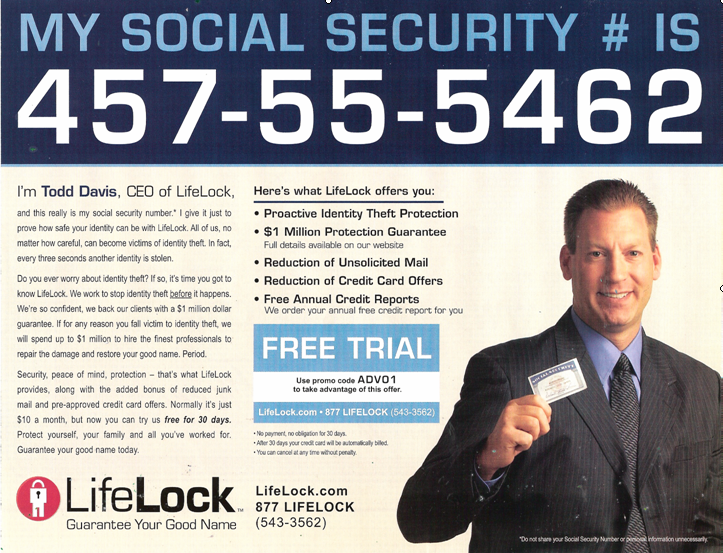

For a time, the ads were everywhere on TV and radio, the ones with the head of a security company brazenly challenging would-be thieves to try to steal his identity. Richard Todd Davis, CEO of LifeLock Inc., was so confident in his company’s ability to protect his identity that he publicly revealed his Social Security number: 457-55-5462.

But according to a new class-action lawsuit filed last week in Jackson County, LifeLock’s identity theft protection services were so inept that Davis’ personal information was stolen repeatedly. “While LifeLock has only publicly acknowledged that Davis’ identity was compromised on one occasion, there are more than 20 driver’s licenses that have been fraudulently obtained [using his personal information],” the suit states. “Furthermore, a simple background check performed using Davis’ Social Security number reveals that his entire personal profile has been compromised to the extent that the birth date associated with his Social Security number is Nov. 2, 1940, which would [inaccurately] make Davis 67 years old.” “Through its advertisements, LifeLock misrepresents and assures consumers that it can protect against all types of fraud including, without limitation, computer hacking, password theft and other noncredit-related theft,” the suit reads.

“This is a service that you pay for and it kind of lays dormant,” said David Paris, an attorney with the New Jersey firm Marks & Klein who is heading the case against LifeLock. “So no one knows that they’re not getting what they paid for, because they don’t know what to look for.”

Paris said that consumers can activate for free the same safeguards that LifeLock does, but the company fails to mention that in its marketing campaign.

The suit alleges that LifeLock’s services can actually harm its clients because the constant placement of fraud alerts can prevent them from getting a home loan or refinancing their existing loans.The suit also traces what it calls the “nefarious origin” of the company, including the background of Robert J. Maynard Jr., who co-founded the company with Davis in 2005.

“Upon information and belief, Maynard developed the idea for LifeLock while sitting in a jail cell after having been arrested for failure to repay a $16,000 casino marker taken out at the Mirage Hotel in Las Vegas,” the suit states. The suit also maintains that Maynard stole his father’s identity by using his information to get an American Express card, which he used to rack up more than $100,000 of debt.”In Wisconsin, a woman’s debit card was stolen, and that thief used that card to sign up for LifeLock,” he said. “If you can’t provide the basic information to verify someone for subscription purposes, how can you be relied upon to protect people’s identities?”

Feel free to use his SS#, it seems everyone else has.

Just another sham company on par with male performance enhancers. Just shred your bills and bank statements, check your credit report regularly and use common sense and you won’t have your identity stolen.

I never did like so much of a persons life tied to a single number, and if the number gets compromised (or just randomly generated), someone could steal so much of your life. That being said, I really don’t know of a good alternative.

Actually, if you read what Lifelock promises vs. what the suit alleges, the suit comes out bogus.

Someone using a SS# to acquire a new account, drivers license, etc. is not the same as compromising an existing account.

There are a number of banks around the country using the service. I don’t know if they’re worth the fees charged to individuals; but, at the moment, I get them for free.

Given how much the quarterly and monthly checkups piss off sleazebags like Experian, that alone makes me happy.

[Comment deleted – Violation of Posting Guidelines. – ed.]

owned

I’m with Bob [#2]. I’m not in favor of having just a few numbers be enough to identify someone. Not long ago I had someone take money out of my checking account without my consent because they had my account and routing numbers. My bank, Chase dealt with it fine and put the money right back in but it was still a hassle.

Not sure what the best solution should be. Maybe biometrics?

The ability to obtain sufficient personal information for ‘identity theft’ is not even difficult as most security experts will admit since Americans readily revel way too much.

The vast majority of entities inquiring about you do not need 90% of what they claim they “require”. Example: a medical office will ask for your SSN #. What for? They’re not allowed to use SSN # to identify you even on an insurance claim. Why is the question still on their forms? Because it’s left over from years ago.

Simple solution: don’t supply unnecessary data regardless of who requests it unless they can provide a truly legitimate reason for them to have it.

#7, You’re correct but it’s such a hassle to argue. At Fry’s Electronics they always ask to see my ID with a credit card purchase although an ID should never be required to verify a credit card as long as the back is signed.

The airport always asks for ID even when flying within the country when it’s not a requirement. Not showing your ID though makes things more troublesome.

