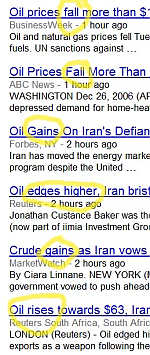

The confusion begins on Google News front page:

It then continues inside:

Becomes a laugh riot when all the stories are examined:

The following clips from Google News show the reason that much reporting in the USA is useless. Is oil up or down? It apparently depends on who you ask and when you ask. Is it up or down because or despite of Iran? Who knows? Some say because, some say despite. When you put all these stories side-by-side it’s actually laughable.

Here the Boston Globe reports falling oil is extending its loses. Extending! And it blames it on the weather?

Curiously the SJ Mercury News says oil is rising and it too blames it on the weather! But the headline “Oil Rises Despite Warm Weather” when clicked on reveals the Headline: “Oil Prices Fall More than $1 on Weather.” Hey! Now the entire post seems to be missing from the Google list.

Here’s a good one. Reuters headlines higher oil prices but reports in the article a fluctuating price. So what is it?

Marketwatch, Bloomberg, FOX and Reuters South Africa say oil rises because of Iran defiance of U.N. Later reporting says oil falls “despite” Iranian defiance.

So here’s the wonderful analysis. We find two possible causes for a move in prices. They may or not be the actual reason. But they sound good. One is warm US weather and the other is Iran telling the UN to get stuffed regarding its nuclear program. Prices go up with oil and it’s because nobody cares about the weather but they are freaked about Iran. The price goes down and it’s because of the weather or because nobody cares much about Iran.

In this instance the entire media mechanism was caught in a whipsaw. The price of crude looks like it was trending up in the morning then reversed right during a news cycle making everyone have to scramble with headline changes and reverse analysis. The reason it went up becomes the reason it went down – somehow. I can hear business editors telling frustrated reporters to “make it work!”

Who is served by this ludicrous nonsense?

It’s not about analysis; it’s about making a short deadline in a 24X7 world; it’s all about word count. Actual accurate analysis is more by accident then by design.

There is no meaningful feedback loop to correct for inaccurate analysis. I used to like the weekly TV magazine shows because they where doing in depth analysis of an issue. Now it all feel good stuff. Most news today is done by ” entertaining clowns” then by serious journalist.

It cost too much to do actual in depth accurate analysis within 24X7 deadline. For me, I get more from news by not watching it and hearing what’s important as told to me by co-workers.

If you don’t check with at least 10 different sources for any news today, you wont get the full story. Journalism has nosedived. The only guy telling it like it REALLY is, is Lou Dobbs.

Uh, before I comment on journalists, commentators, and analysts, I should ask…

John, do you consider yourself a journalist, commentator, analyst, or none of the above?

#2- I would say 10 might even be low balling esp. if you want an international perspective. Being (reasonably) well informed on accuracy in reporting (forgetting journalism for the moment) is a full time job, and it ain’t easy…

All news is spun and distorted by the ultra-secret Government Disinformation Agency to keep us all off balance and under control.

Just do it the old-fashioned way. Buy oil futures at $18/barrel — then, have the politicians in your pocket invade the Middle East.

Was anyone dumb enough to think the price would go down when Dufus invaded Iraq?

#5 The truth is the government has implanted you with an ultra-secret RFID chip.

The ultra-secret Government Disinformation Agency dosn’t need mass media to communicate, they have satellite(s) directly

communicating to your brain while you sleep. Thus keeping us all off balance and under control.

To silence the voices, you need to line your hat with tin-foil. This also works against inter-planetary communications. Works for me.

#2,

And I guess you check out each story several times. I suggest that most news stories will use a major news source to print their story. AP, UPI, and Reuters supply most of the news feeds. Actual reporters from other outlets, including CNN, NBC, CBS, NY Times, and Washington Post usually only cover ongoing trouble spots. It is very expensive to support a journalist in the field.

The problem here is that google was running headlines that were fluctuating with the price of oil. As the stories were written, they became dated within minutes. The Stock Market demand instant information. Most investors are to stupid to also want insightful analysis too.

WELL,

considering that OPEC keeps THEIR price at $25-28 per barrel…

Whose making the other $30-40…

But, then you have to wonder something…

THE USA dont get OVER 90% of its oil FROM the middle east..

