Big Picture catchs a minor story, with big impact.

You may have missed this over the weekend: The Saturday WSJ reports that “More than $2 trillion of U.S. mortgage debt, or about a quarter of all mortgage loans outstanding, comes up for interest-rate resets in 2006 and 2007, estimates Moody’s Economy.com, a research firm in West Chester, Pa.”

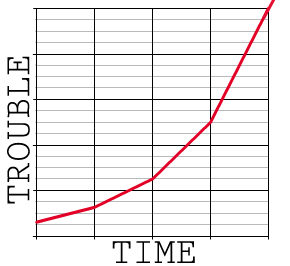

[…] In the hot housing market of recent years, many households took advantage of “affordability” mortgage loans — heavily promoted by lenders — that hold down payments for an initial period. Now the initial periods are coming to an end on many of these loans, leaving borrowers to face resets of their interest rates that can cause monthly payments to shoot up between 10% and 50%

[…] Sure, that sounds pretty bad, but how awful can it be? Well, the worst case scenario is a wave of defaults, foreclosures, and forced sales, forcing home prices appreciably (depreciably?) lower. (more…)

I know that I can’t afford to buy a house here in Northern VA. I suspect a lot of other people couldn’t either if it weren’t for these crazy martgage schemes. I’ve also seen people around here with these huge new houses that cost $400,000 with no furniture because they can’t afford to buy any.

Excellent! I have been waiting for the housing market to crash so I could buy a house. I should have a down payment all saved up by the end of the up coming recession.

John, you must have read the “Grapes of Wrath” one time too many. Long before the potential of casatrophic widespread default, lenders will renegotiate terms as they want to be eventually paid. One should worry far more about default on over-financed automobiles, credit card debt or other unsecured loans that may occur as a secondary effect.

I’m in the middle of buying a foreclosed property that originally sold for $71,000 (www.zillow.com). Research indicates a crazy expansion of prices in my area, (25%) per year over last 4 years. I’m thinking about walking away from the market for 12 months to see where it settles, but that would cost $13,000 in rent.

Hey BL….just what part of New Orleans is that house in?

You can’t buy a single car garage for 71,000 dollars in the bay area.

And that 400,000 dollar Northern Virginia home, that will buy you a 45 y/o 3 bedroom, fixer upper in a not so hot neighborhood where wearing body armor when out side would be a good practice……lol

The Southeast is the only area of the U.S. that I think you can get a house for $71k that hasn’t been condemned. I remember 15 years ago when people there (MS, AL, LA) were buying houses for $25-40k. Heck, they were driving big 4×4 pickups that cost more than that.

I hope the market dumps, and the foreclosure firesales happen. I would love to pick up some rental properties cheap. Also, it would allow 1st time homeowners an actual chance at affording a house, which would be wonderful in our area of Calif.

Not a house, a condo in MA.