In a move that is expected to jump- start rebuilding along the Mississippi Gulf Coast, State Farm Insurance says it has reached an agreement with state officials to pay hundreds of millions of dollars to owners of homes along the coast that were wrecked by Hurricane Katrina.

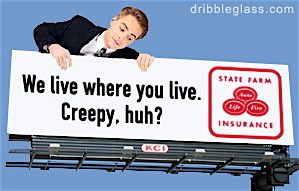

It would also remove a major public relations headache. While State Farm and the other insurers may have had some strong legal arguments, they have been widely perceived as insensitive and uncaring. In many cases, residents whose houses were reduced to concrete slab foundations received just a few thousand dollars in payments. Some received nothing.

State Farm got a vivid picture of the hostility toward it in the first jury trial a little more than a week ago. Senter abruptly declared that State Farm had failed to prove its case and the jury quickly came back with a decision requiring the company to pay $2.5 million in punitive damages to a couple in Biloxi who lost everything in the storm. The judge also awarded the couple the full value of their insurance policy — $223,000. State Farm had maintained that it owed them nothing.

You would have to pay me to insure with creeps like this. Voting with your dollar is an American tradition — and boycotting insurance companies that refuse to help Katrina victims is legitimate and overdue.

Bill Gates from the Simpsons: “I didn’t get rich by signing checks.”

I think PBS or CNN did a show about this. They where standing in the middle of the neighborhood that had been leveled. SF said storm surge destroyed those houses, but as the camera panned left, the neighborhood across the small bay was still standing but battered. The owners were claiming that a tornado had swept through and leveled everything. After that show my wife and I decided to never get State Farm insurance in the future.

I put partial blame on federal flood insurance for the current mentality.

Eideard,

You are absolutely correct. If more people would spend their money with companies that believe in serving the customer, we would all be in a better place as consumers…

good for the them

The insurance companies have gotten out of control in this country

I for one would like to see the insurance companies forced into nonprofit status so that they would not be beholden to stock holders and then all profits would have to be reinvested in the company or saved for future disasters or as now invested

Pmitchell,

Regarding the non-profit status, please see HMOs for how well that works. Bill Maguire of United Health just got a billion dollars for quitting!!!!!

If there were multiple possiblities for what caused the damage and destruction, State Farm’s view seems to have been “let’s go with the one which costs US the least”.

Oh, and off topic, WTF with this slow down cowboy crap when I haven’t posted in 1/2 hour?

NEVER accept a Total Loss settlement at face value from your insurer, 99% of the time you lose thousands.

Often the Carry-Over into a TL are the AirBags, which from the dealer can easily cost 1.5K each to replace.

Yet you can get OEM replacements or from a recycler for less that 500$ on most models.

You Insurer knows this and makes more money on the parts.

Of course, use your judgement. If you don’t want it repaired at all and be forced to drive it until the end of your payments, simply ask for the estimate report of the damages (it’s computerized) and get a quote from a nearby recycler.

On really really bad smashes, this tactic can earn you easily an extra 500$.

Keep in mind that State Farm likely believed it was living to the intent of the policy.

I don’t want to sound uncaring (and I’m not saying that State Farm was right), but I worry about the courts forcing insurance companies paying for claims that are not covered. This is going to drive a huge increase in everyone’s policy.

The problem for many in Florida and along the Gulf coast is that there are few insurance companies willing to insure them. More and more companies are dropping storm damage from policies due to the increase in people living there and the resultant number of claims.

State Farm always did suck.

For the amount of money State Farm spends on advertising every year, it would seem money well spent to settle these claims upfront to avoid bad publicity and lost customers. Instead of paying out these claims upfront and spinning it as a plus for the company through good public relations, they are now forced to pay out these claims and suffer an irrevocably damaged reputation that all the advertising dollars in the world couldn’t reverse. Just a bad strategic blunder and a horrible lack of ethical principles.

#9 — not to be rude 🙂 but, are you still waiting for the Tooth Fairy?

Ask any auto body mechanic who’s tight with a claims adjuster from State Farm. They’re under strict orders to reduce every claim by a minimum of 5%.That may not seem like much to you; but, it runs to millions in increased profits — from being unethical.

They are the worst of a sleazy industry.

I own a home in the Caribbean, for 200K worth of coverage costs me approx $500.00/mth. The house is worth much much more than that, but I cant afford to insure for the max. After Hurricane Marilyn in 1995, the insurers dropped the policies of all homes built of wood, whether they filed a claim or not. The insurer was Lloyds of London. People who had mortgages were FORCED by the banks to take out insurance from disreputable companies to the rate of 2000.00/ mth.

The insurance industry is broken.

Shortly after Katrina hit, my wife’s sister was informed by State farm that her coverage policy was “lost” and there would be no way to honor her coverage based on her word…..

She’s now one of the many that will be getting her money due, as State farm was found to be destroying peoples policies and then re-writing old documents and time stamping them to state farms benefit.

It’s a good thing that my wifes sister kept her documents in a bank vault and proved how sleazy SF really is.

None of my Family carries SF coverage anymore, for anything.

Sundog – why? because it responds to risks? That’s bull.

Yes in this case State Farm were being pretty despicable – but Lloyds dropping wooden houses was them saying “look, a fool can see wooden houses are freaking stupid in a hurricane”

I mean god – we’ve all heard of the three little pigs…

It’s like people that complain they can’t get flood insurance in a flood zone. Well duh. You buy a house in an area that is going to get flooded – you’ll get flooded. Insurance isn’t a game of “when” something happens, it’s a game of “if” something happens.

