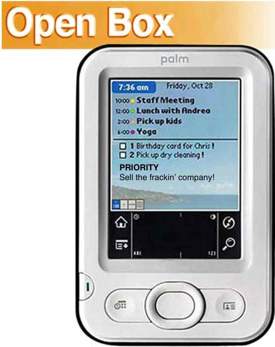

I love my Palm and use it everyday. I’m non my third one. But I suppose it is doomed. Just like my dedicated MP3 player … all to be merged into our cell phones.

whatever the outcome, i hope QC improves..

i’ve had 2 palm tungsten E2’s fail within 3 months of usage..mainly what seems to be due to a faulty power button. meanwhile my old Palm V still works flawlessly..

i’ve seen alot of posts in various forums of Palms failing in the past year or so..

-s