No shipping costs…

60% from canada.

25% from California.

MORE from South america…

And oil wells were Capped(there were millions of them) LONG ago when gas was REAL cheap…..$0.10 per gallon. And all the corps had to do was Keep the mineral rights to the land for YEARS.

So,

Why is US gas so expencive???

ITS a commodity… Its bought sold and the PRICE goes up.

Just kill the Stock exchange.

Biz writers also regularly fail to notice the difference between real prices (i.e., inflation-adjusted) and nominal prices, and this affects reporting on oil, interest rates, metals, etc., and the obligatory “X-year record” stories.

Even when the nominal oil price peaked recently, it didn’t come close to surpassing the 1979 high in real dollars, but there were endless “Oil hits new record high!” headlines. (Such stories also fail to note that the American economy is far less energy intensive than it was 25 years ago, so expensive oil doesn’t bite as badly.)

But articles on daily movements in any index or commodity, especially those that attribute them to specific causes, are obviously useless, and such a straw man isn’t really worth tackling, Mr. Dvorak.

There are only 3 sources I completely trust for news: The Daily Show, The Colbert Report and the Onion. And dvorak.org/blog for commentary. 🙂

I use Look Out The Window News & Weather. If rain is falling, then it’s gonna rain, if it ain’t then it ain’t. If there is no incoming then we’re ok, if there is then we ain’t. I find that if I follow the news too closely I get depressed, and suspect the viability of the human race as a survivor species.

#10 ” Such stories also fail to note that the American economy is far less energy intensive than it was 25 years ago, so expensive oil doesn’t bite as badly.”

Sorry, but I beg to differ. Twenty-five years ago, the average American household used 600 kw-hrs of electricity a month. That number is closer to 1100 now. And goods consume one hell of a lot of energy to produce. Twenty-five years ago, I earned my living by researching new chemical products. In the half-dozen processes I worked on, energy accounted for 15 to 30 percent of the manufacturing costs.

Why do economist continue to underestimate the impact energy has on the economy? To paraphrase a marketing report from last week: “Factoring out energy prices and housing, the cost of goods still rose 2 percent last month.” Excuse me? Factoring out the cost of energy? Has any damn economist spouting such nonsense ever tried running a manufacturing business without paying their energy bill? If energy prices rise 20 percent, you think that a business is going to eat that cost, or pass it on to the consumer? There appears to be a 4 to 7 month delay in passing energy cost through to the consumer. That 2 percent rise in inflation for November came as a result of the $80 we paid last May for a barrel of oil.

You want to maximize your 401k growth? Pay attention to energy prices — a rapid rise in energy prices will be followed a few months later with a bearish market; whereas a significant drop in energy prices almost immediately triggers a bullish market. It is not a coincidence that the booming market of the 90’s coexisted with the cheapest energy prices since the ’73 oil embargo.

what i find disconcerting,

Is that Power, Nat gas, and water has risen, 30%+ in the last 5-7 years..

And new houseing ISNT cheap, even tho they use better construction, and lesser rescources, and have better efficentcy and insulation, then anything built 30+ years ago.

Iv said before, Efficentcy SUCKS…

If you had a small town and all the heat supplied with 60% eff heater cost you $60 per month.

If 1 person found a cheaper 99% eff heater and used it, and dropped his bill to $40, it would be fine.

But, as other chaged over to Better heating.

The gas Corp would say…”We aint getting enough money” raise the price.

And you will be BACK paying $60 per month.

#13: The statistics you cite aren’t the whole picture. Economists correlate GDP to total domestic energy consumption, both in units of energy and dollars spent on energy, and find that in both cases, US economic output has grown far more than energy consumption in the last few decades. This is to be expected, not just from new efficiencies but also from the shift from manufacturing to services.

This is a major reason that high oil prices haven’t caused a 1970s-style shock to the US economy.

I remember long ago when AP and UPI both reported the GNP rising 2%. One agency reported it to be a “healthy 2% increase” and the other reported it to be “an anemic 2% increase”.

Can’t anybody just report it as a 2% increase and save the bias for what used to be called an “editorial”?