#9 – only if the sole intent of the policy was to make money for whoever owns State Farm. Funny, that’s not what their ads claim. But it’s consistent with god’s remark in #13.

Wish I could believe any other insurance company is fundamentally better or more principled. They’re corporations, loyal to nothing, their decisions made by bean-counters who rarely look past the current fiscal year, their public face only a calculated projection. You can’t switch from one con man to another and expect significantly better, or even different, results.

SN (#1) is right. It’s about the money, that’s all.

16. My house was built of stone, steel and concrete. But there were many stick built wooden structures that are built over code and did just fine. My point is, the insurance company, Lloyds, had no problem accepting money for all those years, yet when needed, they cancelled the policies of people with wooden houses (local West Indian families) who couldnt afford to rebuild their homes, without notice.. If done correctly, a wooden home can and does withstand the forces of a hurricane. Most of the damage was done by tornado spin-offs from the hurricane. And that could probably happen to you Gregory.

#16 — please talk to your friendly neighborhood banker [?] before you carry on with your excuses for lousy insurance companies.

You cannot get a mortgage if you live in a flood-prone area without flood insurance. That is the reason for federal flood insurance. The insurance industry creeps won’t even offer pool insurance [no pun].

The reason New Orleans residents bought homes and got mortgages w/o flood insurance — was because the incompetents in the Army Corps of Engineers “guaranteed” the levee system was perfection and flood insurance wasn’t needed.

Of course, that guarantee, the management of FEMA and the American insurance cartel can be combined with $1.60 and get you a cuppa at Starbucks.

#6 HMO’s are NOT non profit organizations they are for profit corporations non profits are charities, country clubs and other organizations but not HMO’s

#20:

Uh, no. At least not in Minnesota:

______________________________________________________

An HMO is an organization that delivers a stated range of services to a defined enrolled population for a fixed monthly or annual premium. In addition, the HMO must assume at least part of the financial risk and/or gain from providing the services. Minn. Stat. §62d.02 defines a HMO as:

…a ***nonprofit corporation*** (my emphasis) …which provides, either directly or through arrangements with providers or other persons, comprehensive health maintenance services, or arranged for the provision of these services, to enrollees on the basis of a fixed prepaid sum without regard to the frequency or extent or services furnished to any particular enrollees.

______________________________________________________

btw, this “slow down cowboy” thing is a real pain in the ass. I haven’t posted anything in months.

Adding to Mister Mustard in regard to #20,

38 of the 64 Blue Cross Blue Shield plans in the USA are non-profit as well… http://www.consumersunion.org/conv/bcbs.html

I stand corrected

I did not know that thanks for the info

well with that avenue screwed, start [edited] them ! maybe they will get the clue we are tired of getting screwed by them

The whole insurance industry has become one big scam. They only want to collect, never to pay. And if you are successful in collecting on a claim, you and your property are blacklisted. Then see how your premiums rise and see how it affects any attempt to sell your property in the future.

State Farm is a mutual insurance company. That means that the policyholders are the company’s owners. So, while not technically a non-profit organization, there are no stockholders or owners demanding dividends and/or capital gains. No one in a mutual company profits if they deny a claim or unjustifiably reduce a claim payment by 5% (or any other absurd amount). If these Katrina claims were denied it’s because, sadly, the available evidence showed that the damage sustained (i.e. flood) was not covered by the policy. Lawyers, politicians and the media are taking advantage of the public’s emotion and ignorance to make a name and money for themselves. They don’t care that insurance companies (not just State Farm) will have to pay for something that the policies were never intended to cover and that it will drive up the cost of everybody’s insurance.

Let’s not be so fast to celebrate.

State Farm insured people against wind damage with SPECIFIC contractual exclusion from flood damage. This was not hidden, it was up front.

Wind is what people paid for, flood is what destroyed their homes. If they wanted flood, they needed to pay for flood.

State Farm should not be liable – unless we are to trash the concept of contracts with fixed terms and just go to big guys pay, little guys win.

And in this latter world, I think all will be surprised as to how small “big guys” will become and that concepts like shared risk insurance will become unavailable to anyone with the potential for a claim – any claim.

This is another example of where the conservative “free markets solve everything” dogma just isn’t true.

Without regulation and government control, insurance companies would screw consumers as often as possible.

I’m not a fan of insurance companies, but if they decide that it’s not worth offering hurricane insurance any longer, what the hell can you do about it? Oh, I know! We’ll let the taxpayers subsidize low premiums for all! YAY! I can’t afford a house myself , but please, raise my taxes!

State Farm is supposed to cover massive hurricanes that destroy a whole city? Was this included in everyone’s policy? This is sounding like the insurance companies that didn’t want to cover 9/112 because it excluded acts of war.

As a person who has been screwed by a famous Insurance company (I won’t say their name but it rhymes with “Freight Arm”) I have to say, I’m not resonating with your sympathy for them.

As I understand it, the insurance companies are screwing their customers because they had hurricane insurance but not flood coverage.

C’mon! Hurricane Katrina caused the damage — — that’s just obvious unless you’re a sleazy insurance company who, I guess, call it “Flood Katrina”.

This is why we have governments — to protect us from private industry.