You don’t even need a social for a credit card but try to get one without providing yours.

LOL

I remember a couple of months ago having this debate here. The credit crap they claim to do can be done BETTER and for free in most states. If you lock your credit reports no one can even check your reports without your direct approval. No credit can be issued without your direct approval. Anything requiring a credit check will fail. The drivers license thing??? Well that is a different story. No one can prevent that but the state.

Is it a pain in the ass? Well that depends on your ability to plan ahead and not be impulsive.

Saw this coming with the very first commercial they aired. What amazes me is people BELIEVE TV COMMERCIALS.

Why? People, for the most part, are stupid. How many people can’t name their own Senators, or find China on a map, or think humans lived in the same era as dinosaurs and lets not forget spam. Most of worlds peoples are morons.

Again, my state looks absolutely spectacular. The complaint in the case includes a great deal of inflammatory crap wholly irrelevant to the “merits” of the case. All alleged damages are speculative. Grubb – the lawyer in this case – is famous for filing consumer protection based suits in minimal damages cases, knowing he can collect big under the W.Va. fee-shifting regime. He recently was awarded fees of $135,000 for a case where he won $7,000 for the plaintiff.

West Virginia: Wild, wonderful, and way, Way, WAY out of mainstream America.

Remember how often the conservatives, like Rush Limbaugh, lectured that the government could do no good.

I sure wish congress had taken a go at some identity security and privacy laws.

The social security number is a lame-ass way to have a national ID. Congress needs to fix the problem but the won’t as long as so many obstructionist Republicans are in office

Actually, this just proves the service works even better. Of course, duh, people are going to try to steal his identity. But the company’s guarantee fixed each occurance each time…just like they would for a customer.

Go put your SSN number out there without a service like LifeLock….. then post a valuable article about the painful time you have fixing it…YOURSELF. Duh.

#13, I know you really can’t help yourself were bashing Republicans is concerned, but I wasn’t aware that fixing the problems associated with tying all personal financial information to a single SS# is on the agenda of anybody in Washington who matters.

#15 I know, and these types call Republican’s angry.

What’s REALLY naive is that you think Experian, a consumer credit bureau, filed this lawsuit to help consumers. Think about it–why did Experian sue? Simple: Experian doesn’t want Lifelock helping us establish AND MAINTAIN fraud alerts on our credit profiles, because scammy direct marketers won’t buy fraud-protected credit profiles from Experian. Lifelock is eating into Experian’s core business of selling our data.

Of course SSNs are not secure–that’s why I use Lifelock to ensure that creditors call me before extending ANY credit in my name. And in the rare event that a creditor ignores the faud alert (as once happened to the lifelock CEO after 50 gazillion attempts to steal his identity), lifelock resolves it.

As for credit freezes, be aware that once you freeze you cannot get cell phones, credit cards, hospital admission, new jobs, etc. I’m guessing that’s why lifelock doesn’t offer them–they’re a pain in the ass.

It’s always fun to point fingers, but try not to think like a drunken mob. Experian is throwing mud and you’re eating it!!

# 15 Sea Lawyer

Just in case you were not aware. June 16, 2006 Hillary Clinton proposed a Privacy Bill. It was a bill designed to make both commercial and government entities responsible for proper security of private data. It also made it so that you could review the private data they have without charge.

I don’t recall a Republican politician that was even remotely concerned with the privacy of their citizens.

First, people have the right to know, and to correct, information which is being kept about them.

Second, people have the right to know what is happening to their personal information when they are cooperating with a business and to make decisions about how their information is used.

And third, in a democracy, people have the right and the obligation to hold their government and the private sector to the highest standards of care with the information they gather.

This legislation not only provides clear privacy rules, but it gives you clear protections for your most private information:

— the right to sue when those rules have been violated

— the right to protect your phone records

— the right to freeze your credit when your identity has been stolen

— the right to know what businesses are doing with your credit and credit reports, and

— the right to expect the government to use the best privacy practices itself with your information…

#18, Oh goody. It apparently still fails to address the fundamental problem that this story brings up – the tying of all personal financial information to a single social security number. Seriously, are you really that daft?

# 19 Sea Lawyer

What is it that you propose then. More numbers? Less numbers? No numbers? Please expound upon your infinite wisdom!!

What solution do you think you have to this issue?

We need to switch to fecal samples for identification purposes.

Lifelock was an idea the CEO came up while he was in jail. All they do is hire someone to call the credit agencies and put a “lock” on your credit account every 30 days – you can do this yourself for free.

For Lifelock to do this – you have to sign a general Power of Attorney, essentially giving them full access to your identity.

I’ll have to find the article again…

Hi. My name is Bill Gaytz. My ss# is 666-69-1234 I dare anyone to try to hack into my account. I will back-up my service with 2.77 trillion dollars if anyone can succeed. You too, can have this kind of security if you just send me 4 oz. of your blood and a double meat, double cheese whopper.

A BBC TV presenter and journalist here in the UK made a similar mistake. Jeremy Clarkson published his bank account number in the Times newspaper, and declared that no one would be able to steal his ID or money. Within days direct debits had been set up with his details to charities etc, proving him wrong. He had to change his account details.

It’s very hard not to get a HUGE laugh out of this. I love it. Beware he who is standing that he does not fall and all of that good stuff!

The offer of course good, but in my opinion difficult to implement. In any case it is necessary to respect him for trying to make new in this business!